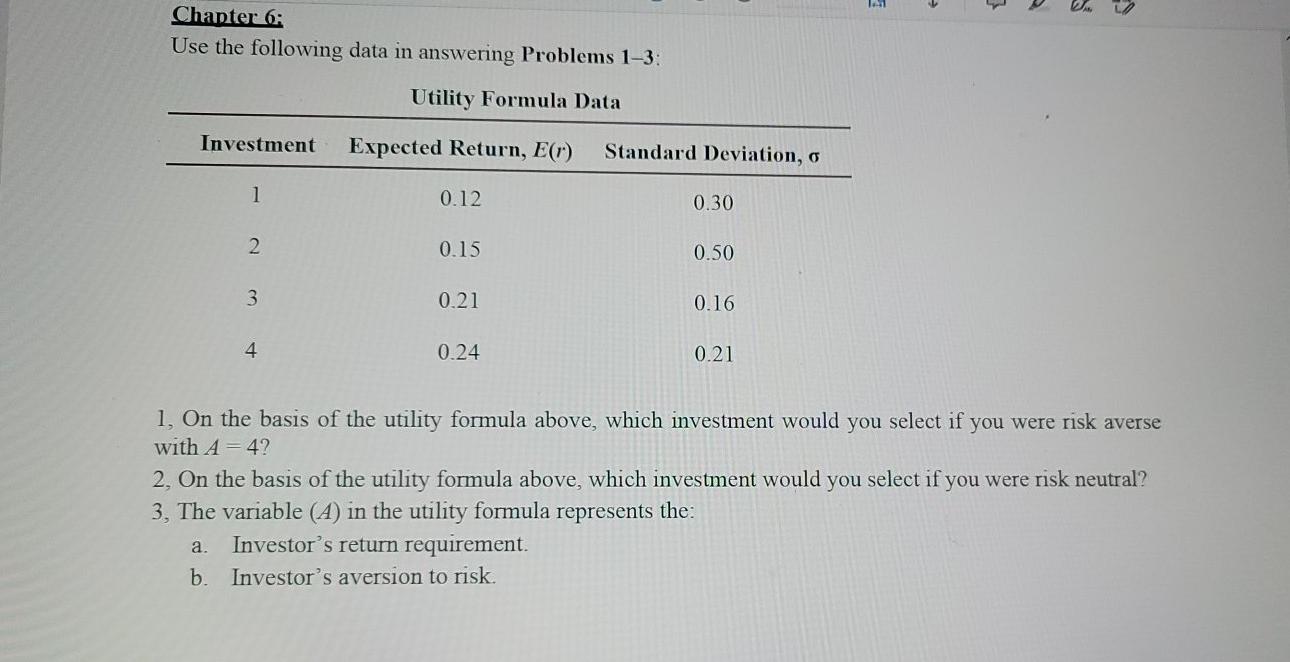

Question: Chapter 6: Use the following data in answering Problems 1-3: Utility Formula Data Investment Expected Return, E(r) Standard Deviation, o 1 0.12 0.30 2 0.15

Chapter 6: Use the following data in answering Problems 1-3: Utility Formula Data Investment Expected Return, E(r) Standard Deviation, o 1 0.12 0.30 2 0.15 0.50 3 0.21 0.16 4 0.24 0.21 1. On the basis of the utility formula above, which investment would you select if you were risk averse with A=4? 2. On the basis of the utility formula above, which investment would you select if you were risk neutral? 3. The variable (A) in the utility formula represents the: Investor's return requirement. b. Investor's aversion to risk. a. C. Certainty equivalent rate of the portfolio. Preference for one unit of return per four units of risk. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts