Question: Chapter 7 Homework 10 1 points eBook Print References Saved Help KP Incorporated is negotiating a 10-year lease for three floors of space in a

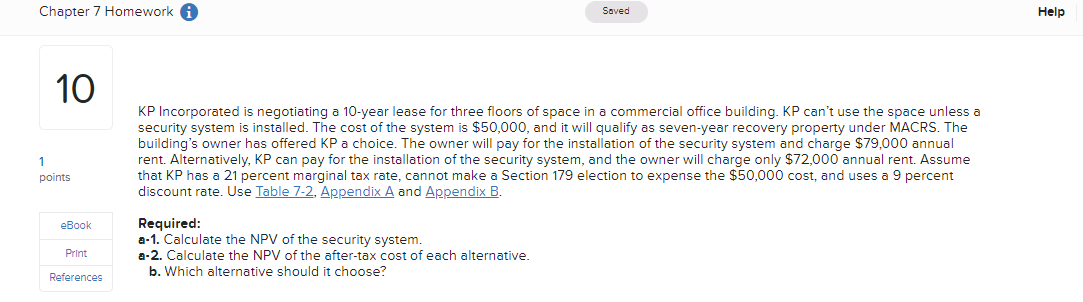

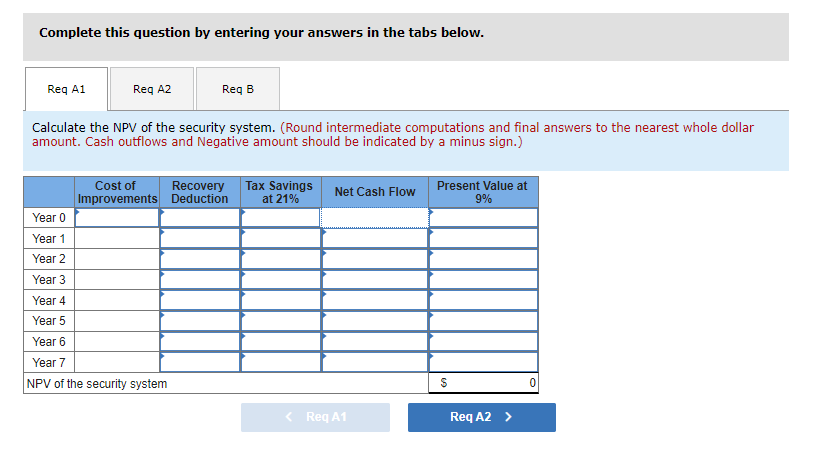

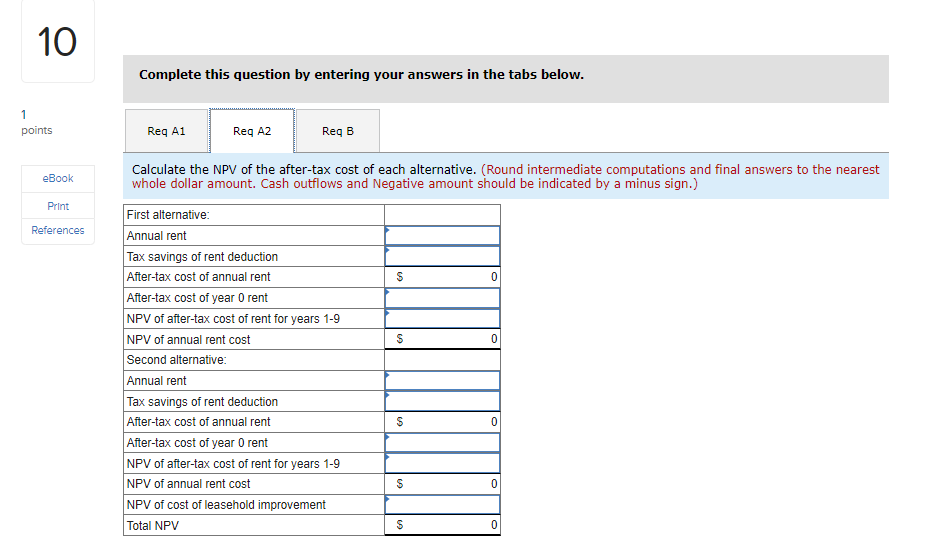

Chapter 7 Homework 10 1 points eBook Print References Saved Help KP Incorporated is negotiating a 10-year lease for three floors of space in a commercial office building. KP can't use the space unless a security system is installed. The cost of the system is $50,000, and it will qualify as seven-year recovery property under MACRS. The building's owner has offered KP a choice. The owner will pay for the installation of the security system and charge $79,000 annual rent. Alternatively, KP can pay for the installation of the security system, and the owner will charge only $72,000 annual rent. Assume that KP has a 21 percent marginal tax rate, cannot make a Section 179 election to expense the $50,000 cost, and uses a 9 percent discount rate. Use Table 7-2, Appendix A and Appendix B. Required: a-1. Calculate the NPV of the security system. a-2. Calculate the NPV of the after-tax cost of each alternative. b. Which alternative should it choose? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Calculate the NPV of the security system. (Round intermediate computations and final answers to the nearest whole dollar amount. Cash outflows and Negative amount should be indicated by a minus sign.) Cost of Recovery Tax Savings Improvements Deduction at 21% Net Cash Flow Present Value at 9% Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 NPV of the security system $ 10 1 points eBook Print References Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Calculate the NPV of the after-tax cost of each alternative. (Round intermediate computations and final answers to the nearest whole dollar amount. Cash outflows and Negative amount should be indicated by a minus sign.) First alternative: Annual rent Tax savings of rent deduction After-tax cost of annual rent $ 0 After-tax cost of year 0 rent NPV of after-tax cost of rent for years 1-9 NPV of annual rent cost Second alternative: Annual rent Tax savings of rent deduction After-tax cost of annual rent After-tax cost of year 0 rent NPV of after-tax cost of rent for years 1-9 NPV of annual rent cost NPV of cost of leasehold improvement Total NPV $ $ $ S 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts