Question: Chapter 8 #40 Lori, who is single, purchased 5-year class property for $200,000 and 7-year class property for $400,000 on May 20, 2016. Lori expects

Chapter 8 #40

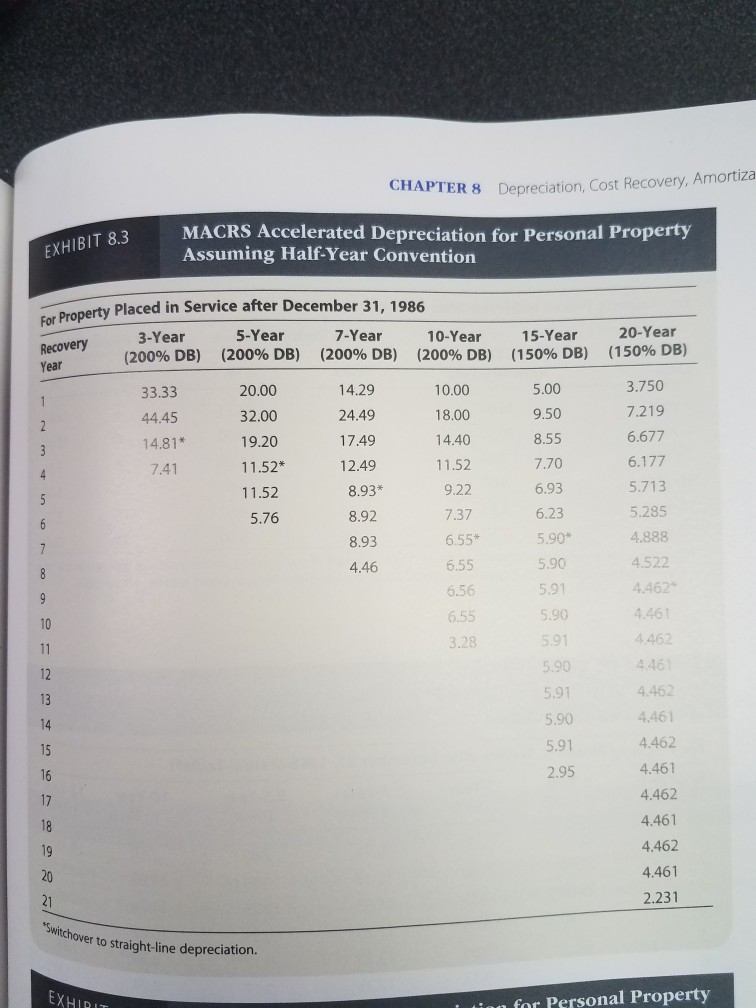

Lori, who is single, purchased 5-year class property for $200,000 and 7-year

class property for $400,000 on May 20, 2016. Lori expects the taxable income

derived from her business (without regard to the amount expensed under 179) to

be about $800,000. Lori wants to elect immediate 179 expensing, but she doesnt

know which asset she should expense under 179. She does not claim any available

additional first-year depreciation.

a. Determine Loris total deduction if the 179 expense is first taken with respect

to the 5-year class asset.

b. Determine Loris total deduction if the 179 expense is first taken with respect

to the 7-year class asset.

c. What is your advice to Lori?

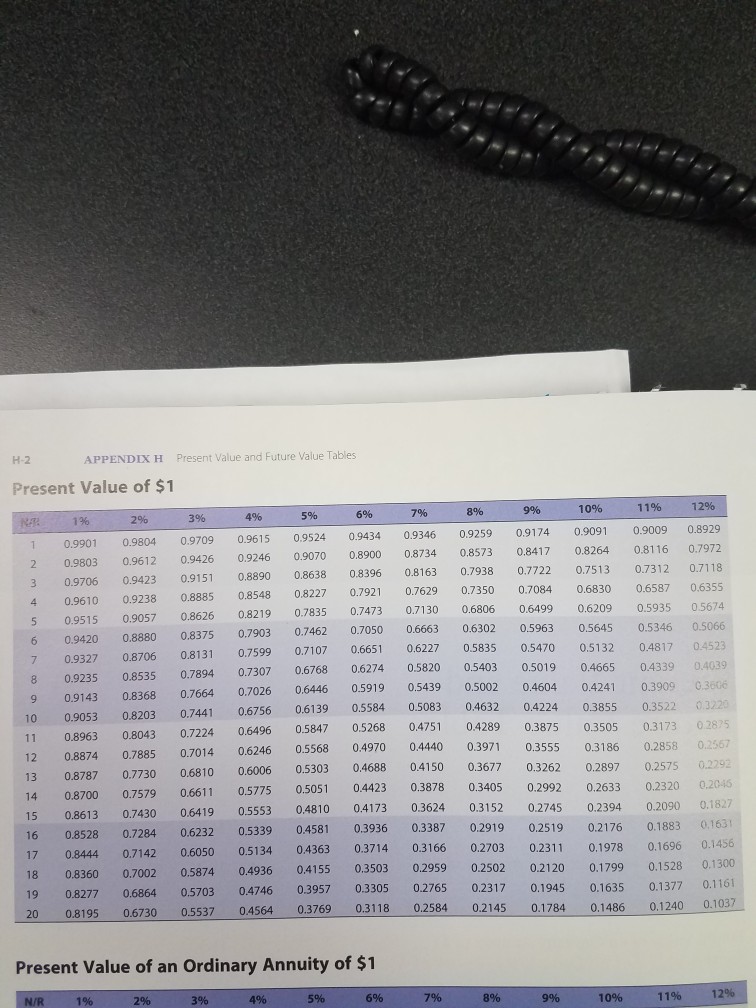

d. Assume that Lori is in the 25% marginal tax bracket and that she uses 179 on

the 7-year asset. Determine the present value of the tax savings from the depreciation

deductions for both assets. See Appendix F for present value factors,

and assume a 6% discount rate.

e. Assume the same facts as in part (d), except that Lori decides not to use 179

on either asset. What is the present value of the tax savings generated by using

the 179 deduction on the 7-year asset?

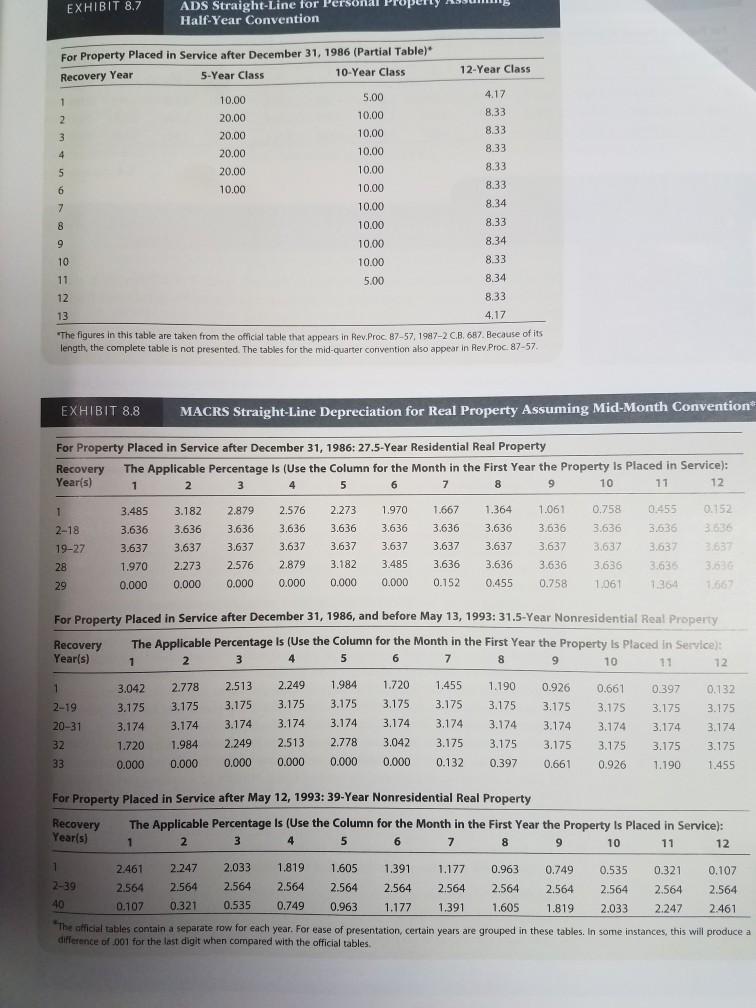

Property HSS ADS Straight-Line for Personal Half-Year Convention EXHIBIT 8.7 For Property Placed in Service after December 31, 1986 (Partial Table)* Recovery Year 10-Year Class 5.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 5.00 12-Year Class 4.17 8.33 8.33 8.33 8.33 8.33 8.34 8.33 8.34 8.33 8.34 8.33 4.17 5-Year Class 10.00 20.00 20,00 20,00 20.00 10.00 13 The figures in this table are taken from the official table that appears in Rev.Proc 87-57, 1987-2 C.B. 687. Because of its length, the complete table is not presented. The tables for the mid-quarter convention also appear in Rev.Proc. 87-57 EXHIBIT 8.8 MACRS Straight-Line Depreciation for Real Property Assuming Mid-Month Convention For Property Placed in Service after December 31, 1986: 27.5-Year Residential Real Property Recovery Years) The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): 9 10 3.485 3.182 2.879 2.576 2.273 1.970 1.667 1364 1.061 0.758 0.455 0.152 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3636 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3637 1.970 2.273 2.576 2.879 3.182 3.485 3.636 3.636 3.636 3.636 3635 0.000 o.000 0.000 0.000 0.000 0.000 0.152 0.455 0.758 1061 2-18 19-27 1.364 1.667 29 For Property Placed in Service after December 31, 1986, and before May 13, 1993: 31.5-Year Nonresidential Real Property Recovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service) Year(s)1 6 9 10 12 3.042 2.778 2.513 2.249 984 1.720 1.455 1.190 0.926 0.661 0.397 0.132 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 20-31 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3.174 3174 3.174 1.720 1.984 2.249 2.513 2.778 3.042 3.175 3.175 3.175 3.175 3.175 3.175 0.000 0.000 0.000 0.000 0.000 0.000 0.132 0.397 0.661 0.926 1.190 1455 2-19 32 For Property Placed in Service after May 12, 1993: 39-Year Nonresidential Real Property ecovery The Applicable Percentage Is (Use the Column for the Month in the First Year the Property Is Placed in Service): Year(s) 9 10 12 2.461 2.247 2.033 1819 1.605 1.39 1.177 0.963 0.749 0.535 0.321 0.107 2.564 2.564 2.564 2.564 2.564 2564 2564 2.564 2.564 2.564 2.564 2.564 0107 0.321 0.535 0.749 0.963 1177 1.391 .605 1.819 2.033 2.247 2.461 official tables contain a separate row for each year. For ease of presentation, certain years are grouped in these tables. In some instances, this will produce a difference of .001 for the last digit when compared with the official tables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts