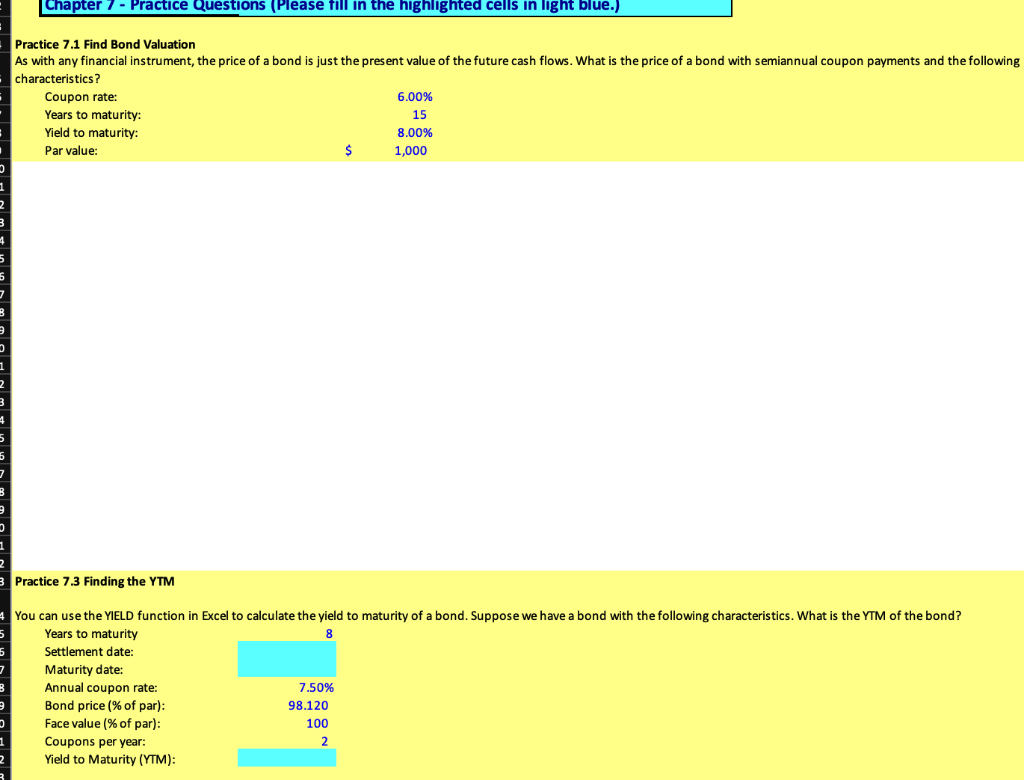

Question: Chapter 7 - Practice Questions (Please fill in the highlighted cells in light blue.) future cash flows. What is the price of a bond with

Chapter 7 - Practice Questions (Please fill in the highlighted cells in light blue.) future cash flows. What is the price of a bond with semiannual coupon payments and the following Practice 7.1 Find Bond Valuation As with any financial instrument, the price of a bond is just the present value of characteristics? Coupon rate: 6.00% Years to maturity: 15 Yield to maturity: 8.00% Par value: $ 1,000 Practice 7.3 Finding the YTM You can use the YIELD function in Excel to calculate the yield to maturity of a bond. Suppose we have a bond with the following characteristics. What is the YTM of the bond? Years to maturity 8 Settlement date: Maturity date: Annual coupon rate: 7.50% Bond price % of par): 98.120 Face value % of par): 100 Coupons per year: 2 Yield to Maturity (YTM)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts