Question: CHAPTER 7 Inventory an COACHED PROBLEMS ?connect CP7-1 Analyzing the Effects of Four Alternative Inventory Costing Methods erappers Supplies tracks the number of units purchased

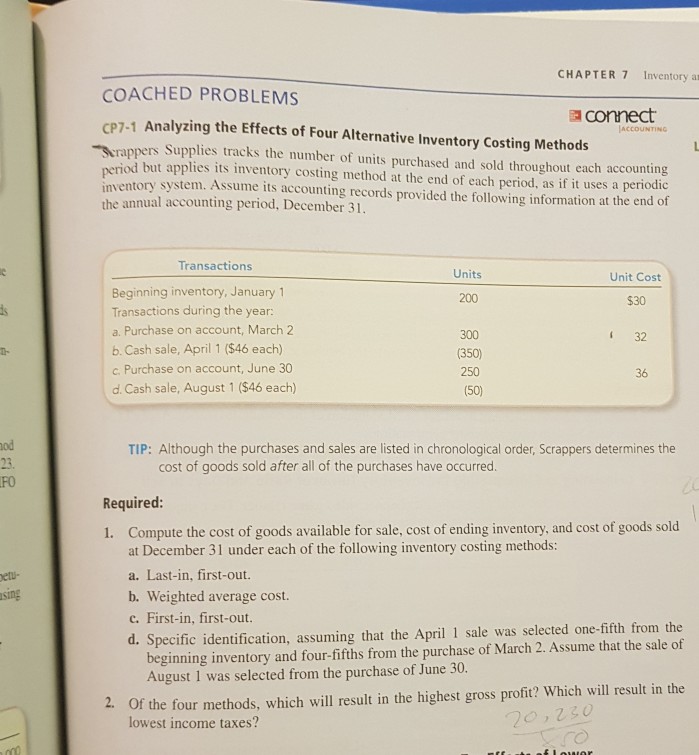

CHAPTER 7 Inventory an COACHED PROBLEMS ?connect CP7-1 Analyzing the Effects of Four Alternative Inventory Costing Methods erappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic ACCOUNTING ventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 Transactions during the year a. Purchase on account, March 2 b. Cash sale, April 1 ($46 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($46 each) 200 $30 300 (350) 250 (50) 32 36 od 23. FO TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred. Required at December 31 under each of the following inventory costing methods a. Last-in, first-out. b. Weighted average cost. c. First-in, first-out. d. etu- sing Specific identification, assuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the purchase of March 2. Assume that the sale of August I was selected from the purchase of June 30. Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes? 2. 20 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts