Question: Chapter 6: Variable Costing and Segment Reporting: Tools for Management 13. How would the following costs be classified (product or period) under variable costing at

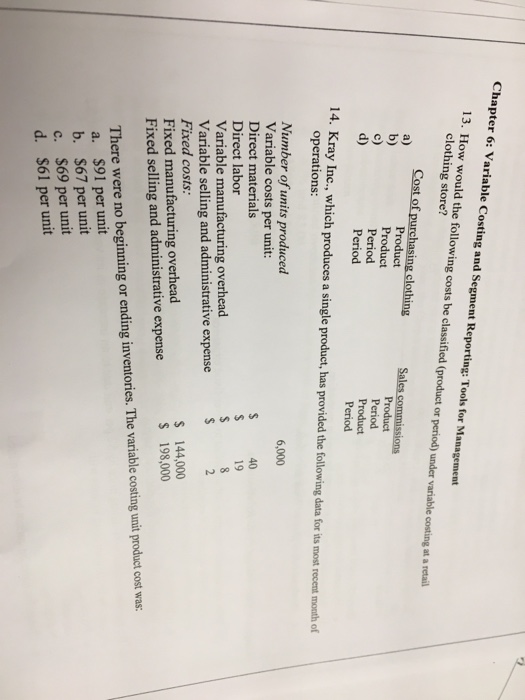

Chapter 6: Variable Costing and Segment Reporting: Tools for Management 13. How would the following costs be classified (product or period) under variable costing at a retail clothing store? Cost of purchasing cl Product Product Period Period b) Product Period Product Period d) 14. Kray Inc., which produces a single product, has provided the following data for its most recent month of operations: Number of units produced Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense 6,000 S 40 19 $ 144,000 s 198,000 There were no beginning or ending inventories. The variable costing unit product cost was: a. $91 per unit b. $67 per unit c. $69 per unit d. $61 per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts