Question: CHAPTER 8 a SALES TAX 2 . 0 QUESTION 1 Explain for each of the following transactions, whether subject to Sales Tax Act 2 0

CHAPTER

SALES TAX

QUESTION

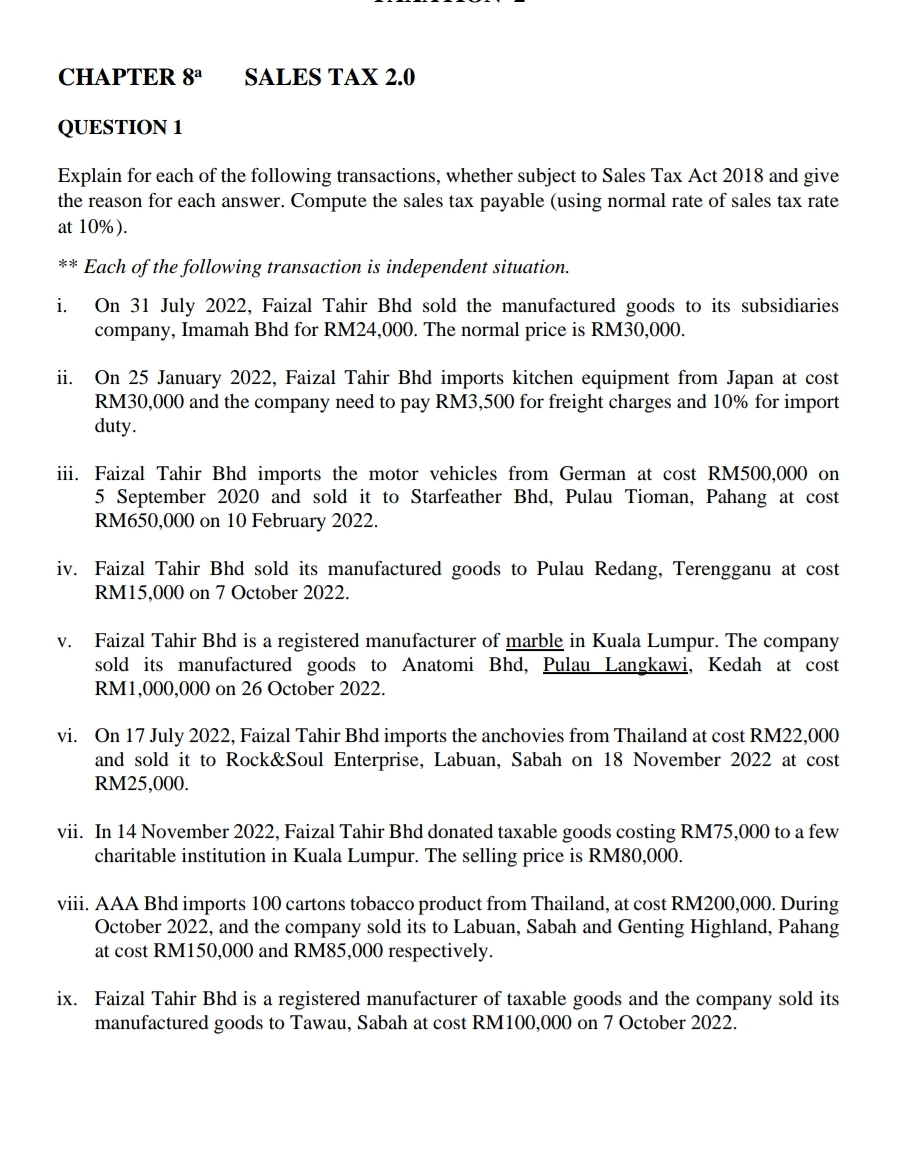

Explain for each of the following transactions, whether subject to Sales Tax Act and give the reason for each answer. Compute the sales tax payable using normal rate of sales tax rate at

Each of the following transaction is independent situation.

i On July Faizal Tahir Bhd sold the manufactured goods to its subsidiaries company, Imamah Bhd for RM The normal price is RM

ii On January Faizal Tahir Bhd imports kitchen equipment from Japan at cost RM and the company need to pay RM for freight charges and for import duty.

iii. Faizal Tahir Bhd imports the motor vehicles from German at cost RM on September and sold it to Starfeather Bhd Pulau Tioman, Pahang at cost RM on February

iv Faizal Tahir Bhd sold its manufactured goods to Pulau Redang, Terengganu at cost RM on October

v Faizal Tahir Bhd is a registered manufacturer of marble in Kuala Lumpur. The company sold its manufactured goods to Anatomi Bhd Pulau Langkawi, Kedah at cost RM on October

vi On July Faizal Tahir Bhd imports the anchovies from Thailand at cost RM and sold it to Rock&Soul Enterprise, Labuan, Sabah on November at cost RM

vii. In November Faizal Tahir Bhd donated taxable goods costing RM to a few charitable institution in Kuala Lumpur. The selling price is RM

viii. AAA Bhd imports cartons tobacco product from Thailand, at cost RM During October and the company sold its to Labuan, Sabah and Genting Highland, Pahang at cost RM and RM respectively.

ix Faizal Tahir Bhd is a registered manufacturer of taxable goods and the company sold its manufactured goods to Tawau, Sabah at cost RM on October

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock