Question: Chapter 7 Exercise 3 Circle the statement(s) below that are true, A. The traditional approach for evaluating the performance of the business includes analyzing single-

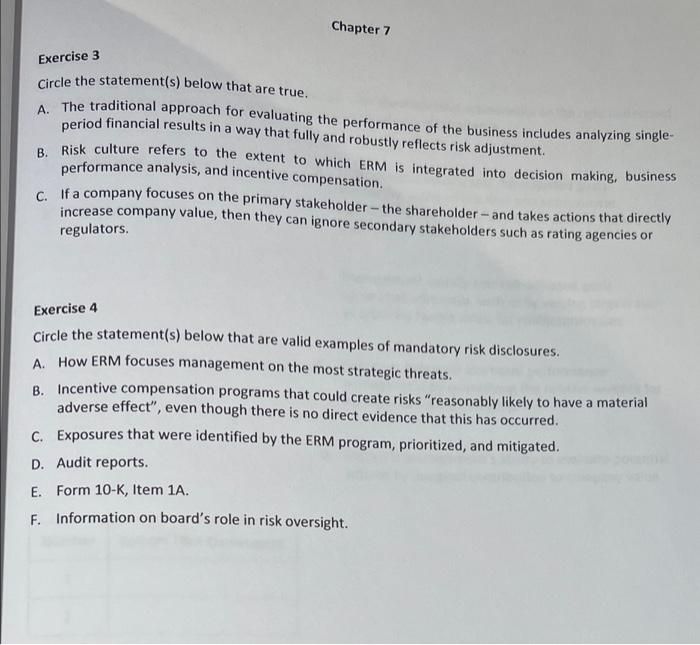

Chapter 7 Exercise 3 Circle the statement(s) below that are true, A. The traditional approach for evaluating the performance of the business includes analyzing single- period financial results in a way that fully and robustly reflects risk adjustment. B. Risk culture refers to the extent to which ERM is integrated into decision making, business performance analysis, and incentive compensation. c. If a company focuses on the primary stakeholder - the shareholder - and takes actions that directly increase company value, then they can ignore secondary stakeholders such as rating agencies or regulators. Exercise 4 Circle the statement(s) below that are valid examples of mandatory risk disclosures. A. How ERM focuses management on the most strategic threats. B. Incentive compensation programs that could create risks "reasonably likely to have a material adverse effect", even though there is no direct evidence that this has occurred. C. Exposures that were identified by the ERM program, prioritized, and mitigated. D. Audit reports. E. Form 10-K, Item 1A. F. Information on board's role in risk oversight. Chapter 7 Exercise 3 Circle the statement(s) below that are true, A. The traditional approach for evaluating the performance of the business includes analyzing single- period financial results in a way that fully and robustly reflects risk adjustment. B. Risk culture refers to the extent to which ERM is integrated into decision making, business performance analysis, and incentive compensation. c. If a company focuses on the primary stakeholder - the shareholder - and takes actions that directly increase company value, then they can ignore secondary stakeholders such as rating agencies or regulators. Exercise 4 Circle the statement(s) below that are valid examples of mandatory risk disclosures. A. How ERM focuses management on the most strategic threats. B. Incentive compensation programs that could create risks "reasonably likely to have a material adverse effect", even though there is no direct evidence that this has occurred. C. Exposures that were identified by the ERM program, prioritized, and mitigated. D. Audit reports. E. Form 10-K, Item 1A. F. Information on board's role in risk oversight

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts