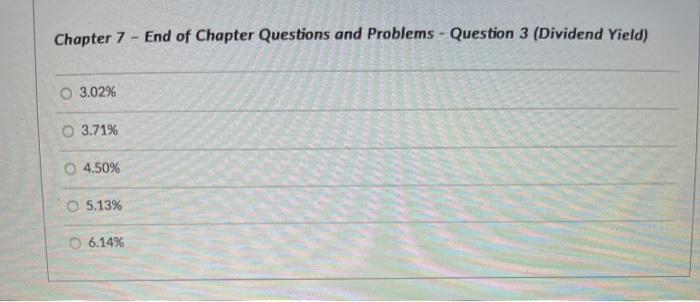

Question: Chapter 7 - End of Chapter Questions and Problems - Question 3 (Dividend Yield) O 3.02% O 3.71% 4.50% O 5.13% 6.14% 1 3. Stock

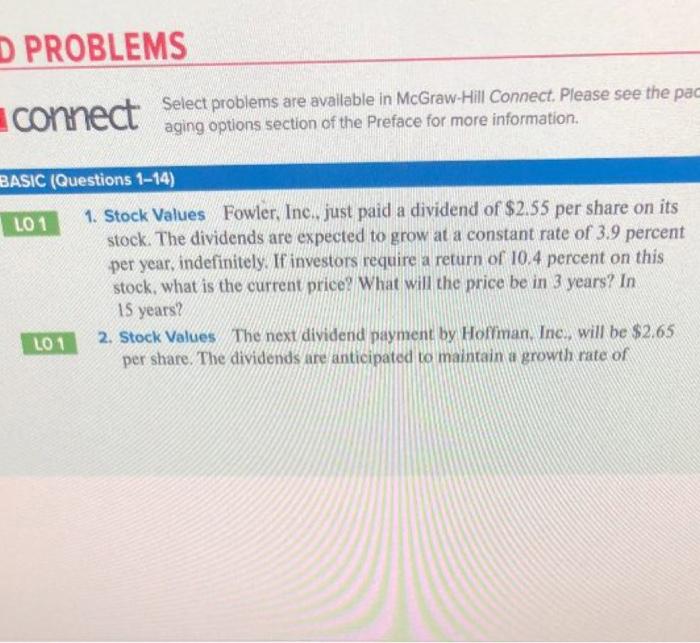

Chapter 7 - End of Chapter Questions and Problems - Question 3 (Dividend Yield) O 3.02% O 3.71% 4.50% O 5.13% 6.14% 1 3. Stock Values For the company in the previous problem, what is the dividend yield? What is the expected capital gains yield? CHAPTER 7 Euty Markets and Senekalution LO1 LO1 LO1 LO1 45 percent forever. If the stock currently sells for $43.15 per share, what is the required return? 1. Stock Valves For the company in the previous problem, what is the dividend yield! What is the expected capital gains yield? 4. Stock Values Poulter Corporation will pay a dividend of $3.25 per share next year. The company pledges to increase its dividend by 5.1 percent per year, indefinitely. If you require a return of Il percent on your investment, how much will you pay for the company's stock today! S. Stock Valuation Redan, Inc., is expected to maintain a constant 43 percent growth rate in its dividends, indefinitely. If the company has a dividend yield of 5.6 percent, what is the required return on the company's stock 6. Stock Valuation Suppose you know that a company's stock currently selli for 567 per share and the required return on the stock is 10.8 percent. You sho know that the total return on the stock is evenly divided between capital gains yield and dividend yield. If it's the company's policy to always maintain a constant growth rate in its dividends, what is the current dividend per Share 7. Stock Valuation Barkhand Corp. pays a constant $1.25 dividend on its stock. The company will maintain this dividend for the next nine years and will then cease poing dividends forever. If the required return on this stock is 9.2 percent wat is the current share price! 2. Valuing Preferred Stock Smiling Elephant, Inc. has an of preferred stock outstanding that pays a $285 dividend every year, in perpetuity of this issue currently sells for $72.32 per share, what is the required retur 9. Voting Rights Aller successfully completing your corporate Finance is you feel the next challenge had is to serve on the board of directors of Schenkel Enterprises. Unfortunately, you will be the only individual voting for you. If the company has 525.000 shares outstanding and the stock Currently sells for $38. how much will cost you to buy at the company s straight voting Assume that the company es curative voting and there are four wat in the current section how much will it cost you to buy LO1 LO1 LO 2 LO1 LO1 L01 10. Growth at the price of Alpe Caia 567. Investor of 10.5 percentiler acks the company plan to pay a dividend of $4.25 Best year what the expected for the company's stock price! 11 Veuing Preferred Sock Eyes.com has a new preferred clock it calle 20/20 preferred. The woch will 530 dividend per year, that the first divided will not be paid until 20 years from all you require a return of 7 percent on this ock, how much should you 2. Stoch Valuation Cape Corp will pay dividend of 26. The composed that will maintain a conth percent year forever. If you want to 12 per much you pay for the shock what reno percent What does this tell you see the hip between regled ock price Stuck Valtion and The Beaning Coupe 1 pers. The best for the company. What die wody pro Whibent Pere 21 LO 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts