Question: Chapter 7 Question 9 9. Input area: Zero Coupon Bonds [LO2] You find a zero coupon bond with a par value of $10,000 and 17

![Chapter 7 Question 9 9. Input area: Zero Coupon Bonds [LO2]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66ff899c80ddb_94066ff899c034c2.jpg)

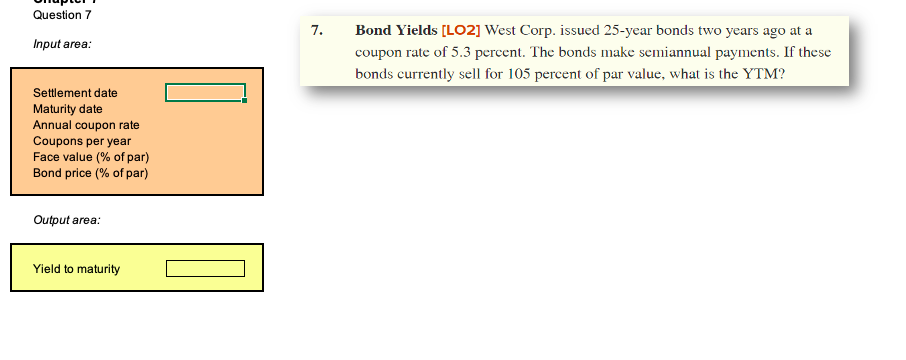

Chapter 7 Question 9 9. Input area: Zero Coupon Bonds [LO2] You find a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. Settlement date Maturity date Coupon rate Coupons per year Face value Yield to maturity Par value Output area: Price Question 7 7. Input area: Bond Yields [LO2] West Corp. issued 25-year bonds two years ago at a coupon rate of 5.3 percent. The bonds make semiannual payments. If these bonds currently sell for 105 percent of par value, what is the YTM? Settlement date Maturity date Annual coupon rate Coupons per year Face value (% of par) Bond price (% of par) Output area: Yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts