Question: Chapter 6 Problem 14 This problemake you to analyze the capital structure of HCA, Inc. the largest private operator of health care facilities in the

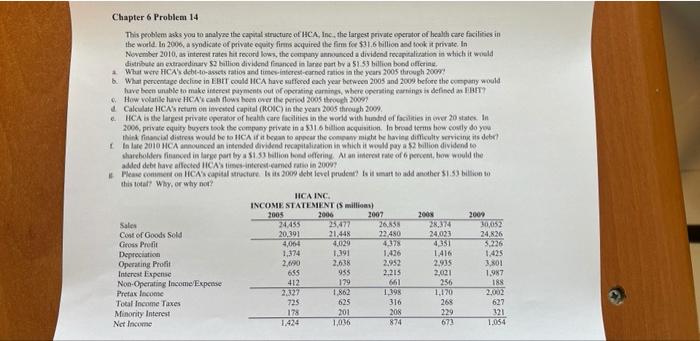

Chapter 6 Problem 14 This problemake you to analyze the capital structure of HCA, Inc. the largest private operator of health care facilities in the world. In 2006, a syndicate of private equity finns acquired the firm for $31.6 billion and took it private. In November 2010. as interest rates hit record lows, the company announced a dividend recapitalisation in which it would distribute an extraordinary $2 billion dividend financed in late part by a 51 59 billion bood offerine What were HCA debt-to-assets ratios and times interest.carned ratios in the years 2005 through 2007 What percentage decline in EBIT could HCA have affered each year between 2005 and 2009 before the company would have been unable to make andere payments out of operating corning where operating currings is defined as BETT How volatile le HCA cash flows hen over the period 2005 through 2009 Calculate HCA's return on invested capital (ROIC) in the year 2005 through 2009 HCA dhe largest private operator of health care facilities in the world with busted of facilities in over 20 states in 2006, private cquity buyers took the company private in a $316 billion acquisition. In broad terms how costly do you Think financial dintre would he to HCA then to appear the company might he have difficulty wervicing its debut? In late 2010 HCA announced an intended dividend recapitation in which it would pay $2 billion dividend to shareholder fondin lige part by a 515) willion fond offering. An erst we of percent, how would the dded debt have alfected TICAS interest.com ratio in 20007 Mete comment on HCA's capital Mature Isis 2009 debt level prudent? Is it umat to add another 51.53 bilo this total? Why, or why not? HICA INC INCOME STATEMENT(S millions) 2005 2006 2007 2005 2009 Sales 24455 23,477 26.38 28.374 305052 Cost of Goods Sold 20.391 21.448 22,480 24.023 Gross Proti 24,826 4,064 4029 4,378 4351 5.226 Depreciation 1.374 1.191 1.426 1.416 1.425 Operating Profit 2.00 2.638 2.952 2.935 3.01 Interest Expense 655 955 2.215 2.001 1.987 Non-Operating Income Expertise 412 179 661 256 188 Pretax Income 2.327 1.862 1.198 1.170 2002 Total Income Taxes 725 625 316 268 Minority Interest 178 201 208 229 321 Net Income 1,036 874 673 1.054 627 Chapter 6 Problem 14 This problemake you to analyze the capital structure of HCA, Inc. the largest private operator of health care facilities in the world. In 2006, a syndicate of private equity finns acquired the firm for $31.6 billion and took it private. In November 2010. as interest rates hit record lows, the company announced a dividend recapitalisation in which it would distribute an extraordinary $2 billion dividend financed in late part by a 51 59 billion bood offerine What were HCA debt-to-assets ratios and times interest.carned ratios in the years 2005 through 2007 What percentage decline in EBIT could HCA have affered each year between 2005 and 2009 before the company would have been unable to make andere payments out of operating corning where operating currings is defined as BETT How volatile le HCA cash flows hen over the period 2005 through 2009 Calculate HCA's return on invested capital (ROIC) in the year 2005 through 2009 HCA dhe largest private operator of health care facilities in the world with busted of facilities in over 20 states in 2006, private cquity buyers took the company private in a $316 billion acquisition. In broad terms how costly do you Think financial dintre would he to HCA then to appear the company might he have difficulty wervicing its debut? In late 2010 HCA announced an intended dividend recapitation in which it would pay $2 billion dividend to shareholder fondin lige part by a 515) willion fond offering. An erst we of percent, how would the dded debt have alfected TICAS interest.com ratio in 20007 Mete comment on HCA's capital Mature Isis 2009 debt level prudent? Is it umat to add another 51.53 bilo this total? Why, or why not? HICA INC INCOME STATEMENT(S millions) 2005 2006 2007 2005 2009 Sales 24455 23,477 26.38 28.374 305052 Cost of Goods Sold 20.391 21.448 22,480 24.023 Gross Proti 24,826 4,064 4029 4,378 4351 5.226 Depreciation 1.374 1.191 1.426 1.416 1.425 Operating Profit 2.00 2.638 2.952 2.935 3.01 Interest Expense 655 955 2.215 2.001 1.987 Non-Operating Income Expertise 412 179 661 256 188 Pretax Income 2.327 1.862 1.198 1.170 2002 Total Income Taxes 725 625 316 268 Minority Interest 178 201 208 229 321 Net Income 1,036 874 673 1.054 627

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts