Question: Chapter 6: Risk and Returns 4. What is the approximate expected coefficient of variation of returns for a projected one-year project that is 50%50% probabilities

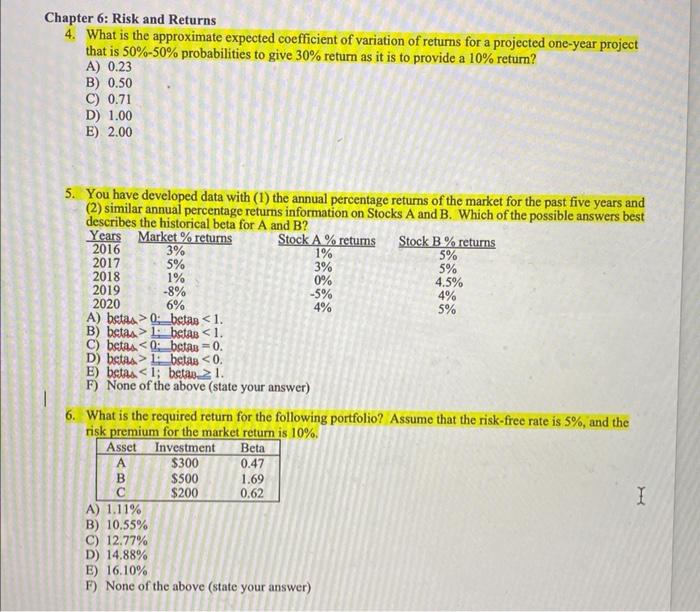

Chapter 6: Risk and Returns 4. What is the approximate expected coefficient of variation of returns for a projected one-year project that is 50%50% probabilities to give 30% return as it is to provide a 10% return? A) 0.23 B) 0.50 C) 0.71 D) 1.00 E) 2.00 5. You have developed data with (1) the annual percentage returns of the market for the past five years and (2) similar annual percentage returns information on Stocks A and B. Which of the possible answers best describes the historical beta for A and B ? 6. What is the required return for the following portfolio? Assume that the risk-free rate is 5%, and the risk premium for the market return is 10%. A) 1.11% B) 10.55% C) 12.77% D) 14.88% E) 16.10% F) None of the above (state your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts