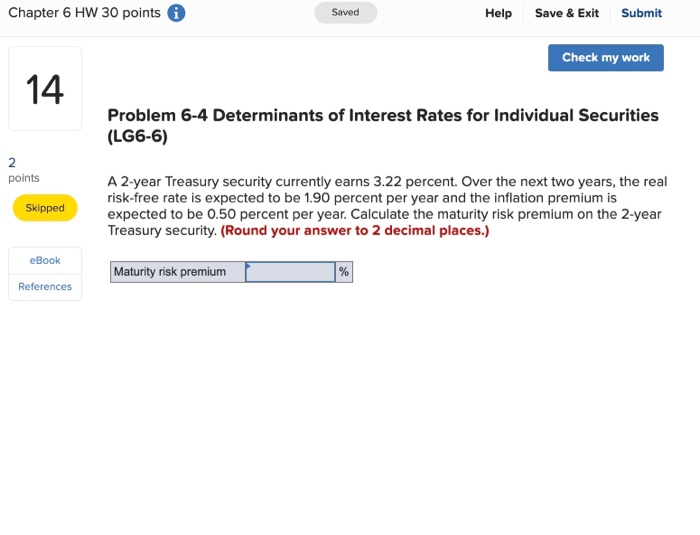

Question: Chapter 6 HW 30 points Saved Help Save & Exit Submit Check my work 14 Problem 6-4 Determinants of Interest Rates for Individual Securities (LG6-6)

Chapter 6 HW 30 points Saved Help Save & Exit Submit Check my work 14 Problem 6-4 Determinants of Interest Rates for Individual Securities (LG6-6) points Skipped A 2-year Treasury security currently earns 3.22 percent. Over the next two years, the real risk-free rate is expected to be 1.90 percent per year and the inflation premium is expected to be 0.50 percent per year. Calculate the maturity risk premium on the 2-year Treasury security. (Round your answer to 2 decimal places.) eBook Maturity risk premium % References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts