Question: Chapter 8 Example 1 Conventional is considering investing $37.5 million today in a new retail store. The new store will fall into the 15- year

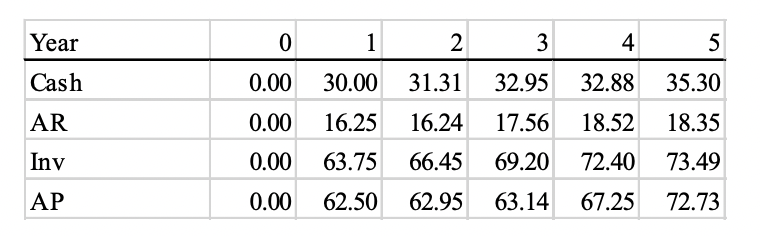

Chapter 8 Example 1 Conventional is considering investing $37.5 million today in a new retail store. The new store will fall into the 15- year MACRS class and will be built on land Conventional acquired a year ago for $3 million. This land could be sold today for $4 million. Conventional expects revenues a year from today to equal $500 million. In the following years, sales are expected to grow by 2% per year. Conventional estimates that variable costs be the same as at existing stores and thus will equal 75% of revenues and that fixed costs associated with the store will equal $87.5 million per year. The $100 million per year spend operating Conventionals corporate headquarters will not change as a result of the new store, but 10% of this cost will be allocated to the new store when the accounting department calculates the stores profits. Net working capital (in millions) associated with the store will be as follows: Set up the calculations needed to determine the new stores unlevered net income and free cash flow today and four years from today if Conventionals marginal tax rate equals 35%.

\begin{tabular}{|l|r|r|r|r|r|r|} \hline Year & 0 & 1 & 2 & 3 & 4 & 5 \\ \hline Cash & 0.00 & 30.00 & 31.31 & 32.95 & 32.88 & 35.30 \\ \hline AR & 0.00 & 16.25 & 16.24 & 17.56 & 18.52 & 18.35 \\ \hline Inv & 0.00 & 63.75 & 66.45 & 69.20 & 72.40 & 73.49 \\ \hline AP & 0.00 & 62.50 & 62.95 & 63.14 & 67.25 & 72.73 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts