Question: Chapter 6: Working Capital and the Financial Decision B. Construct a cash receipt schedule for January through December (in dollars). Experience has shown that 20%

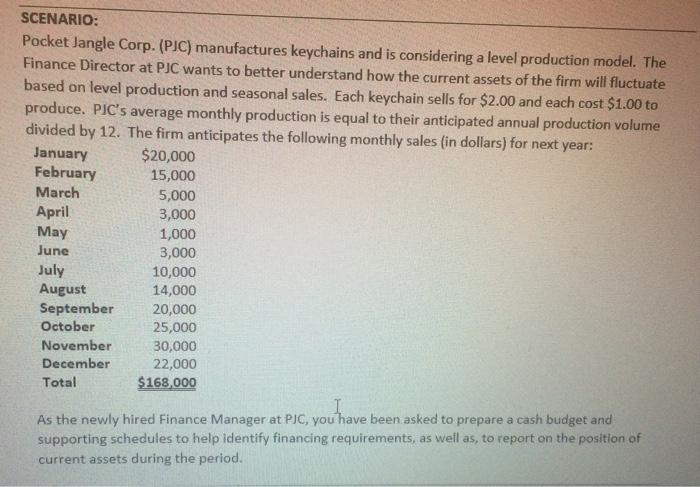

B. Construct a cash receipt schedule for January through December (in dollars). Experience has shown that 20% of sales are collected in the month of the sale and 80% are collected in the month following the sale. Sales in December were $15,000. C. Construct a cash payment schedule January through December (in dollars). Production costs are paid for in the month in which they occur. Other cash payments, besides those for production costs, are $6,000 per month. D. Construct a cash budget for January through December (in dollars). The beginning cash balance is $1,000, which is also equal to their required monthly minimum balance. Funds are borrowed from the bank when shortages exist and repaid when there is a cash surplus. SCENARIO: Pocket Jangle Corp. (PIC) manufactures keychains and is considering a level production model. The Finance Director at PJC wants to better understand how the current assets of the firm will fluctuate based on level production and seasonal sales. Each keychain sells for $2.00 and each cost $1.00 to produce. PJC's average monthly production is equal to their anticipated annual production volume divided by 12. The firm anticipates the following monthly sales (in dollars) for next year: January $20,000 February 15,000 March 5,000 April 3,000 May 1,000 June 3,000 July 10,000 August 14,000 September 20,000 October 25,000 November 30,000 December 22,000 Total $168,000 As the newly hired Finance Manager at PJC, you have been asked to prepare a cash budget and supporting schedules to help identify financing requirements, as well as, to report on the position of current assets during the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts