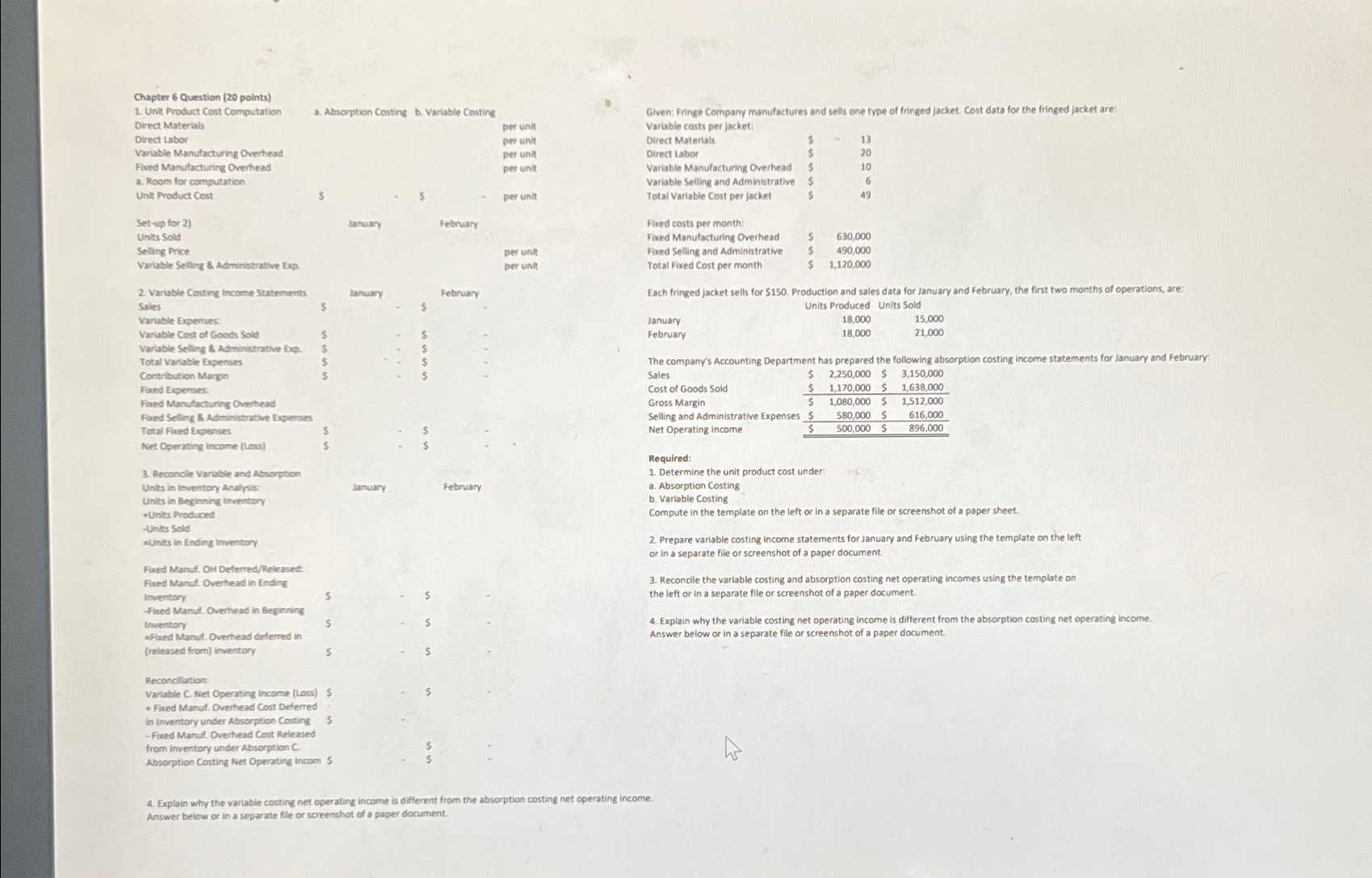

Question: Chapter 6 Question ( 2 0 points ) Unit Product Cost Computation Direct Materials Direct Labor Variable Manufacturing Overhead Fixed Manufacturing Overhead a . Room

Chapter Question points

Unit Product Cost Computation Direct Materials

Direct Labor

Variable Manufacturing Overhead

Fixed Manufacturing Overhead

a Room for computation

Unit Product Cost

Setup for

Units Sold

Selling Price

Variable Selling & Administrative Bep.

Variable Costing income Statements Sales Variable Expenses:

Variable Cost of Goods Soled

Variable Selling & Adminictrative ben.

Total Variable Expenses

Contribution Margin

Fuxed Expenses:

Fored Manstacturing Overheas

Foed Selling & Administrative Expenses

Total Fixed Expenses

Net Operating income Loss

Reconole Varuble and ALsorption

Units in Inventory Analysis:

Units in Beginning Imvention

tunits produced

Units Sole

munits in Ending inventon

Fued Manul. OH DeferredReleased:

Fixed Manul, Overthead in Endins

inventory

Faxed Manul. Overhead in Beginning Inventory

wived Manut Overhead deferred in rretensed from inventory

a Absorption Costing b Variable Costing

Reconcliation:

Variable C Net Operating income Loss S

Fixed Manut. Overthead Cost. Delerred.

in inventory under Absorption Costing S

Fixed Manut. Overhead Cost Released

from inventory under Absorption

Absorption Costing Net Operating tincom s

Given: Fringe Company manufactures and sells one type of fringed jacket cost data for the fringed jacket are: Variable costs per jacket:

Direct Materials

Direct Labor

Variable Manufacturing Overhead

Variable Selling and Administrative

Total Variable Cost per jacket

$

$

s

Fixed costs per month:

Fixed Manufacturing Overhead $ $

Fired Selting and Aministrative $

Total Fixed Cost per month $

Each fringed jacket sells for $ Production and sales data for January and February, the first two months of operations, are:

Units Produced Units Sold

January

February

The company's Accounting Department has prepared the following absorption costing income statements for lanuary and February Sales

Cost of Goods Sold

Gross Margin

Selling and Administrative Expenses

table$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock