Question: Chapter 6 Homework #1 Saved 3 Problem 06.010 Annual Worth and Capital Recovery Calculations 10 points U.S. Steel is considering a plant expansion to produce

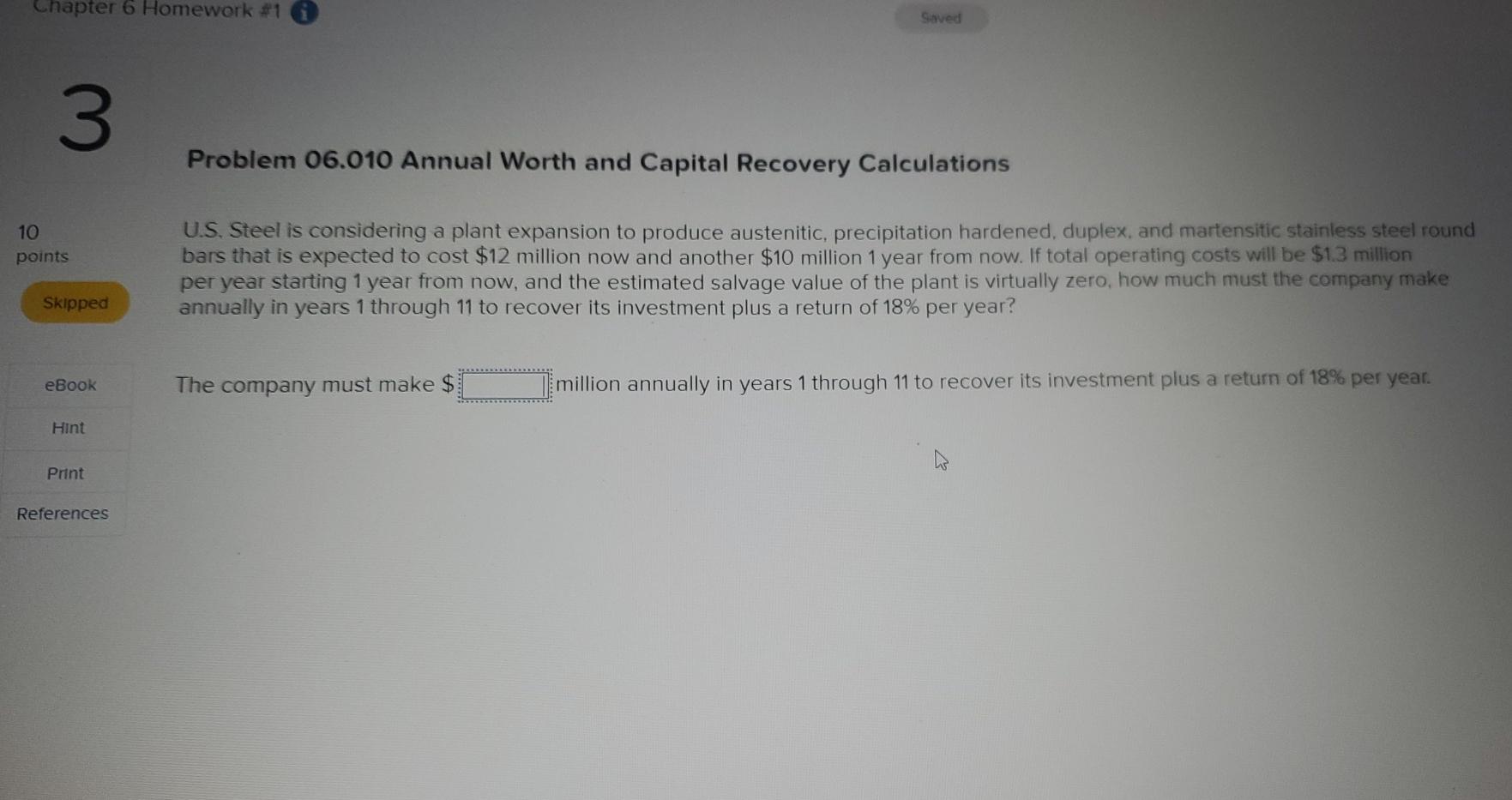

Chapter 6 Homework #1 Saved 3 Problem 06.010 Annual Worth and Capital Recovery Calculations 10 points U.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and martensitic stainless steel round bars that is expected to cost $12 million now and another $10 million 1 year from now. If total operating costs will be $1.3 million per year starting 1 year from now, and the estimated salvage value of the plant is virtually zero, how much must the company make annually in years 1 through 11 to recover its investment plus a return of 18% per year? Skipped eBook The company must make $ million annually in years 1 through 11 to recover its investment plus a return of 18% per year. Hint Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts