Question: Chapter 8 Homework Help Save & Exit Check Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out

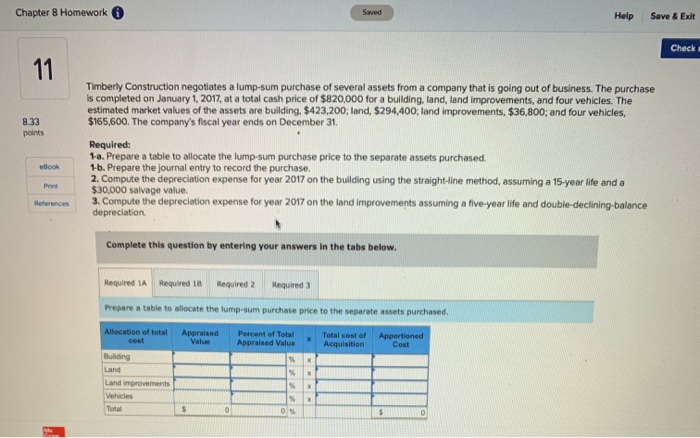

Chapter 8 Homework Help Save & Exit Check Timberly Construction negotiates a lump sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2017, at a total cash price of $820,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $423,200, land, $294,400, land improvements, $36.800; and four vehicles, $165,600. The company's fiscal year ends on December 31 8.33 points Required: 1-a. Prepare a table to allocate the lump sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2017 on the building using the straight line method, assuming a 15-year life and a $30,000 salvage value 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double declining balance depreciation P References Complete this question by entering your answers in the tabs below. Required A Required 18 Required 2 Required 3 Prepare a table to allocate the lump-sum purchase price to the separate assets purchased Allocation of total cost Appraised Percent of Total Appraised Value Total cost of Acquisition Apportioned Cost Bulang OS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts