Question: CHAPTER 8 DE08-02 Use the Dynamic Exhibit to answer the following questions. 1. When the percent of uncollectible accounts on current accounts is 1% and

CHAPTER 8 DE08-02 Use the Dynamic Exhibit to answer the following questions.

1. When the percent of uncollectible accounts on current accounts is 1% and the unadjusted balance in allowance for doubtful accounts is a credit of $3,250, the entry for bad debt expense is a debit to bad debt expense for $________

2. When the percent of uncollectible accounts on current accounts is 2% and the unadjusted balance in allowance for doubtful accounts is a debit of $2,100, the entry for bad debt expense is a debit to bad debt expense for $______

3. When the unadjusted balance of Allowance for Doubtful Accounts is a debit of $2,100, and the percent of uncollectible accounts on current accounts is 2%, the adjusted balance at December 31 after the entry f or uncollectible accounts is made is $______

or uncollectible accounts is made is $______

4. When the unadjusted balance of Allowance for Doubtful Accounts is a credit of $3,250, and the percent of uncollectible accounts on current accounts is 2%, the adjusted balance at December 31 after the entry for uncollectible accounts is made is $_______

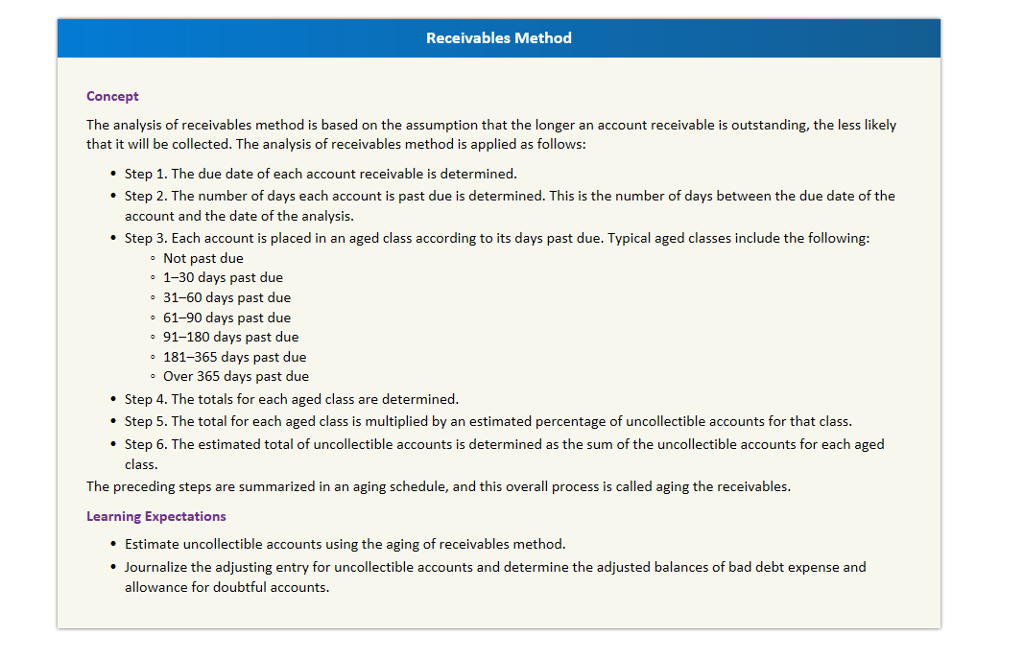

Receivables Method Concept The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding, the less likely that it will be collected. The analysis of receivables method is applied as follows: . Step 1. The due date of each account receivable is determined . Step 2. The number of days each account is past due is determined. This is the number of days between the due date of the account and the date of the analysis. * Step 3. Each account is placed in an aged class according to its days past due. Typical aged classes include the following: Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due 181-365 days past due over 365 days past due Step 4. The totals for each aged class are determined. . Step 5. The total for each aged class is multiplied by an estimated percentage of uncollectible accounts for that class Step 6. The estimated total of uncollectible accounts is determined as the sum of the uncollectible accounts for each aged class. The preceding steps are summarized in an aging schedule, and this overall process is called aging the receivables Learning Expectations .Estimate uncollectible accounts using the aging of receivables method. Journalize the adjusting entry for uncollectible accounts and determine the adjusted balances of bad debt expense and allowance for doubtful accounts. Receivables Method Concept The analysis of receivables method is based on the assumption that the longer an account receivable is outstanding, the less likely that it will be collected. The analysis of receivables method is applied as follows: . Step 1. The due date of each account receivable is determined . Step 2. The number of days each account is past due is determined. This is the number of days between the due date of the account and the date of the analysis. * Step 3. Each account is placed in an aged class according to its days past due. Typical aged classes include the following: Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due 181-365 days past due over 365 days past due Step 4. The totals for each aged class are determined. . Step 5. The total for each aged class is multiplied by an estimated percentage of uncollectible accounts for that class Step 6. The estimated total of uncollectible accounts is determined as the sum of the uncollectible accounts for each aged class. The preceding steps are summarized in an aging schedule, and this overall process is called aging the receivables Learning Expectations .Estimate uncollectible accounts using the aging of receivables method. Journalize the adjusting entry for uncollectible accounts and determine the adjusted balances of bad debt expense and allowance for doubtful accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts