Question: Chapter 7 Homework EX.07.20 Direct Method and Overhead Rates Belami Company manufactures both shampoo and conditioner, with each product manufactured in separate departments. Three support

Chapter 7 Homework

- EX.07.20

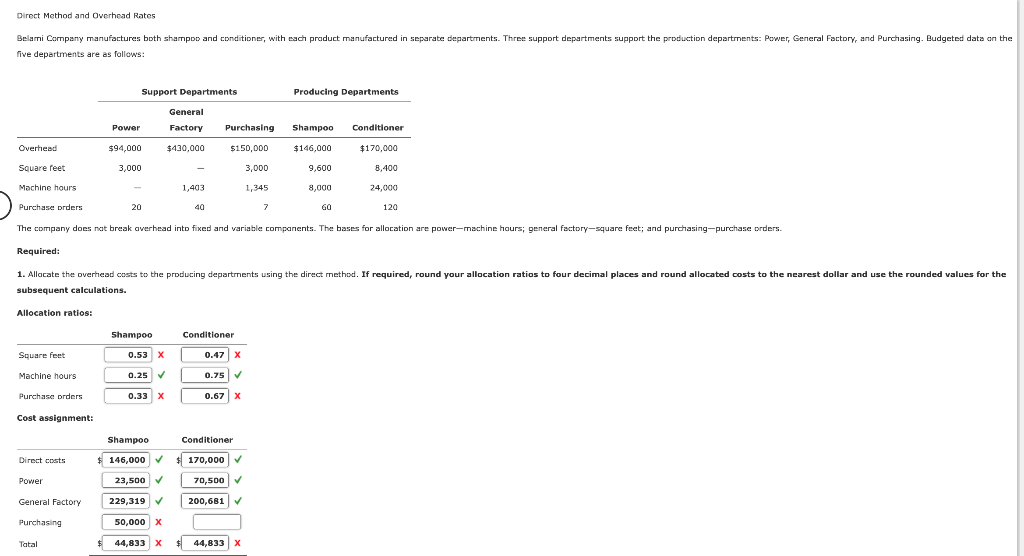

Direct Method and Overhead Rates Belami Company manufactures both shampoo and conditioner, with each product manufactured in separate departments. Three support departments support the production departments: Power, General Factory, and Purchasing. Budgeted data on the five departments are as follows: Support Departments Producing Departments General Power Factory Purchasing Conditioner Shampoo $146,000 Overhead $94,000 $ $430,000 $ $150,000 $170,000 $ Square feet 3,000 3,000 9,600 8,400 Machine hours 1,403 1,345 8,000 24,000 Purchase orders 20 40 7 GO 120 The company does not break averhead into fixed and variable components. The bases for allocation are power-machine hours, general factory-square feet; and purchasing-purchase orders. Required: 1. Allocate the overhead costs to the producing departments using the direct method. If required, round your allocation ratios to four decimal places and round allocated costs to the nearest dollar and use the rounded values for the subsequent calculations. Allocation ratios: Shampoo Conditioner Square feet 0.53 X 0.47 X Machine hours 0.25 0.75 Purchase orders 0.33 x 0.67 x Cost assignment: Shampoo Conditioner Direct costs $ 146,000 $ 170,000 Power 23,500 70,500 General Factory 229,319 200,681 Purchasing 50,000 X Tatal 44,833 X $44,833 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts