Question: Chapter 8 Financial Options Use the binomial option pricing model to find the price of a call option with the following characteristics: o Company's current

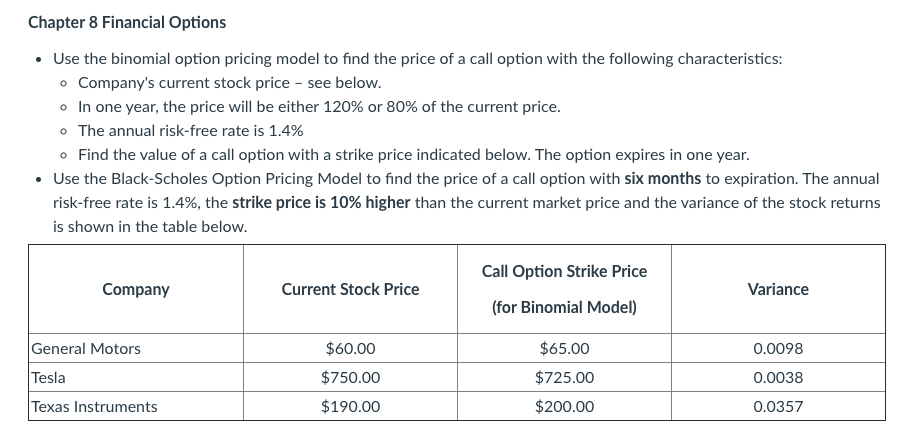

Chapter 8 Financial Options Use the binomial option pricing model to find the price of a call option with the following characteristics: o Company's current stock price - see below. o In one year, the price will be either 120% or 80% of the current price. The annual risk-free rate is 1.4% Find the value of a call option with a strike price indicated below. The option expires in one year. Use the Black-Scholes Option Pricing Model to find the price of a call option with six months to expiration. The annual risk-free rate is 1.4%, the strike price is 10% higher than the current market price and the variance of the stock returns is shown in the table below. Call Option Strike Price Company Current Stock Price Variance (for Binomial Model) 0.0098 General Motors Tesla Texas Instruments $60.00 $750.00 $65.00 $725.00 $200.00 0.0038 $190.00 0.0357

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts