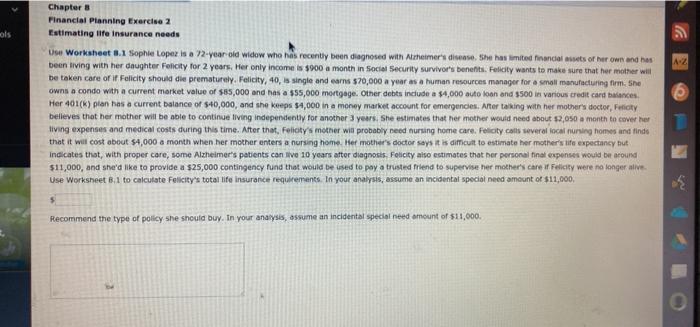

Question: Chapter 8 Financial Planning Exercise 2 Estimating life insurance needs A-Z Use Worksheet 8.1 Sophie Lopez is a 22-year old widow who has recently been

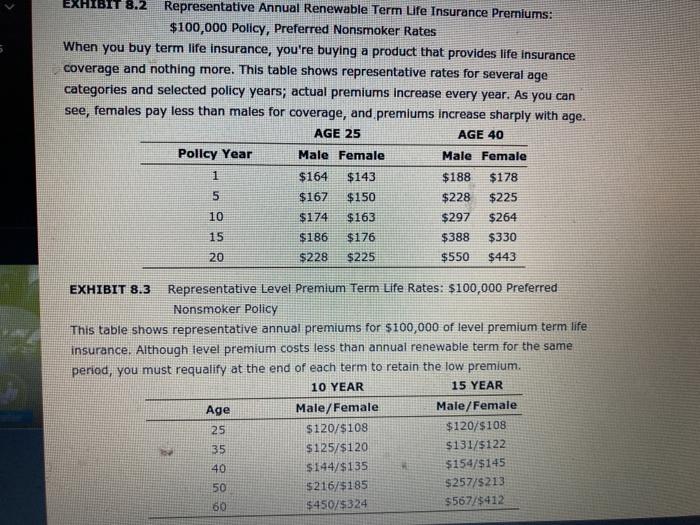

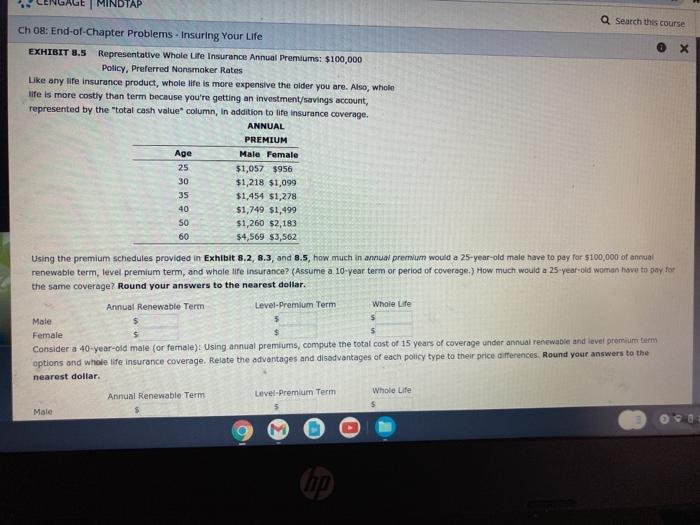

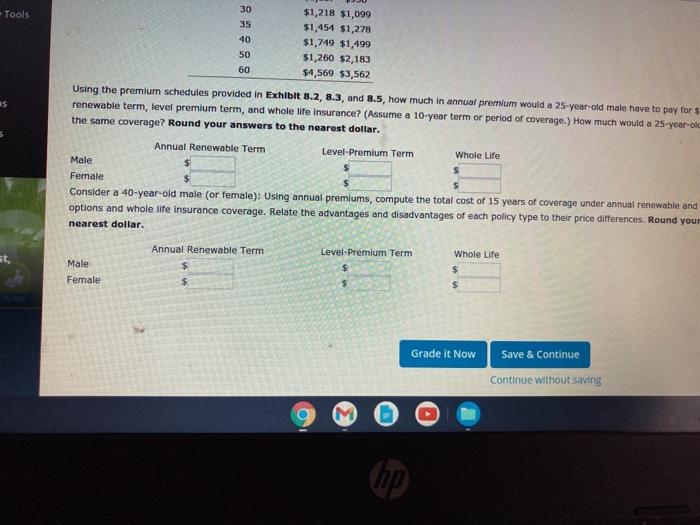

Chapter 8 Financial Planning Exercise 2 Estimating life insurance needs A-Z Use Worksheet 8.1 Sophie Lopez is a 22-year old widow who has recently been diagnosed with Alzheimer's disease. She has limited financial assets of her own and has been living with her daughter Felicity for 2 years. Her only income is $900 a month in Social Security survivor's benefits. Felicity wants to make sure that her mother will be taken care or if Felicity should die prematurely. Felicity, 40, is single and earns $20,000 a year as a human resources manager for a small manufacturing firm. She owns a condo with a current market value of $85,000 and has a $55,000 mortgage. Other debts include a $4,000 auto loan and $500 in various credit card balances Her 401(k) plan has a current balance of $40,000, and she keeps $4,000 in a money market account for emergencies. After taking with her mother's doctor, Fetty believes that her mother will be able to continue living independently for another years. She estimates that her mother would need about 1,050 a month to cover her living expenses and medical costs during this time. After that, Felicity's mother will probably need nursing home care Felicity Coils several local nursing homes and finds that it will cost about $4,000 a month when her mother enters a nursing home. Her mother's doctor says it is difficult to estimate her mother's life expectancy but Indicates that with proper care, some Alzheimer's patients can live 10 years after diagnosis. Felicity also estimates that her personal final expenses would be around $11,000, and she'd like to provide a $25,000 contingency fund that would be used to pay a trusted friend to supervise her mother's care of Felicity were no longer alive Use Worksheet 6.1 to calculate Felicity's total life insurance requirements. In your analysis, assume an incidentat special need amount of $11,000 5 Recommend the type of policy she should buy. In your analysis, assume an incidental special need amount of $11,000. EXHIBIT 8.2 Representative Annual Renewable Term Life Insurance Premiums: $100,000 Policy, Preferred Nonsmoker Rates When you buy term life insurance, you're buying a product that provides life insurance coverage and nothing more. This table shows representative rates for several age categories and selected policy years; actual premiums increase every year. As you can see, females pay less than males for coverage, and premiums increase sharply with age. AGE 25 AGE 40 Policy Year Male Female Male Female 1 $164 $143 $188 $178 5 $167 $150 $228 $225 10 $174 $163 $297 $264 15 $186 $176 $388 $330 20 $228 $225 $550 $443 EXHIBIT 8.3 Representative Level Premium Term Life Rates: $100,000 Preferred Nonsmoker Policy This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium. 10 YEAR 15 YEAR Age Male/Female Male/Female 25 $120/$108 $120/$108 35 $125/$120 $131/5122 $144/$135 $154/$145 50 $216/$185 $257/5213 60 $450/$324 $567/$412 40 MINDTAP Q Search this course Ch 08: End-of-Chapter Problems - Insuring Your Life EXHIBIT 8.5 Representative Whole Life Insurance Annual Premiums: $100,000 Policy. Preferred Nonsmoker Rates Like any life insurance product, whole life is more expensive the older you are. Also, whole life is more costly than term because you're getting an investment/savings account, represented by the total cash value column, in addition to life insurance coverage. ANNUAL PREMIUM Age Male Female 25 $1,057 $956 30 $1,218 $1,099 35 $1,454 $1,278 40 $1,749 $1,499 SO $1,260 $2,183 60 $4,569 $3,562 Using the premium schedules provided in Exhibit 8.2, 8.3, and 8.5, how much in annual premun would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance? (Assume a 10-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Female Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 15 years of coverage under annual renewable and level premium term options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences. Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Tools 30 35 40 $1,218 $1,099 $1,454 $1,278 $1,749 $1,499 $1,260 $2,183 $4,569 $3,562 50 60 Using the premium schedules provided in Exhibit 8.2, 8.3, and 8.5, how much in annual premium would a 25-year-old male have to pay for $ renewable term, level premium term, and whole life insurance? (Assume a 10-year term or period of coverage.) How much would a 25-year-old the same coverage? Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Female Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 15 years of coverage under annual renewable and options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences. Round your nearest dollar. Annual Renewable Term Level-Premium Term Male Female Whole Life $ $ $ Grade it Now Save & Continue Continue without saving Chapter 8 Financial Planning Exercise 2 Estimating life insurance needs A-Z Use Worksheet 8.1 Sophie Lopez is a 22-year old widow who has recently been diagnosed with Alzheimer's disease. She has limited financial assets of her own and has been living with her daughter Felicity for 2 years. Her only income is $900 a month in Social Security survivor's benefits. Felicity wants to make sure that her mother will be taken care or if Felicity should die prematurely. Felicity, 40, is single and earns $20,000 a year as a human resources manager for a small manufacturing firm. She owns a condo with a current market value of $85,000 and has a $55,000 mortgage. Other debts include a $4,000 auto loan and $500 in various credit card balances Her 401(k) plan has a current balance of $40,000, and she keeps $4,000 in a money market account for emergencies. After taking with her mother's doctor, Fetty believes that her mother will be able to continue living independently for another years. She estimates that her mother would need about 1,050 a month to cover her living expenses and medical costs during this time. After that, Felicity's mother will probably need nursing home care Felicity Coils several local nursing homes and finds that it will cost about $4,000 a month when her mother enters a nursing home. Her mother's doctor says it is difficult to estimate her mother's life expectancy but Indicates that with proper care, some Alzheimer's patients can live 10 years after diagnosis. Felicity also estimates that her personal final expenses would be around $11,000, and she'd like to provide a $25,000 contingency fund that would be used to pay a trusted friend to supervise her mother's care of Felicity were no longer alive Use Worksheet 6.1 to calculate Felicity's total life insurance requirements. In your analysis, assume an incidentat special need amount of $11,000 5 Recommend the type of policy she should buy. In your analysis, assume an incidental special need amount of $11,000. EXHIBIT 8.2 Representative Annual Renewable Term Life Insurance Premiums: $100,000 Policy, Preferred Nonsmoker Rates When you buy term life insurance, you're buying a product that provides life insurance coverage and nothing more. This table shows representative rates for several age categories and selected policy years; actual premiums increase every year. As you can see, females pay less than males for coverage, and premiums increase sharply with age. AGE 25 AGE 40 Policy Year Male Female Male Female 1 $164 $143 $188 $178 5 $167 $150 $228 $225 10 $174 $163 $297 $264 15 $186 $176 $388 $330 20 $228 $225 $550 $443 EXHIBIT 8.3 Representative Level Premium Term Life Rates: $100,000 Preferred Nonsmoker Policy This table shows representative annual premiums for $100,000 of level premium term life insurance. Although level premium costs less than annual renewable term for the same period, you must requalify at the end of each term to retain the low premium. 10 YEAR 15 YEAR Age Male/Female Male/Female 25 $120/$108 $120/$108 35 $125/$120 $131/5122 $144/$135 $154/$145 50 $216/$185 $257/5213 60 $450/$324 $567/$412 40 MINDTAP Q Search this course Ch 08: End-of-Chapter Problems - Insuring Your Life EXHIBIT 8.5 Representative Whole Life Insurance Annual Premiums: $100,000 Policy. Preferred Nonsmoker Rates Like any life insurance product, whole life is more expensive the older you are. Also, whole life is more costly than term because you're getting an investment/savings account, represented by the total cash value column, in addition to life insurance coverage. ANNUAL PREMIUM Age Male Female 25 $1,057 $956 30 $1,218 $1,099 35 $1,454 $1,278 40 $1,749 $1,499 SO $1,260 $2,183 60 $4,569 $3,562 Using the premium schedules provided in Exhibit 8.2, 8.3, and 8.5, how much in annual premun would a 25-year-old male have to pay for $100,000 of annual renewable term, level premium term, and whole life insurance? (Assume a 10-year term or period of coverage.) How much would a 25-year-old woman have to pay for the same coverage? Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Female Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 15 years of coverage under annual renewable and level premium term options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences. Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Tools 30 35 40 $1,218 $1,099 $1,454 $1,278 $1,749 $1,499 $1,260 $2,183 $4,569 $3,562 50 60 Using the premium schedules provided in Exhibit 8.2, 8.3, and 8.5, how much in annual premium would a 25-year-old male have to pay for $ renewable term, level premium term, and whole life insurance? (Assume a 10-year term or period of coverage.) How much would a 25-year-old the same coverage? Round your answers to the nearest dollar. Annual Renewable Term Level-Premium Term Whole Life Male Female Consider a 40-year-old male (or female): Using annual premiums, compute the total cost of 15 years of coverage under annual renewable and options and whole life insurance coverage. Relate the advantages and disadvantages of each policy type to their price differences. Round your nearest dollar. Annual Renewable Term Level-Premium Term Male Female Whole Life $ $ $ Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts