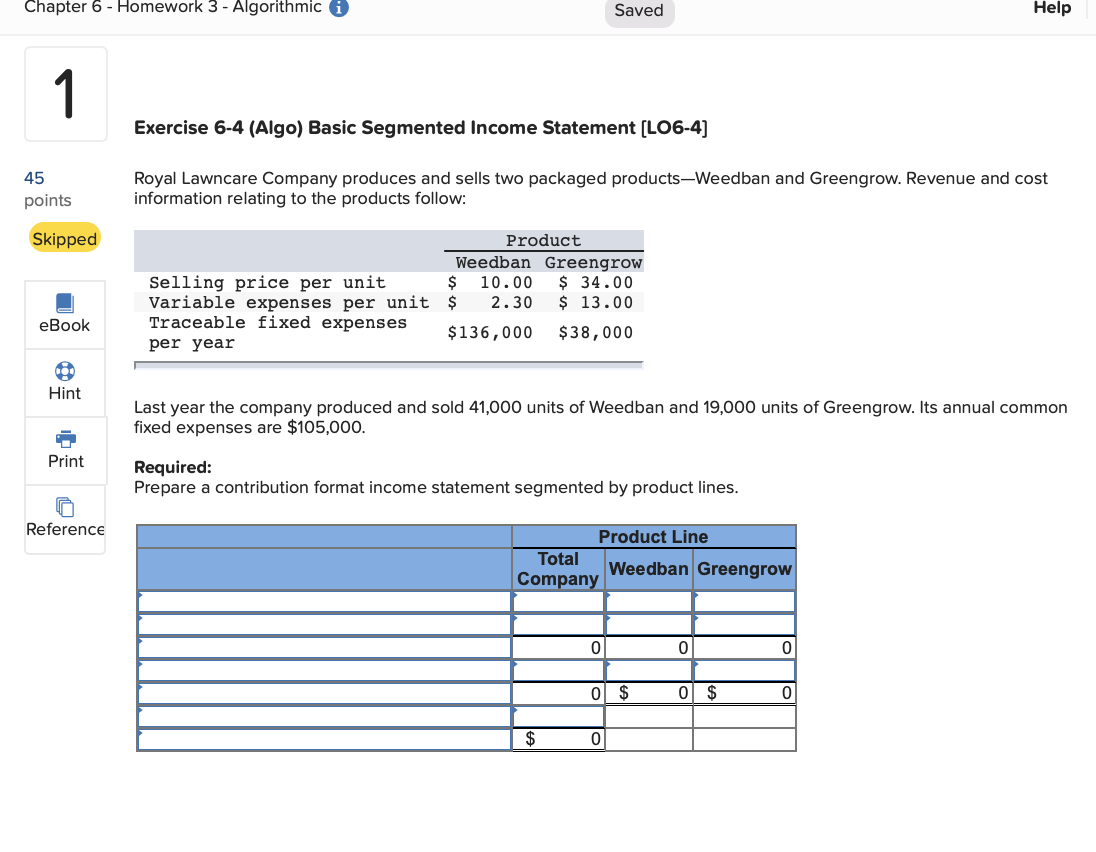

Question: Chapter 6 - Homework 3 - Algorithmic i Saved Saved Help 1 Exercise 6-4 (Algo) Basic Segmented Income Statement (LO6-4) 45 points Royal Lawncare Company

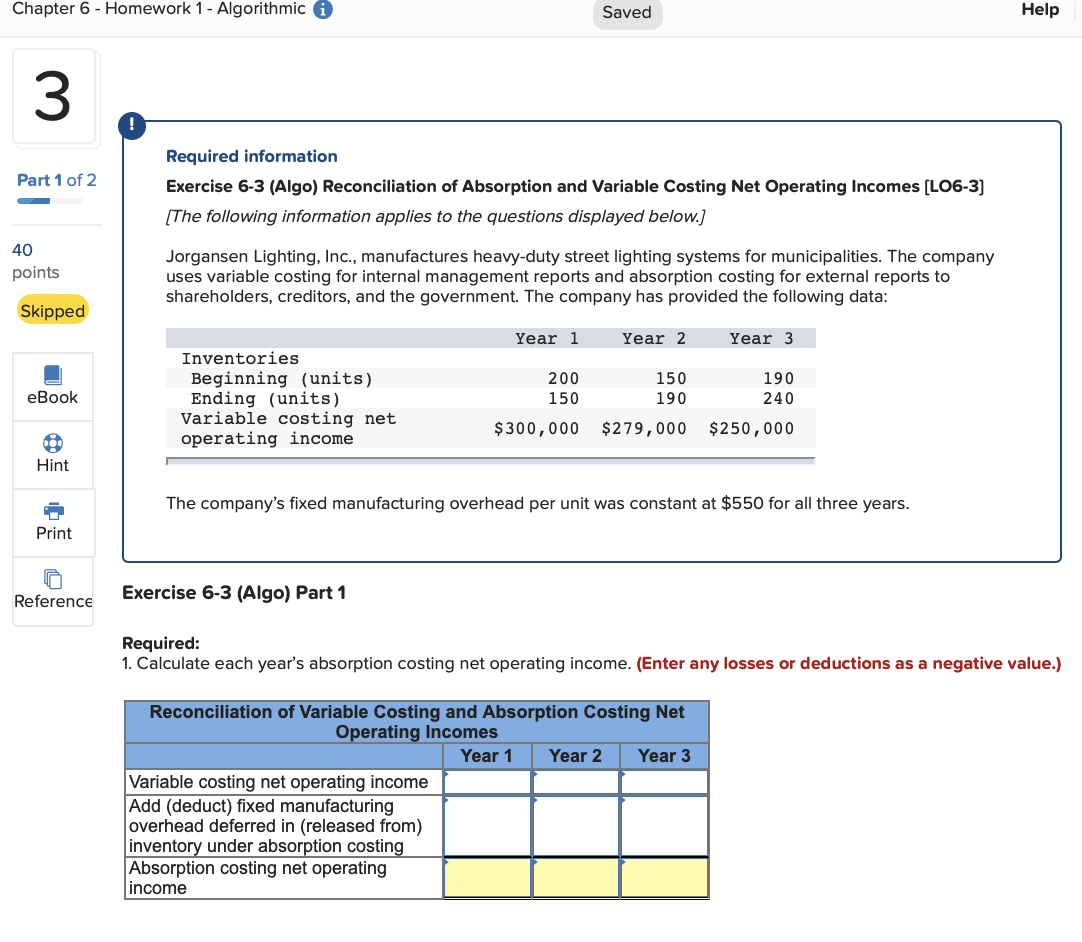

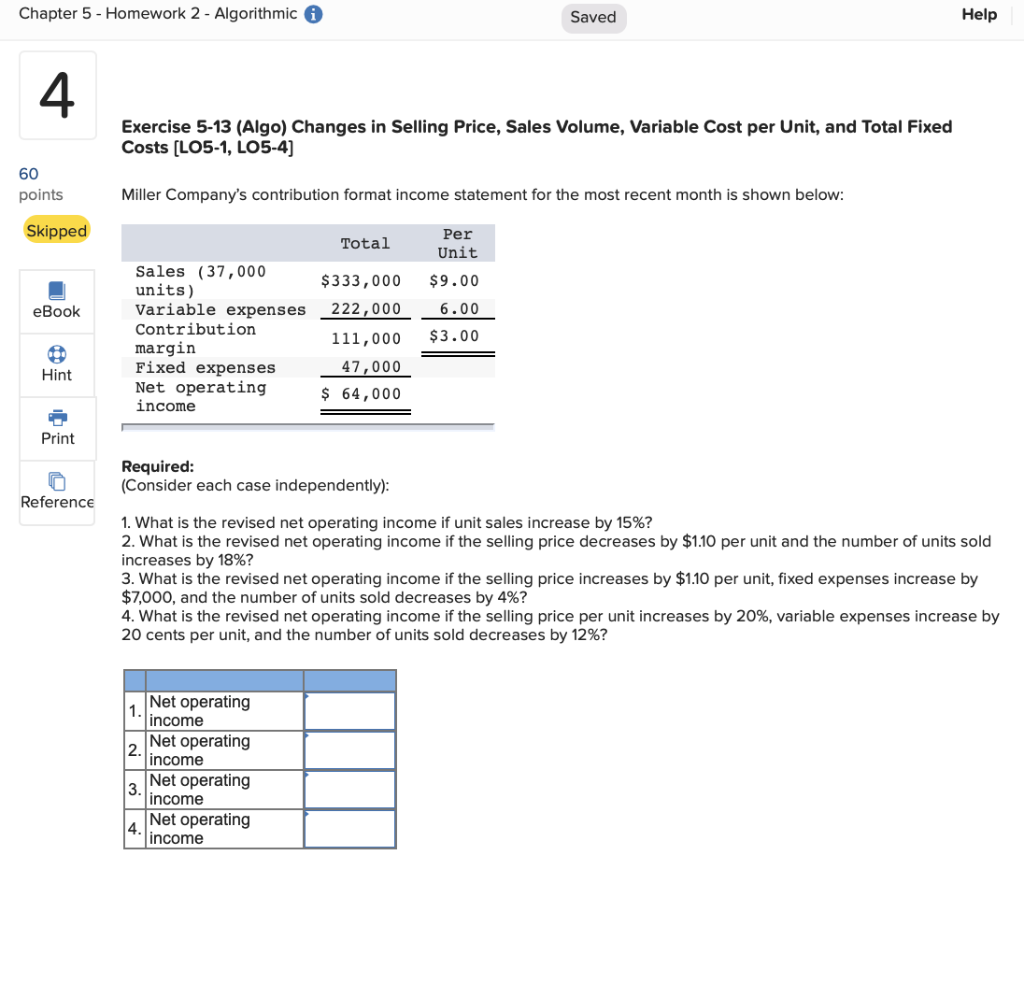

Chapter 6 - Homework 3 - Algorithmic i Saved Saved Help 1 Exercise 6-4 (Algo) Basic Segmented Income Statement (LO6-4) 45 points Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Skipped Selling price per unit Variable expenses per unit Traceable fixed expenses per year Product Weedban Greengrow $ 10.00 $ 34.00 $ 2.30 $ 13.00 $136,000 $38,000 eBook Hint Last year the company produced and sold 41,000 units of Weedban and 19,000 units of Greengrow. Its annual common fixed expenses are $105,000. Print Required: Prepare a contribution format income statement segmented by product lines. Reference Product Line Total Weedban Greengrow Company 0 0 0 $ 0 $ 0 $ 0 Chapter 6 - Homework 1 - Algorithmic i Saved Help 3 Part 1 of 2 Required information Exercise 6-3 (Algo) Reconciliation of Absorption and Variable Costing Net Operating Incomes (L06-3] [The following information applies to the questions displayed below.) 40 points Jorgansen Lighting, Inc., manufactures heavy-duty street lighting systems for municipalities. The company uses variable costing for internal management reports and absorption costing for external reports to shareholders, creditors, and the government. The company has provided the following data: Skipped Year 1 Year 2 Year 3 Inventories Beginning (units) Ending (units) Variable costing net operating income eBook 200 150 150 190 190 240 $300,000 $279,000 $250,000 Hint The company's fixed manufacturing overhead per unit was constant at $550 for all three years. Print Reference Exercise 6-3 (Algo) Part 1 Required: 1. Calculate each year's absorption costing net operating income. (Enter any losses or deductions as a negative value.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Year 3 Variable costing net operating income Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income Chapter 5 - Homework 2 - Algorithmic Saved Help 4 Exercise 5-13 (Algo) Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs (LO5-1, LO5-4) 60 points Miller Company's contribution format income statement for the most recent month is shown below: Skipped Total Per Unit $9.00 eBook 6.00 Sales (37,000 units) Variable expenses Contribution margin Fixed expenses Net operating income $333,000 222,000 111,000 47,000 $ 64,000 $3.00 Hint Print Required: (Consider each case independently): Reference 1. What is the revised net operating income if unit sales increase by 15%? 2. What is the revised net operating income if the selling price decreases by $1.10 per unit and the number of units sold increases by 18%? 3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 4%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 12%? Net operating 1. income Net operating 2. income Net operating 3. income Net operating 4. income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts