Question: Chapter 7 - Q1: Please help answer the question in detail in the following image below. (Please note decimals and rounding) a. What price would

Chapter 7 - Q1: Please help answer the question in detail in the following image below. (Please note decimals and rounding)

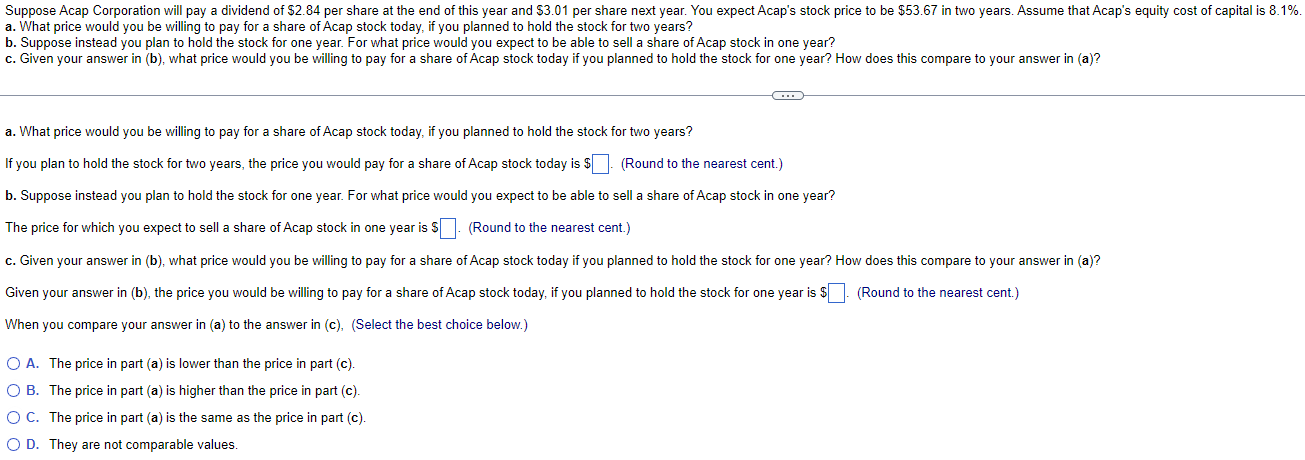

a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? c. Given your answer in (b), what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this compare to your answer in (a)? a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? If you plan to hold the stock for two years, the price you would pay for a share of Acap stock today is $. (Round to the nearest cent.) b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? The price for which you expect to sell a share of Acap stock in one year is . (Round to the nearest cent.) c. Given your answer in (b), what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this compare to your answer in (a)? Given your answer in (b), the price you would be willing to pay for a share of Acap stock today, if you planned to hold the stock for one year is $ (Round to the nearest cent.) When you compare your answer in (a) to the answer in (c), (Select the best choice below.) A. The price in part (a) is lower than the price in part (c). B. The price in part (a) is higher than the price in part (c). C. The price in part (a) is the same as the price in part (c). D. They are not comparable values

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts