Question: Chapter 7 & 8 : # 2 Check My Work Feedback Understand that the dividend payment represents an annuity. Refer to the valuation equation for

Chapter & : #

Check My Work Feedback

Understand that the dividend payment represents an annuity.

Refer to the valuation equation for a perpetual preferred stock.

Make sure that you use correct decimal for return number in the denominator.

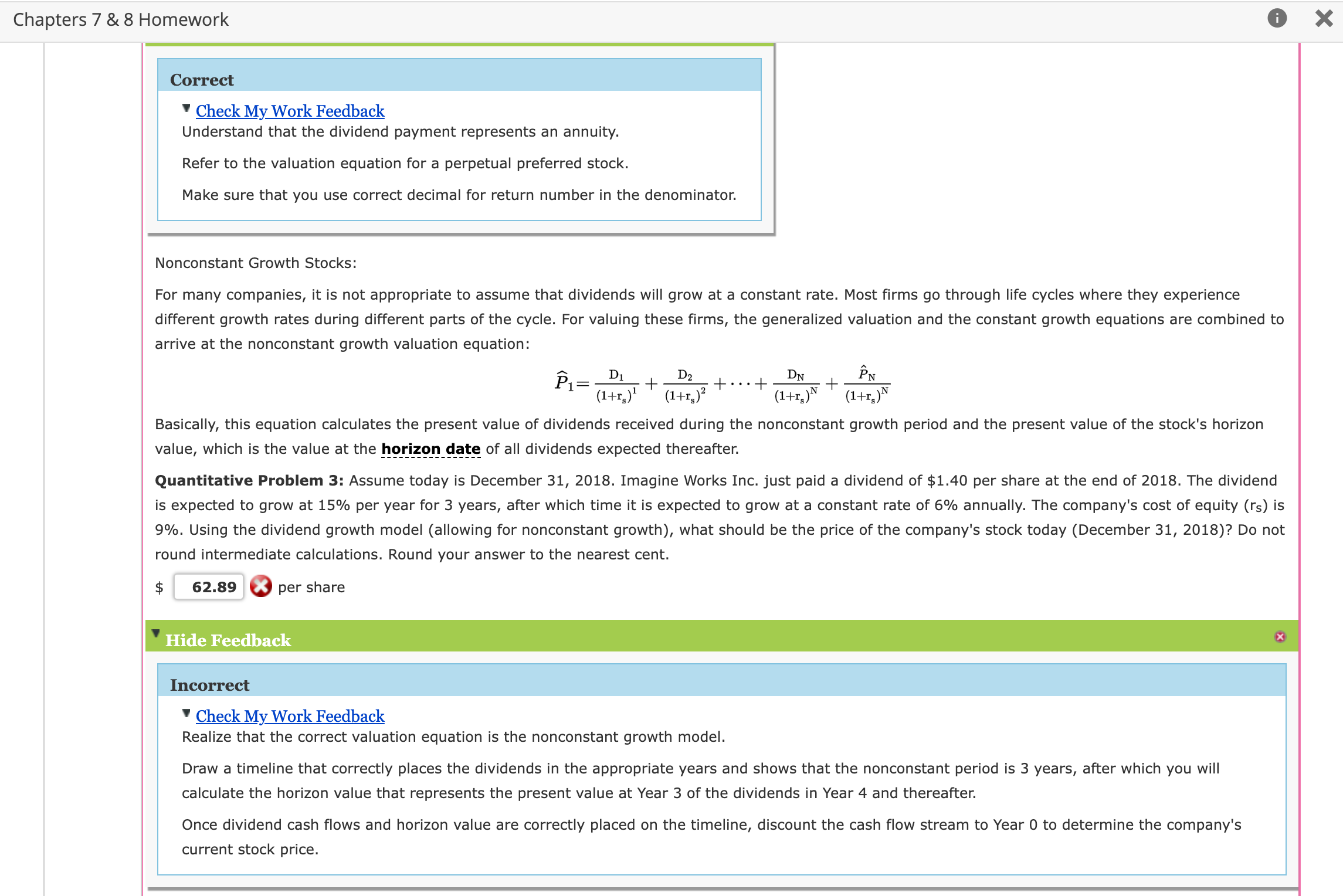

Nonconstant Growth Stocks:

For many companies, it is not appropriate to assume that dividends will grow at a constant rate. Most firms go through life cycles where they experience

different growth rates during different parts of the cycle. For valuing these firms, the generalized valuation and the constant growth equations are combined to

arrive at the nonconstant growth valuation equation:

widehatPDrsDrscdotsDNrsN hatPNrsN

Basically, this equation calculates the present value of dividends received during the nonconstant growth period and the present value of the stock's horizon

value, which is the value at the horizon date of all dividends expected thereafter.

Quantitative Problem : Assume today is December Imagine Works Inc. just paid a dividend of $ per share at the end of The dividend

is expected to grow at per year for years, after which time it is expected to grow at a constant rate of annually. The company's cost of equity rs is

Using the dividend growth model allowing for nonconstant growth what should be the price of the company's stock today December Do not

round intermediate calculations. Round your answer to the nearest cent.

$

per share

Hide Feedback

Incorrect

Check My Work Feedback

Realize that the correct valuation equation is the nonconstant growth model.

Draw a timeline that correctly places the dividends in the appropriate years and shows that the nonconstant period is years, after which you will

calculate the horizon value that represents the present value at Year of the dividends in Year and thereafter.

Once dividend cash flows and horizon value are correctly placed on the timeline, discount the cash flow stream to Year to determine the company's

current stock price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock