Question: CHAPTER 7 Internal Control and Cash EXERCISES Exercise 7 - 1 Analyzing internal control LO 1 Lombard Company is a young business that has grown

CHAPTER Internal Control and Cash

EXERCISES

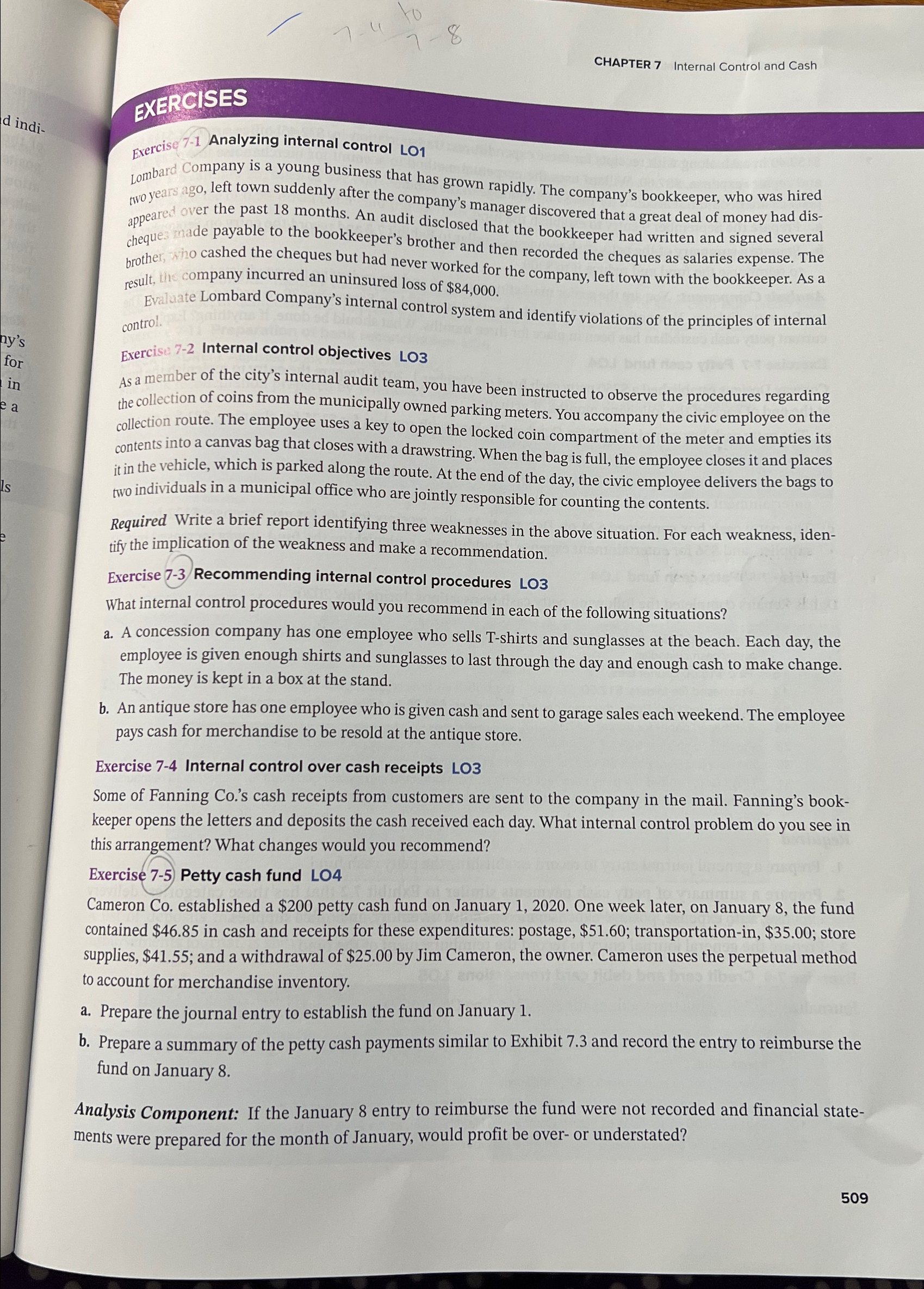

Exercise Analyzing internal control LO

Lombard Company is a young business that has grown rapidly. The company's bookkeeper, who was hired two years ago, left town suddenly after the company's manager discovered that a great deal of money had disappeared over the past months. An audit disclosed that the bookkeeper had written and signed several cheques made payable to the bookkeeper's brother and then recorded the cheques as salaries expense. The brother, who cashed the cheques but had never worked for the company, left town with the bookkeeper. As a result, the company incurred an uninsured loss of $

Evaluate Lombard Company's internal control system and identify violations of the principles of internal control.

Exercise Internal control objectives

As a member of the city's internal audit team, you have been instructed to observe the procedures regarding the collection of coins from the municipally owned parking meters. You accompany the civic employee on the collection route. The employee uses a key to open the locked coin compartment of the meter and empties its contents into a canvas bag that closes with a drawstring. When the bag is full, the employee closes it and places it in the vehicle, which is parked along the route. At the end of the day, the civic employee delivers the bags to two individuals in a municipal office who are jointly responsible for counting the contents.

Required Write a brief report identifying three weaknesses in the above situation. For each weakness, identify the implication of the weakness and make a recommendation.

Exercise Recommending internal control procedures

What internal control procedures would you recommend in each of the following situations?

a A concession company has one employee who sells Tshirts and sunglasses at the beach. Each day, the employee is given enough shirts and sunglasses to last through the day and enough cash to make change. The money is kept in a box at the stand.

b An antique store has one employee who is given cash and sent to garage sales each weekend. The employee pays cash for merchandise to be resold at the antique store.

Exercise Internal control over cash receipts LO

Some of Fanning Cos cash receipts from customers are sent to the company in the mail. Fanning's bookkeeper opens the letters and deposits the cash received each day. What internal control problem do you see in this arrangement? What changes would you recommend?

Exercise Petty cash fund LO

Cameron Co established a $ petty cash fund on January One week later, on January the fund contained $ in cash and receipts for these expenditures: postage, $; transportationin $; store supplies, $; and a withdrawal of $ by Jim Cameron, the owner. Cameron uses the perpetual method to account for merchandise inventory.

a Prepare the journal entry to establish the fund on January

b Prepare a summary of the petty cash payments similar to Exhibit and record the entry to reimburse the fund on January

Analysis Component: If the January entry to reimburse the fund were not recorded and financial statements were prepared for the month of January, would profit be over or understated?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock