Question: Chapter 8 6. Why do we need to use beta to invest in a stock? How can you measure (or estimate) it? If a stock

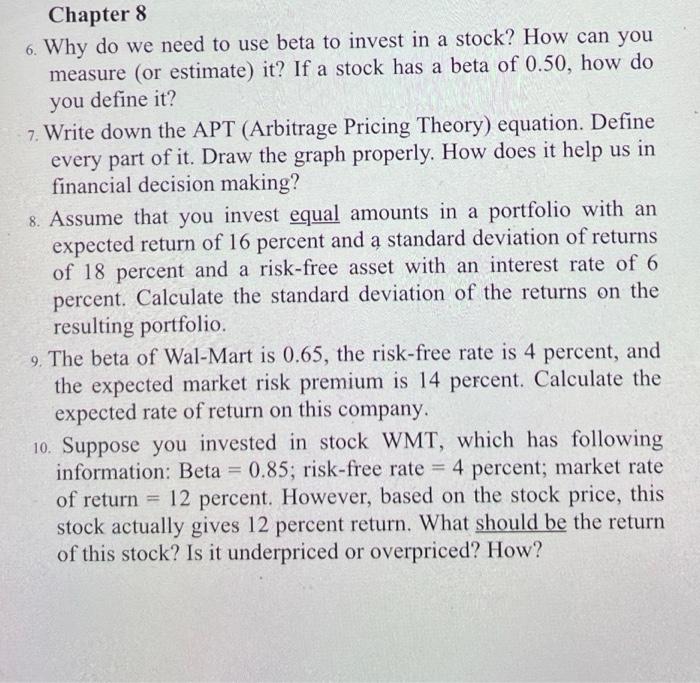

Chapter 8 6. Why do we need to use beta to invest in a stock? How can you measure (or estimate) it? If a stock has a beta of 0.50, how do you define it? 7. Write down the APT (Arbitrage Pricing Theory) equation. Define every part of it. Draw the graph properly. How does it help us in financial decision making? 8. Assume that you invest equal amounts in a portfolio with an expected return of 16 percent and a standard deviation of returns of 18 percent and a risk-free asset with an interest rate of 6 percent. Calculate the standard deviation of the returns on the resulting portfolio 9. The beta of Wal-Mart is 0.65, the risk-free rate is 4 percent, and the expected market risk premium is 14 percent. Calculate the expected rate of return on this company. 10. Suppose you invested in stock WMT, which has following information: Beta = 0.85; risk-free rate = 4 percent; market rate of return = 12 percent. However, based on the stock price, this stock actually gives 12 percent return. What should be the return of this stock? Is it underpriced or overpriced? How

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts