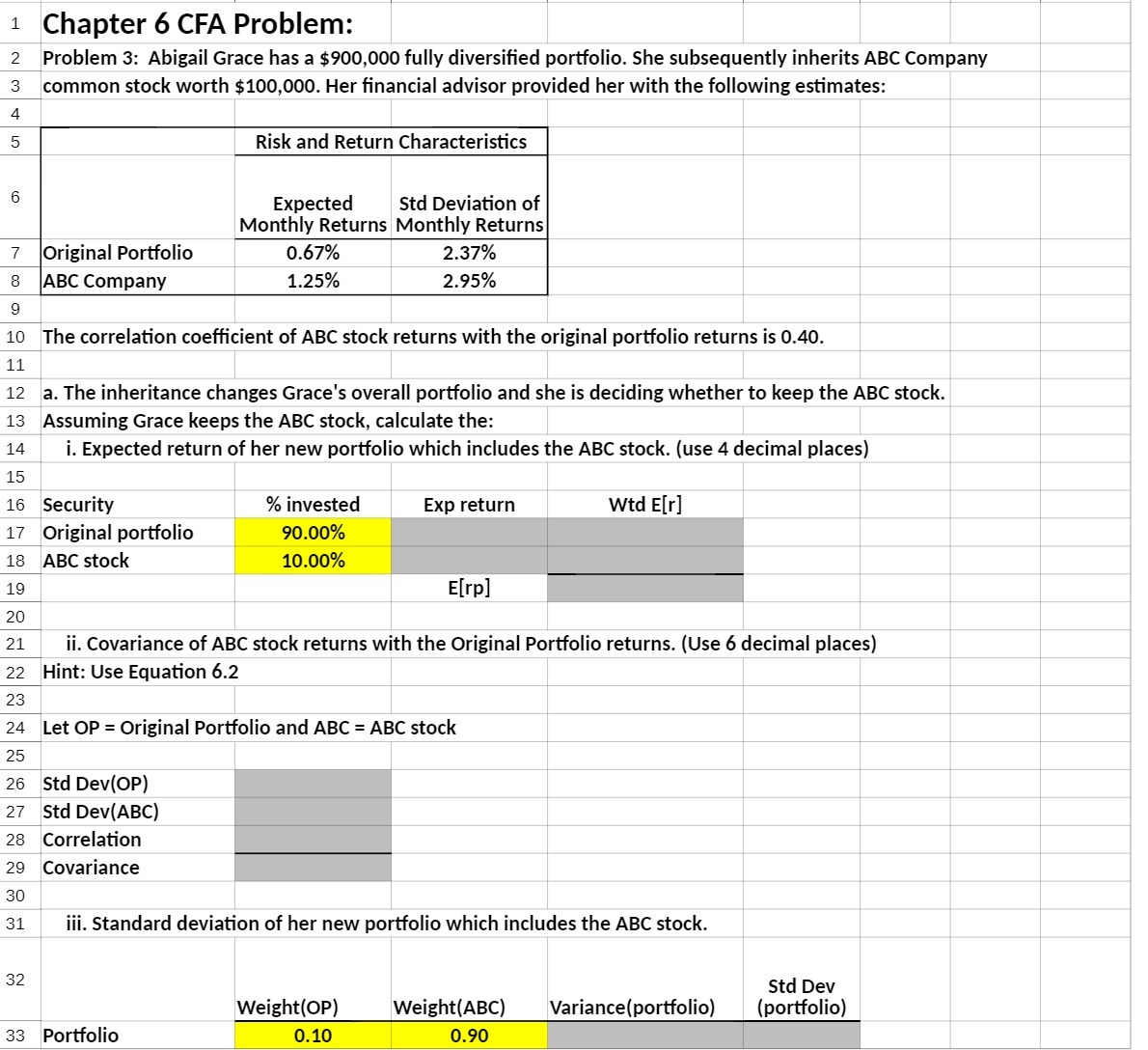

Question: Chapter 6 CFA Problem : Problem 3 : Abigail Grace has a $ 900 , 000 fully diversified portfolio . She subsequently inherits ABC Company

Chapter 6 CFA Problem :" Problem 3 : Abigail Grace has a $ 900 , 000 fully diversified portfolio . She subsequently inherits ABC Company 3 common stock worth $100 , 000 . Her financial advisor provided her with the following estimates : Risk and Return Characteristics Expected Std Deviation of Monthly Returns Monthly Returns 7 \\Original Portfolio 0 . 67% 2. 37% 8 | ABC Company 1 . 25% 2. 95% 6 10 The correlation coefficient of ABC stock returns with the original portfolio returns is 0. 40 . 11 12 a . The inheritance changes Grace's overall portfolio and she is deciding whether to keep the ABC stock . 13 Assuming Grace keeps the ABC stock , calculate the :" 14 i . Expected return of her new portfolio which includes the ABC stock . ( use 4 decimal places ) 15 16 Security % invested Exp return Wed E[r] 17 Original portfolio 90. 00 % 18 ABC stock 10. 00 % 19 E[rp ] 20 21 ji . Covariance of ABC stock returns with the Original Portfolio returns . ( Use 6 decimal places ) 22 Hint : Use Equation 6 . 2 23 24 Let OP = Original Portfolio and ABC = ABC stock 25 26 Std Dev ( OP ) 27 5td Dev ( ABC ) 28 Correlation 29 Covariance 30 31 ili . Standard deviation of her new portfolio which includes the ABC stock ." std Dev Weight ( OP ) Weight ( ABC ) Variance ( portfolio ) ( portfolio ) 3.3 Portfolio 0 . 10 0 . 90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts