Question: Chapter 6 Inventories 335 EX 6-8 Weighted average cost flow method under perpetual inventory system Obj. 3 The following units of a particular item were

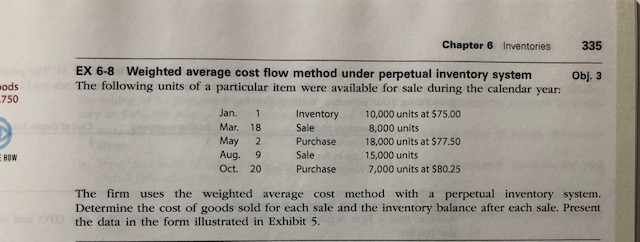

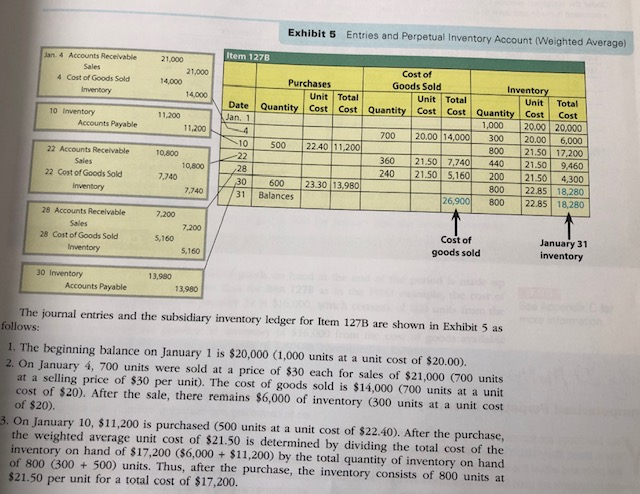

Chapter 6 Inventories 335 EX 6-8 Weighted average cost flow method under perpetual inventory system Obj. 3 The following units of a particular item were available for sale during the calendar year: ods 750 Jan. 1 Mar. 18 May 2 Purchase Aug. 9 Sale Oct. 20 Inventory10,000 units at $75.00 Sale 8,000 units 18,000 units at $77.50 15,000 units 7,000 units at $80.25 HOW Purchase The firm uses the weighted average cost method with a perpetual inventory system. Determine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5. Exhibit 5 Entries and Perpetual Inventory Account (Weighted Average) Item 127B Jan. 4 Accounts Receivable21,000 Sales 4 Cost of Goods Sold Cost of Goods Sold 21,000 Purchases Inventory 14,000 Unit Total Unit Total 20.00 14,000 21.50 7.740 Unit Total 14,000 Date Quantity Cost Cost Quantity Cost Cost Quantity Cost Jan, 1 Cost 10 Inventory 11,200 1,000 20.00 20,000 Accounts Payable 11,200 00 2 300 20.00 6.000 21.50 17.200 360 2 440 21.50 9460 240 21.50 5160 200 21.50 4300 10 500 22.40 11.200 22 Accounts Receivable 10,800 Sales 10,800 28 30 31 Balances 22 Cost of Goods Sold 7,740 800 22.85 18,280 26,900 800 22.85 18,280 600 23.30 13,980 Inventory 7,740 28 Accounts Receivable 7,200 Sales 7.200 Cost of goods sold January 31 inventory 28 Cost of Goods Sold 5,160 5,160 30 Inventory 13,980 Accounts Payable 13,980 The journal entries and the subsidiary inventory ledger for Item 127B are shown in Exhibit 5 as follows 1. The beginning balance on January 1 is $20,000 (1,000 units at a unit cost of $20.00). 2. On January 4, 700 units were sold at a price of $30 each for sales of $21,000 (700 units at a selling price of $30 per unit). The cost of goods sold is $14,000 (700 units at a unit cost of $20). After the sale, there remains $6,000 of inventory (300 units at a unit cost of $20) 3. On January 10, $11,200 is purchased (500 units at a unit cost of $22.40). After the purchase, the weighted average unit cost of $21.50 is determined by dividing the total cost of the inventory on hand of $17,200 (S6,000 $11,200) by the total quantity of inventory on hand of 800 (300500) units. Thus, after the purchase, the inventory consists of 800 units at 821.50 per unit for a total cost of $17,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts