Question: Chapter 8 Expected return: definition and computations. Risk definition and computations. Risk vs. diversification. Differentiate firm specific risk (Non-systematic risk) vs. market risk (systematic risk)

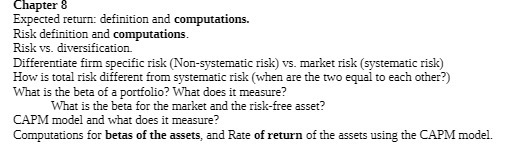

Chapter 8 Expected return: definition and computations. Risk definition and computations. Risk vs. diversification. Differentiate firm specific risk (Non-systematic risk) vs. market risk (systematic risk) How is total risk different from systematic risk (when are the two equal to each other?) What is the beta of a portfolio? What does it measure? What is the beta for the market and the risk-free asset? CAPM model and what does it measure? Computations for betas of the assets, and Rate of return of the assets using the CAPM model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts