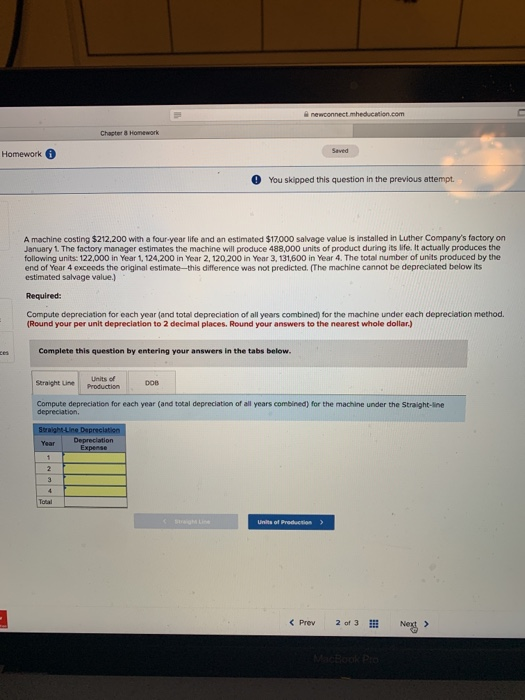

Question: Chapter 8 Homework Homework O You skipped this question in the previous attempt A machine costing $212.200 with a four year life and an estimated

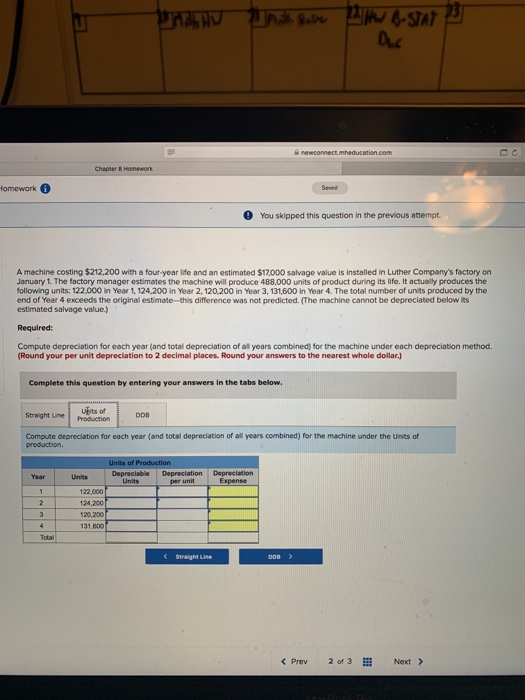

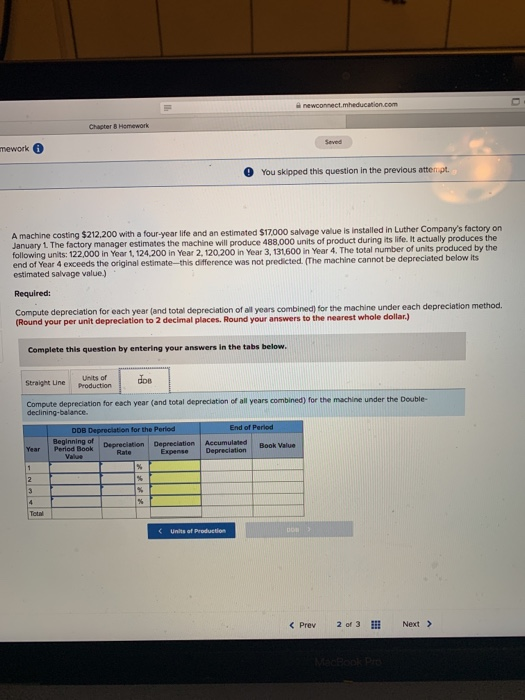

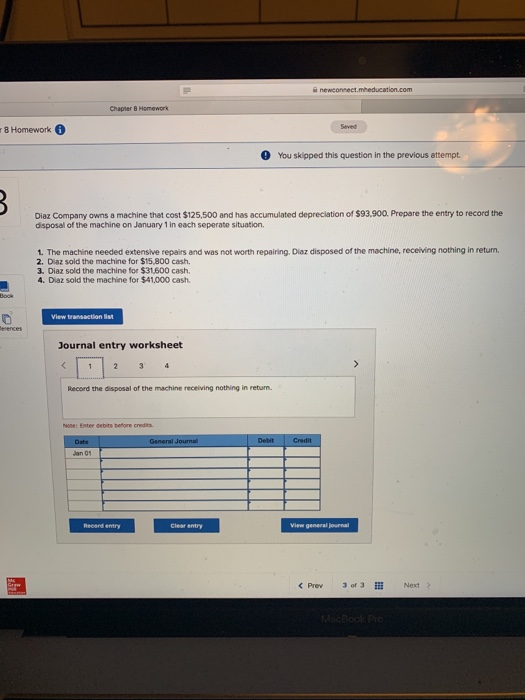

Chapter 8 Homework Homework O You skipped this question in the previous attempt A machine costing $212.200 with a four year life and an estimated $17.000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 488,000 units of product during its life. It actually produces the following units: 122,000 in Year 1,124,200 in Year 2, 120.200 in Year 3, 131,600 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate--this difference was not predicted. (The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) Complete this question by entering your answers in the tabs below. Straight Line Units of Production DOB Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Straight-line depreciation Straight-Line Depreciation Year Depreciation Units of Production > Un Babe P 6-STAT 23 Duc Chapter 8 Homework Homework You skipped this question in the previous attempt A machine costing $212,200 with a four-year life and an estimated $17,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 488,000 units of product during its life. It actually produces the following units: 122,000 in Year 1.124.200 in Year 2, 120.200 in Year 3, 131,600 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate this difference was not predicted. The machine cannot be depreciated below its estimated salvage value.) Required: Compute depreciation for each year and total depreciation of all years combined) for the machine under each depreciation method (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Straight line Uits of Production DO Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Units of production Units of Production Depreciable Depreciation Units per unit Units Depreciation Expense 122,000 124.200 120 200 mework You skipped this question in the previous attempt A machine costing 5212.200 with a four-year life and an estimated $17.000 salvage value is installed in Luther Company's factory on January 1 The factory manager estimates the machine will produce 488.000 units of product during its life. It actually produces the following units: 122.000 in Year 1.124.200 In Year 2, 120.200 in Year 3, 134600 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate this difference was not predicted. The machine cannot be depreciated below its estimated salvage value) Required: Compute depreciation for each year and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar) Complete this question by entering your answers in the tabs below. Sunt of Production Compute depreciation for each year (and total depreciation of all years combined) for the machine under the Double- declining-balance. End of Period DDB Depreciation for the Period Beginning of Pared Depreciation Depreciation Expense Year Acum Depreciation n e c meducation.com 8 Homework You skipped this question in the previous attempt Diaz Company owns a machine that cost $125,500 and has accumulated depreciation of $93.900. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return 2. Diaz sold the machine for $15,800 cash. 3. Diaz sold the machine for $31600 cash, 4. Diaz sold the machine for $41,000 cash View transaction Journal entry worksheet Record the disposal of the machine receiving nothing in return er det before credit General Journal Debt Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts