Question: Chapter 6 - Q6 (Part 1) : Please help me find the answer to the following questions in the image below: The following table summarizes

Chapter 6 - Q6 (Part 1) : Please help me find the answer to the following questions in the image below:

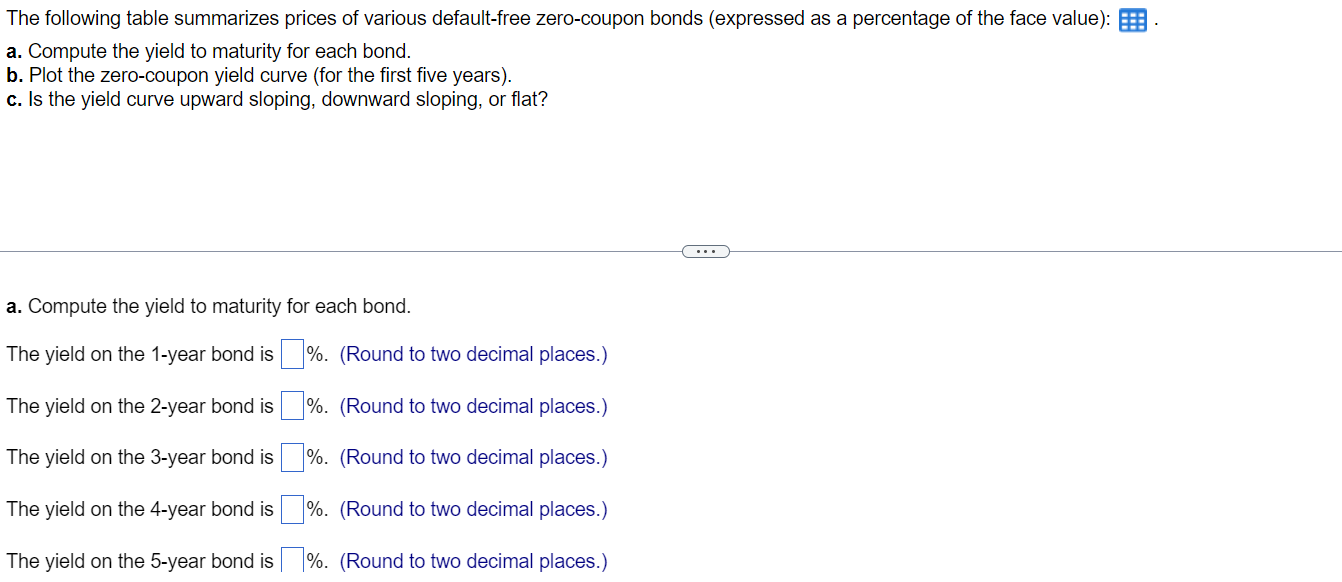

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is \%. (Round to two decimal places.) The yield on the 2-year bond is \%. (Round to two decimal places.) The yield on the 3-year bond is \%. (Round to two decimal places.) The yield on the 4-year bond is \%. (Round to two decimal places.) The yield on the 5-year bond is %. (Round to two decimal places.) The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? a. Compute the yield to maturity for each bond. The yield on the 1-year bond is \%. (Round to two decimal places.) The yield on the 2-year bond is \%. (Round to two decimal places.) The yield on the 3-year bond is \%. (Round to two decimal places.) The yield on the 4-year bond is \%. (Round to two decimal places.) The yield on the 5-year bond is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts