Question: Chapter 7 Homework Assignment i Saved Help Save & Exit Submit Check my work 15 Problem 7-59 (LO 7-4) (Algo) 1.11 points Larry recently invested

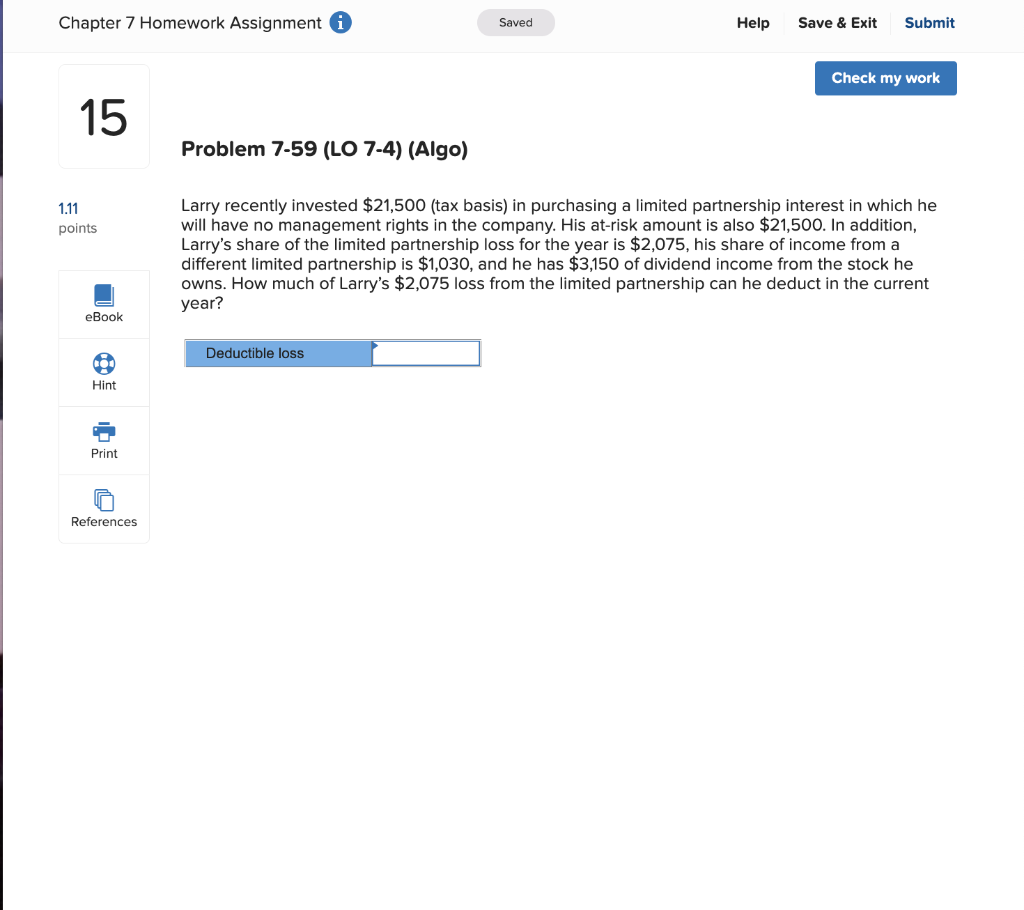

Chapter 7 Homework Assignment i Saved Help Save & Exit Submit Check my work 15 Problem 7-59 (LO 7-4) (Algo) 1.11 points Larry recently invested $21,500 (tax basis) in purchasing a limited partnership interest in which he will have no management rights in the company. His at-risk amount is also $21,500. In addition, Larry's share of the limited partnership loss for the year is $2,075, his share of income from a different limited partnership is $1,030, and he has $3,150 of dividend income from the stock he owns. How much of Larry's $2,075 loss from the limited partnership can he deduct in the current year? eBook Deductible loss Hint Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts