Question: Chapter 7, Problem 36QP Bookmarlk Show all steps ON Problem Characterize the risk exposure(s) of the following FI transactions by choosing one or more of

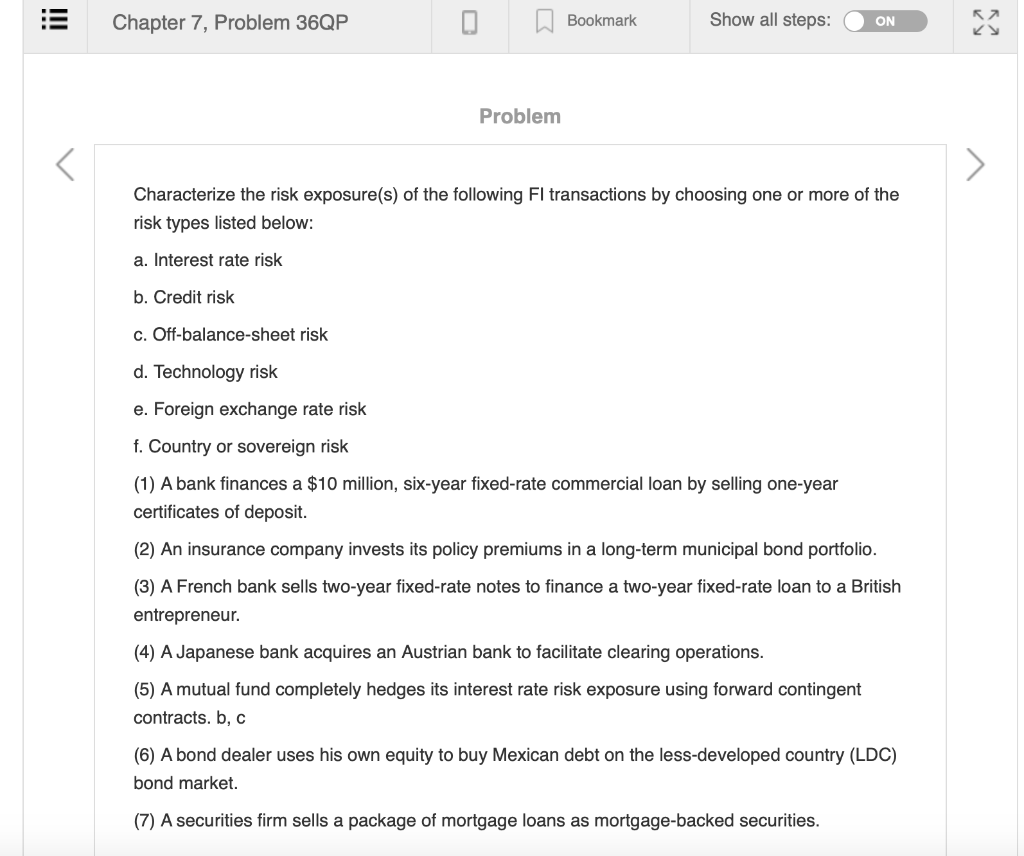

Chapter 7, Problem 36QP Bookmarlk Show all steps ON Problem Characterize the risk exposure(s) of the following FI transactions by choosing one or more of the risk types listed below a. Interest rate risk b. Credit risk c. Off-balance-sheet risk d. Technology risk e. Foreign exchange rate risk f. Country or sovereign risk (1) A bank finances a $10 million, six-year fixed-rate commercial loan by selling one-year certificates of deposit (2) An insurance company invests its policy premiums in a long-term municipal bond portfolio. (3) A French bank sells two-year fixed-rate notes to finance a two-year fixed-rate loan to a British entrepreneur. (4) A Japanese bank acquires an Austrian bank to facilitate clearing operations (5) A mutual fund completely hedges its interest rate risk exposure using forward contingent contracts. b, c (6) A bond dealer uses his own equity to buy Mexican debt on the less-developed country (LDC) bond market. (7) A securities firm sells a package of mortgage loans as mortgage-backed securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts