Question: Chapter 6 TRP 6 - 2 Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated In the problem.

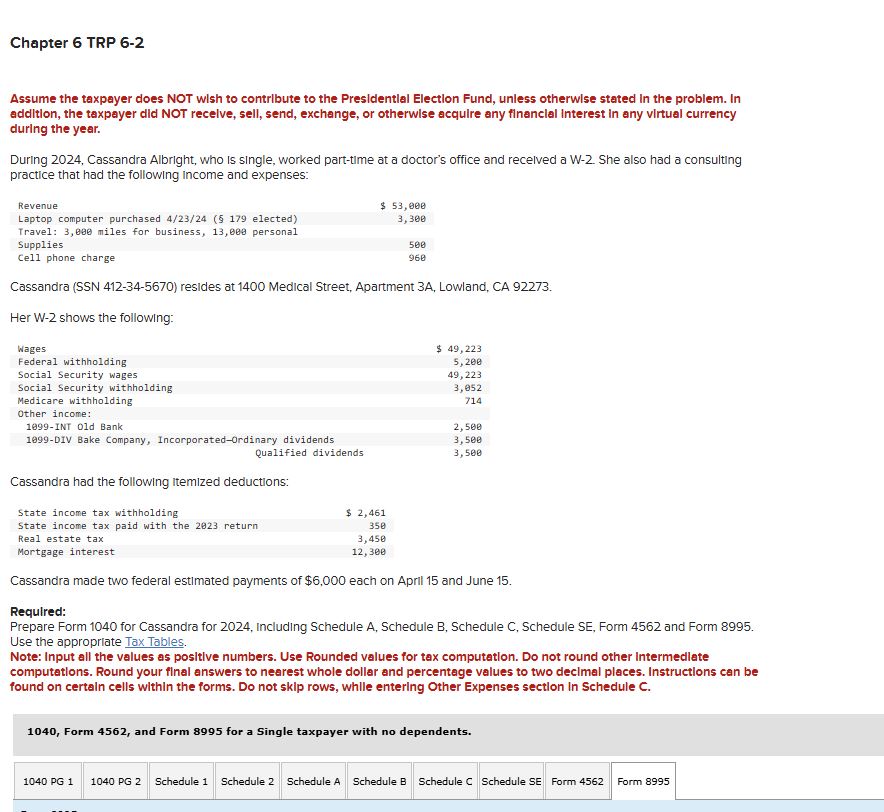

Chapter TRP Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated In the problem. In addition, the taxpayer did NOT recelve, sell, send, exchange, or otherwise acquire any financlal interest in any virtual currency during the year. During Cassandra Albright, who Is single, worked parttime at a doctor's office and recelved a W She also had a consulting practice that had the following income and expenses: Cassandra SSN resides at Medical Street, Apartment A Lowland, CA Her W shows the following: Cassandra had the following itemized deductions: Cassandra made two federal estimated payments of $ each on April and June Required: Prepare Form for Cassandra for Including Schedule A Schedule B Schedule C Schedule SE Form and Form Use the appropriate Tax Tables. Note: Input all the values as positive numbers. Use Rounded values for tax computation. Do not round other Intermediate computations. Round your final answers to nearest whole dollar and percentage values to two decimal places. Instructions can be found on certaln cells within the forms. Do not skip rows, while entering Other Expenses section In Schedule C Form and Form for a Single taxpayer with no dependents.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock