Question: Chapter 7 Connect Problems Saved Help Save & Exit Submit Check my work A corporate bond with a coupon rate of 6.6 percent has 12

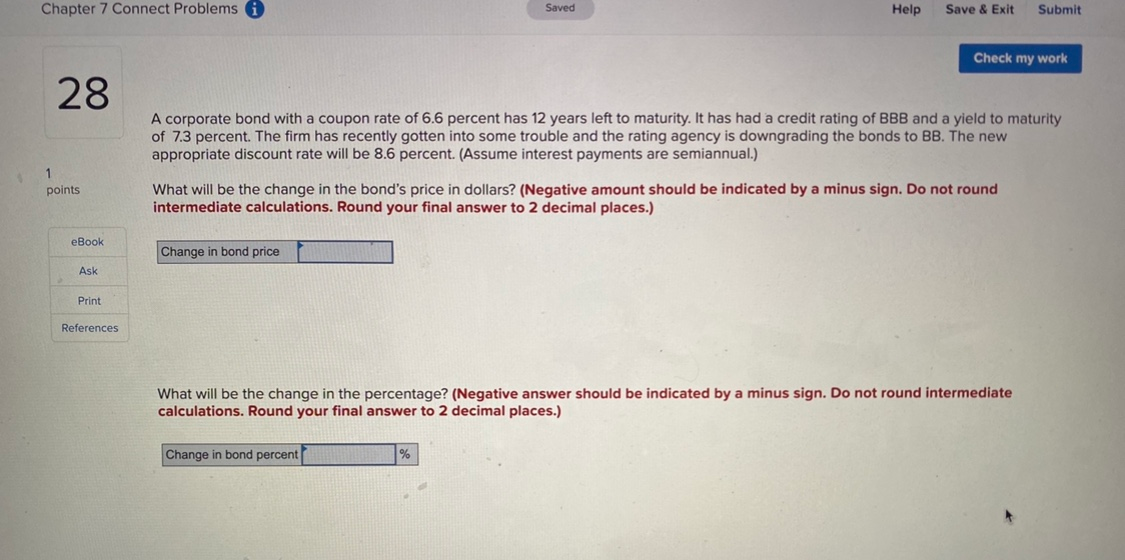

Chapter 7 Connect Problems Saved Help Save & Exit Submit Check my work A corporate bond with a coupon rate of 6.6 percent has 12 years left to maturity. It has had a credit rating of BBB and a yield to maturity of 7.3 percent. The firm has recently gotten into some trouble and the rating agency is downgrading the bonds to BB. The new appropriate discount rate will be 8.6 percent. (Assume interest payments are semiannual.) points What will be the change in the bond's price in dollars? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to 2 decimal places.) eBook Change in bond price Ask Print References What will be the change in the percentage? (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round your final answer to 2 decimal places.) Change in bond percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts