Question: Chapter 7 study assignment Saved Help Save & Exit Submit Check my work Orion Iron Corp. tracks the number of units purchased and sold throughout

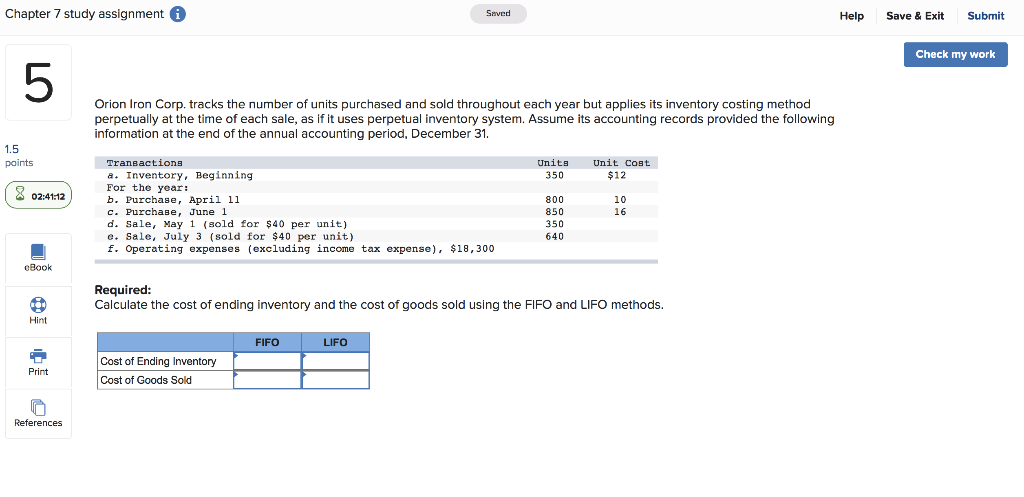

Chapter 7 study assignment Saved Help Save & Exit Submit Check my work Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing method perpetually at the time of each sale, as if it uses perpetual inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. paints Units 350 Unit Cost $12 (8 02:41:12 Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $40 per unit) e. Sale, July 3 (sold for $40 per unit) f. Operating expenses (excluding income tax expense), $18,300 10 16 800 850 350 640 eBook Required: Calculate the cost of ending inventory and the cost of goods sold using the FIFO and LIFO methods. Hint FIFO LIFO Print Cost of Ending Inventory Cost of Goods Sold References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts