Question: Chapter 8 accounting worksheet 1. What are the two features that set Plant Assets/Fixed Assets apart from other assets. a. b. 2. Of the different

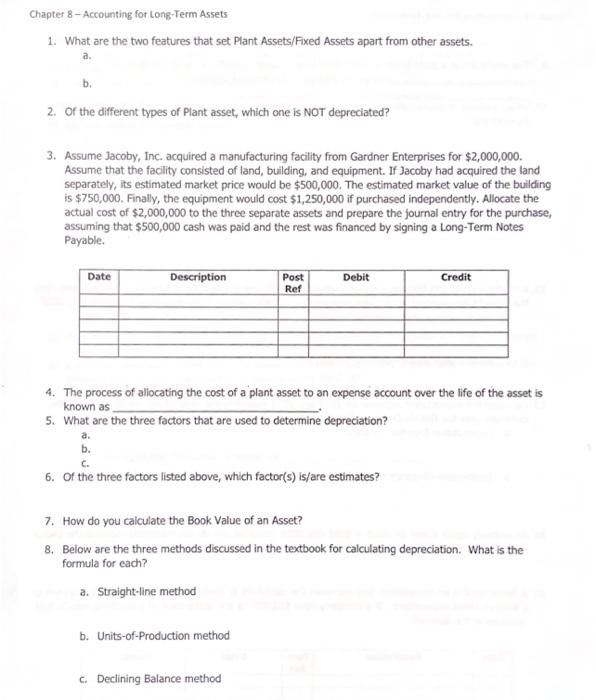

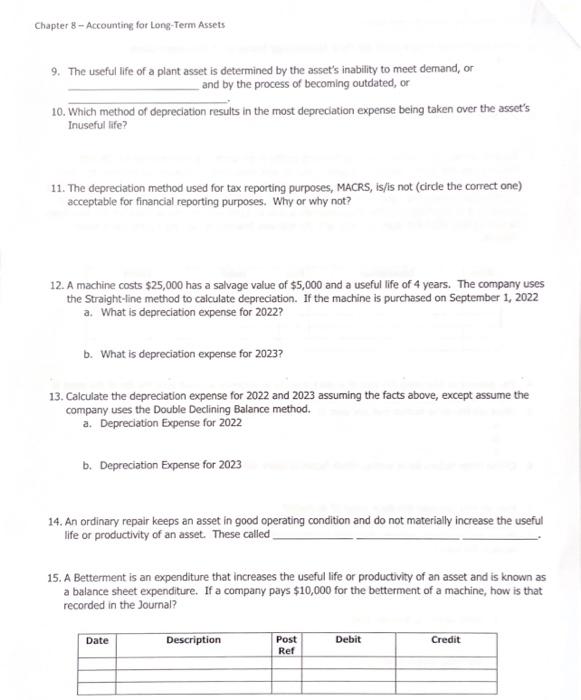

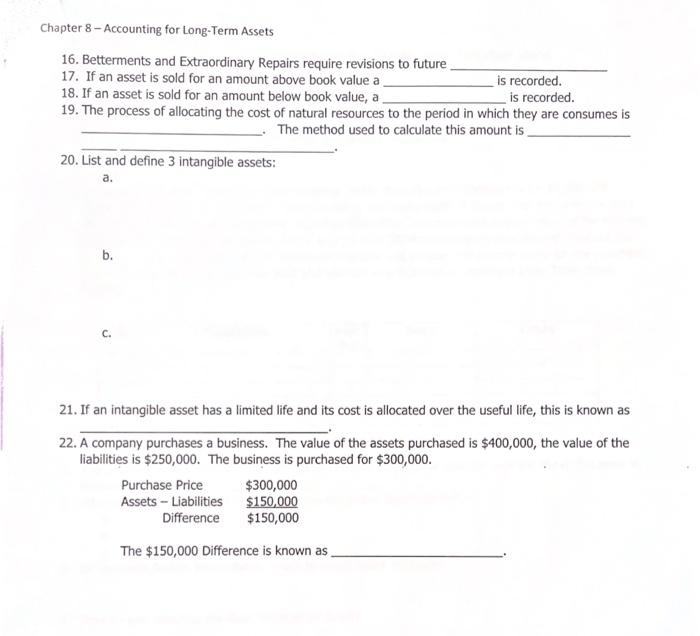

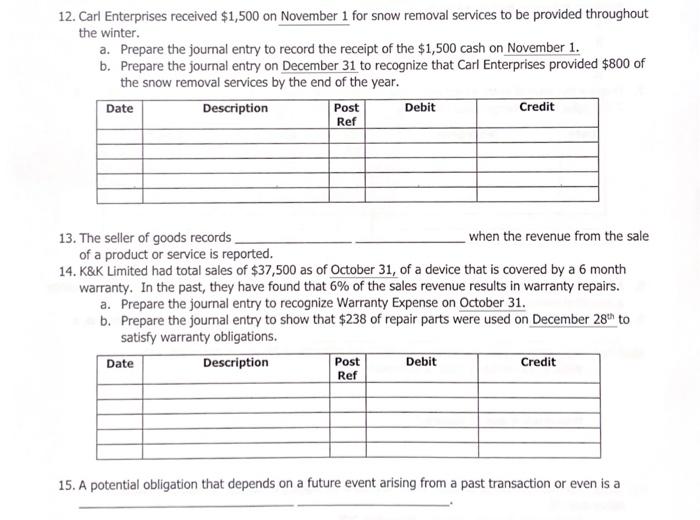

1. What are the two features that set Plant Assets/Fixed Assets apart from other assets. a. b. 2. Of the different types of Plant asset, which one is NOT depreciated? 3. Assume Jacoby, Inc. acquired a manufacturing facility from Gardner Enterprises for $2,000,000. Assume that the facility consisted of land, building, and equipment. If Jacoby had acquired the land separately, its estimated market price would be $500,000. The estimated market value of the building is $750,000. Finally, the equipment would cost $1,250,000 if purchased independently. Allocate the actual cost of $2,000,000 to the three separate assets and prepare the journal entry for the purchase, assuming that $500,000 cash was paid and the rest was financed by signing a Long-Term Notes Payable. 4. The process of allocating the cost of a plant asset to an expense account over the life of the asset is known as 5. What are the three factors that are used to determine depreciation? a. b. c. 6. Of the three factors listed above, which factor(s) is/are estimates? 7. How do you calculate the Book Value of an Asset? 8. Below are the three methods discussed in the textbook for calculating depreciation. What is the formula for each? a. Straight-line method b. Units-of-Production method c. Decining Balance method 11. The depreciation method used for tax reporting purposes, MACRS, is/is not (circle the correct one) acceptable for financial reporting purposes. Why or why not? 12. A machine costs $25,000 has a salvage value of $5,000 and a useful life of 4 years. The company uses the Straight-line method to calculate depreciation. If the machine is purchased on September 1,2022 a. What is depreciation expense for 2022 ? b. What is depreciation expense for 2023 ? 13. Calculate the depreciation expense for 2022 and 2023 assuming the facts above, except assume the company uses the Double Declining Balance method. a. Depreciation Expense for 2022 b. Depreciation Expense for 2023 14. An ordinary repair keeps an asset in good operating condition and do not materially increase the useful life or productivity of an asset. These called 15. A Betterment is an expenditure that increases the useful life or productivity of an asset and is known as a balance sheet expenditure. If a company pays $10,000 for the betterment of a machine, how is that recorded in the Journal? Chapter 8 -Accounting for Long-Term Assets 16. Betterments and Extraordinary Repairs require revisions to future 17. If an asset is sold for an amount above book value a is recorded. 18. If an asset is sold for an amount below book value, a is recorded. 19. The process of allocating the cost of natural resources to the period in which they are consumes is - The method used to calculate this amount is 20. List and define 3 intangible assets: a. b. c. 21. If an intangible asset has a limited life and its cost is allocated over the useful life, this is known as 22. A company purchases a business. The value of the assets purchased is $400,000, the value of the liabilities is $250,000. The business is purchased for $300,000. The $150,000 Difference is known as 12. Carl Enterprises received $1,500 on November 1 for snow removal services to be provided throughout the winter. a. Prepare the journal entry to record the receipt of the $1,500 cash on November 1 . b. Prepare the journal entry on December 31 to recognize that Carl Enterprises provided $800 of the snow removal services by the end of the year. 13. The seller of goods records when the revenue from the sale of a product or service is reported. 14. K\&K Limited had total sales of $37,500 as of October 31 , of a device that is covered by a 6 month warranty. In the past, they have found that 6% of the sales revenue results in warranty repairs. a. Prepare the journal entry to recognize Warranty Expense on October 31. b. Prepare the journal entry to show that $238 of repair parts were used on December 28th to satisfy warranty obligations. 15. A potential obligation that depends on a future event arising from a past transaction or even is a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts