Question: CHAPTER 7 HOMEWORK PROBLEMS - SHOW ALL WORK IN ALL PROBLEMS 7.1. If purchases were 45% of sales and other expenses were 45% of sales,

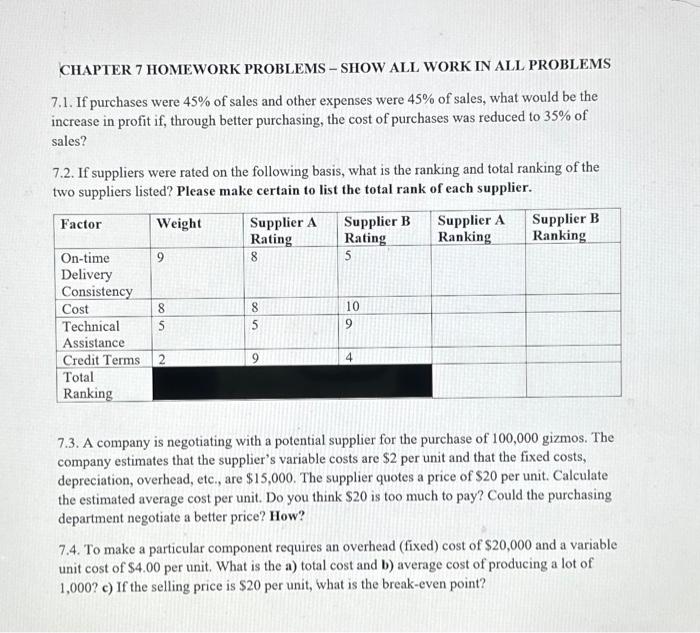

CHAPTER 7 HOMEWORK PROBLEMS - SHOW ALL WORK IN ALL PROBLEMS 7.1. If purchases were 45% of sales and other expenses were 45% of sales, what would be the increase in profit if, through better purchasing, the cost of purchases was reduced to 35% of sales? 7.2. If suppliers were rated on the following basis, what is the ranking and total ranking of the two suppliers listed? Please make certain to list the total rank of each supplier. 7.3. A company is negotiating with a potential supplier for the purchase of 100,000 gizmos. The company estimates that the supplier's variable costs are $2 per unit and that the fixed costs, depreciation, overhead, etc., are $15,000. The supplier quotes a price of $20 per unit. Calculate the estimated average cost per unit. Do you think $20 is too much to pay? Could the purchasing department negotiate a better price? How? 7.4. To make a particular component requires an overhead (fixed) cost of $20,000 and a variable unit cost of $4.00 per unit. What is the a) total cost and b) average cost of producing a lot of 1,000 ? ) If the selling price is $20 per unit, what is the break-even point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts