Question: Chapter 7 Homework Saved Help Save & Exit Submit 1.5 8 points 01:43:04 10 References Exercise 7-14 (Algo) Calculate uncollectible accounts using the aging

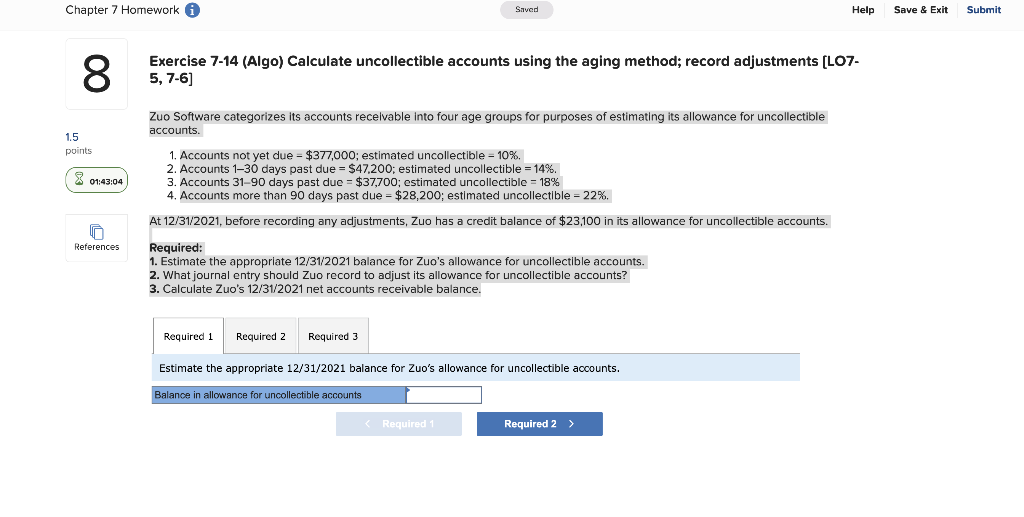

Chapter 7 Homework Saved Help Save & Exit Submit 1.5 8 points 01:43:04 10 References Exercise 7-14 (Algo) Calculate uncollectible accounts using the aging method; record adjustments [LO7- 5,7-6] Zuo Software categorizes its accounts receivable into four age groups for purposes of estimating its allowance for uncollectible accounts. 1. Accounts not yet due = $377,000; estimated uncollectible = 10%. 2. Accounts 1-30 days past due = $47,200; estimated uncollectible = 14%. 3. Accounts 31-90 days past due = $37,700; estimated uncollectible - 18% 4. Accounts more than 90 days past due = $28,200; estimated uncollectible - 22%. At 12/31/2021, before recording any adjustments, Zuo has a credit balance of $23,100 in its allowance for uncollectible accounts. Required: 1. Estimate the appropriate 12/31/2021 balance for Zuo's allowance for uncollectible accounts. 2. What journal entry should Zuo record to adjust its allowance for uncollectible accounts? 3. Calculate Zuo's 12/31/2021 net accounts receivable balance. Required 1 Required 2 Required 3 Estimate the appropriate 12/31/2021 balance for Zuo's allowance for uncollectible accounts. Balance in allowance for uncollectible accounts < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts