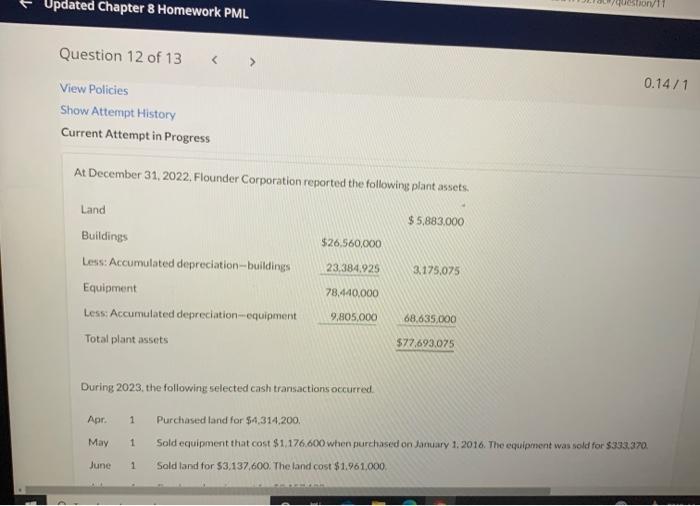

Question: chapter 8 homework PML Updated Chapter 8 Homework PML 0.14/1 Question 12 of 13 View Policies Show Attempt History Current Attempt in Progress At December

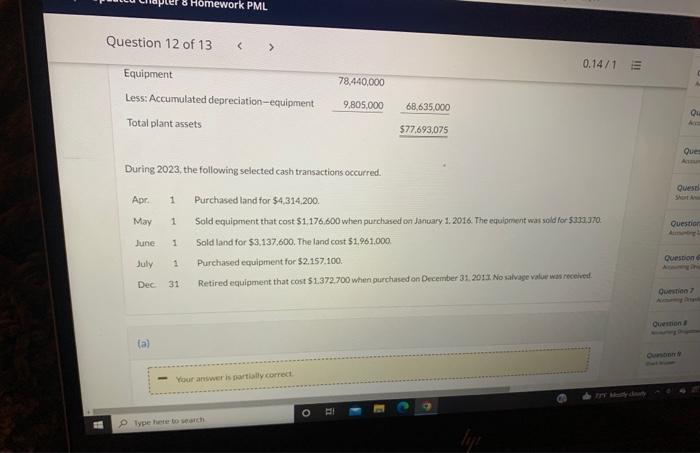

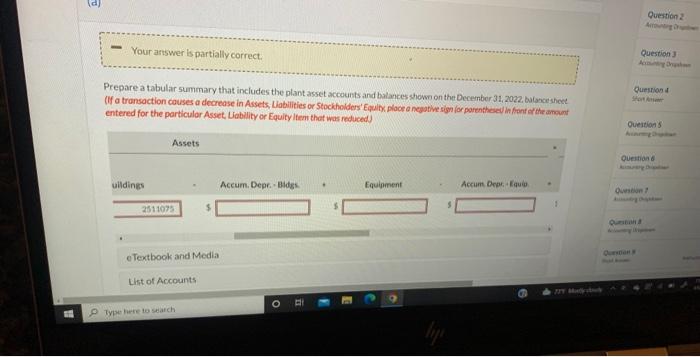

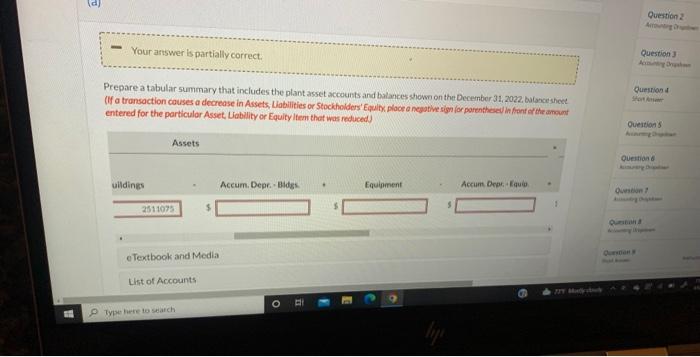

Updated Chapter 8 Homework PML 0.14/1 Question 12 of 13 View Policies Show Attempt History Current Attempt in Progress At December 31, 2022, Flounder Corporation reported the following plant assets. Land $ 5,883.000 $26.560,000 23,384.925 3.175.075 Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets 78.440,000 9,805,000 68,635,000 577.693.075 During 2023. the following selected cash transactions occurred Apr. 1 Purchased land for $4,314,200. May 1 Sold equipment that cost $1,176,600 when purchased on January 1, 2016. The equipment was sold for $333,370 June 1 Sold land for $3,137,600. The land cost $1.961.000, Homework PML Question 12 of 13 0.14/1 78.440.000 Equipment Less: Accumulated depreciation-equipment Total plant assets 9.805.000 68.635.000 Qu $77.693,075 Que Quest 1 During 2023, the following selected cash transactions occurred. Apr 1 Purchased land for $4.314.200 May Sold equipment that cost $1,176.600 when purchased on January 1, 2016. The equipment was sold for $313.370. Sold land for $3,137,600. The land cost $1.961.000 July Purchased equipment for $2.157.100 Retired equipment that cost $1.372.700 when purchased on December 31, 2011 No salvage valor was received Question June 1 1 Question Dec 31 Question Ouman al Your answer is partis correct Type here to search d Question Your answer is partially correct. Question Anal Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2022. balance sheet (If a transaction causes a decrease in Assets, Liabilities or Stockholders'Equilty placra neputiesign for parenthese in front of the amount entered for the particular Asset, Uability or Equity Item that was reduced Question Short Questions Assets Question uildings Accum. Depr. Bides Equipment Accum peque 2511075 On e Textbook and Media List of Accounts 2 Type here to search d Question Your answer is partially correct. Question Anal Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2022. balance sheet (If a transaction causes a decrease in Assets, Liabilities or Stockholders'Equilty placra neputiesign for parenthese in front of the amount entered for the particular Asset, Uability or Equity Item that was reduced Question Short Questions Assets Question uildings Accum. Depr. Bides Equipment Accum peque 2511075 On e Textbook and Media List of Accounts 2 Type here to search Updated Chapter 8 Homework PML 0.14/1 Question 12 of 13 View Policies Show Attempt History Current Attempt in Progress At December 31, 2022, Flounder Corporation reported the following plant assets. Land $ 5,883.000 $26.560,000 23,384.925 3.175.075 Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total plant assets 78.440,000 9,805,000 68,635,000 577.693.075 During 2023. the following selected cash transactions occurred Apr. 1 Purchased land for $4,314,200. May 1 Sold equipment that cost $1,176,600 when purchased on January 1, 2016. The equipment was sold for $333,370 June 1 Sold land for $3,137,600. The land cost $1.961.000, Homework PML Question 12 of 13 0.14/1 78.440.000 Equipment Less: Accumulated depreciation-equipment Total plant assets 9.805.000 68.635.000 Qu $77.693,075 Que Quest 1 During 2023, the following selected cash transactions occurred. Apr 1 Purchased land for $4.314.200 May Sold equipment that cost $1,176.600 when purchased on January 1, 2016. The equipment was sold for $313.370. Sold land for $3,137,600. The land cost $1.961.000 July Purchased equipment for $2.157.100 Retired equipment that cost $1.372.700 when purchased on December 31, 2011 No salvage valor was received Question June 1 1 Question Dec 31 Question Ouman al Your answer is partis correct Type here to search d Question Your answer is partially correct. Question Anal Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2022. balance sheet (If a transaction causes a decrease in Assets, Liabilities or Stockholders'Equilty placra neputiesign for parenthese in front of the amount entered for the particular Asset, Uability or Equity Item that was reduced Question Short Questions Assets Question uildings Accum. Depr. Bides Equipment Accum peque 2511075 On e Textbook and Media List of Accounts 2 Type here to search d Question Your answer is partially correct. Question Anal Prepare a tabular summary that includes the plant asset accounts and balances shown on the December 31, 2022. balance sheet (If a transaction causes a decrease in Assets, Liabilities or Stockholders'Equilty placra neputiesign for parenthese in front of the amount entered for the particular Asset, Uability or Equity Item that was reduced Question Short Questions Assets Question uildings Accum. Depr. Bides Equipment Accum peque 2511075 On e Textbook and Media List of Accounts 2 Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts