Question: Chapter 8 Assignment 1 0 Saved Help Save & Exit Submit Check my work 5 O Part 2 of 2 5 points Required Information Problem

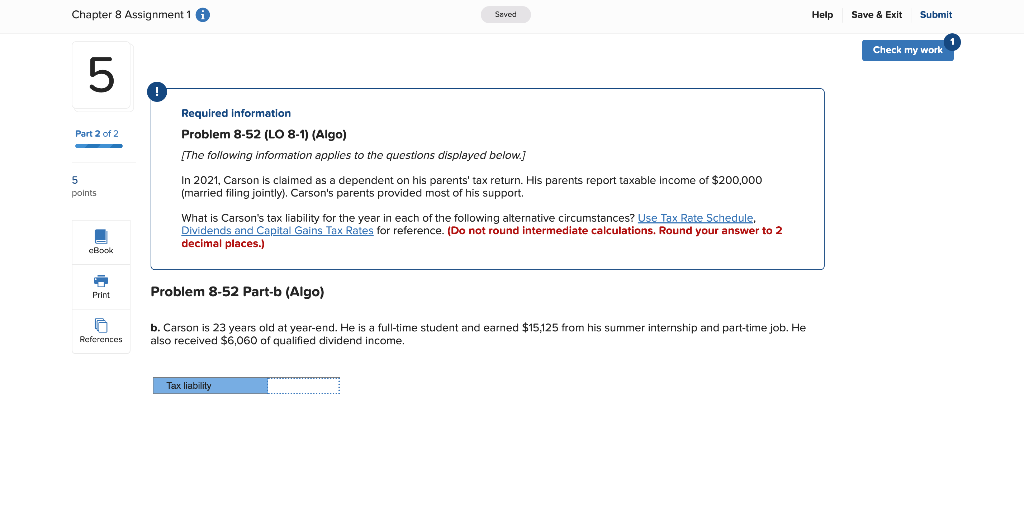

Chapter 8 Assignment 1 0 Saved Help Save & Exit Submit Check my work 5 O Part 2 of 2 5 points Required Information Problem 8-52 (LO 8-1) (Algo) {The following information applies to the questions displayed below.] In 2021, Carson is claimed as a dependent on his parents' tax return. His parents report taxable income of $200,000 (married filing jointly). Carson's parents provided most of his support What is Carson's tax liability for the year in each of the following alternative circumstances? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Problem 8-52 Part-b (Algo) Print References b. Carson is 23 years old at year-end. He is a full-time student and earned $15,125 from his summer internship and part-time job. He also received $6,060 of qualified dividend income. Tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts