Question: Chapter 6 Problem 14 a . What were HCA's liabilities - to - assets ratios and times - interest - earned ratios in the years

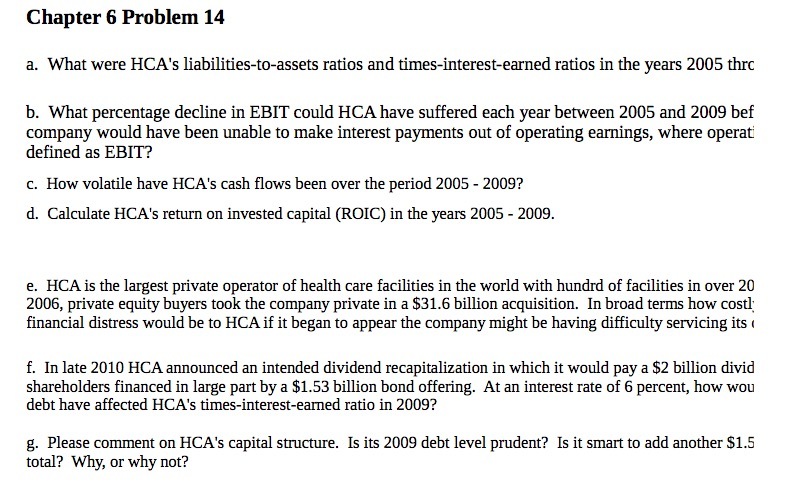

Chapter 6 Problem 14 a . What were HCA's liabilities - to - assets ratios and times - interest - earned ratios in the years 2005 this b. What percentage decline in EBIT could HCA have suffered each year between 2005 and 2009 bef company would have been unable to make interest payments out of operating earnings , where operate defined as EBIT ? C . How volatile have HCA's cash flows been over the period 2005 - 2009 ? d . Calculate HCA's return on invested capital ( ROIC ) in the years 2005 - 2009 . e . HCA is the largest private operator of health care facilities in the world with hundred of facilities in over 20 2006 , private equity buyers took the company private in a $31 . 6 billion acquisition . In broad terms how cost !* financial distress would be to HCA if it began to appear the company might be having difficulty servicing its " f. In late 2010 HCA announced an intended dividend recapitalization in which it would pay a $ 2 billion divid shareholders financed in large part by a $1 . 53 billion bond offering . At an interest rate of 6 percent , how wow debt have affected HCA's times - interest - earned ratio in 2009 ? E. Please comment on HCA's capital structure . Is its 2009 debt level prudent ?" Is it smart to add another $1 . 5 total ? Why, or why not ?"

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts