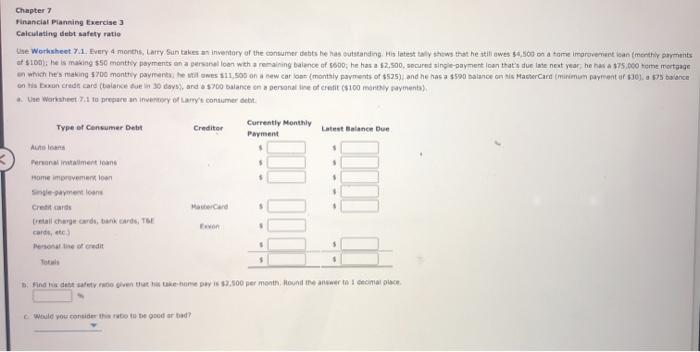

Question: Chapter 7 Financial Planning Exercise 3 Calculating debt safety ratio ise Worksheet 7.1.Every 4 months, Larry Suntakes an inventory of the consumer debts he has

Chapter 7 Financial Planning Exercise 3 Calculating debt safety ratio ise Worksheet 7.1.Every 4 months, Larry Suntakes an inventory of the consumer debts he has outstanding His latest shows that he still wes $4,500 na tome improvement loan (monthly payments at $1001, he making $50 monthly payments on a personal loan with a remaining balance of $600, he has a $2.500, secured single-payment loan that's deste next year he has a $75.000 home mortgage on which he's making 700 monthly payment, he wil 511.500 on a cew car loan (monthly payments of $525), and he has a $590 balance on his MasterCard (minimum payment of $10). $75 balance on his box credit card balance in do days) and 8 s700 balance on a personal line of credit ($100mly payments) Use Worksheet 7.1 to prepare an inventory of any consumer debt. Type of consumer Debt Creditor Currently Monthly Payment Latest Balance Due Auto loans Personal intention Home improvement loan Segment loans Credit cards retail charge card bancards, TE cards, Personale credit $ FOR . $ 1. Find det sette given the one is 3.500 per month Hound the anwesecima would you consider than to be good or bad

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts