Question: Chapter 7 Assignment A Saved Help Save & Check my work mode : This shows what is correct or incorrect for the work you have

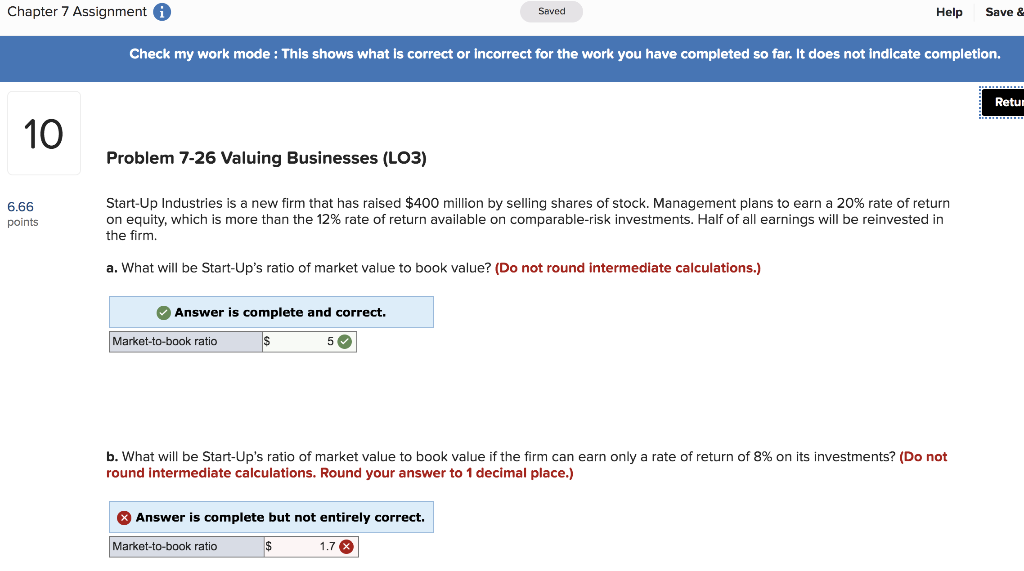

Chapter 7 Assignment A Saved Help Save & Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Retur 10 Problem 7-26 Valuing Businesses (LO3) 6.66 points Start-Up Industries is a new firm that has raised $400 million by selling shares of stock. Management plans to earn a 20% rate of return on equity, which more than the 12% rate of return available on comparable-risk investments. Half of all earnings will be reinvested in the firm, a. What will be Start-Up's ratio of market value to book value? (Do not round intermediate calculations.) Answer is complete and correct. Market-to-book ratio $ 5 b. What will be Start-Up's ratio of market value to book value if the firm can earn only a rate of return of 8% on its investments? (Do not round Intermediate calculations. Round your answer to 1 decimal place.) Answer is complete but not entirely correct. Market-to-book ratio $ 1.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts