Question: Chapter 8 Lab Saved Help Save & Exit Submit 13 Problem 8-6A Recording accounts receivable transactions and bad debt adjustments LO1, 2, 3 Peru Industries

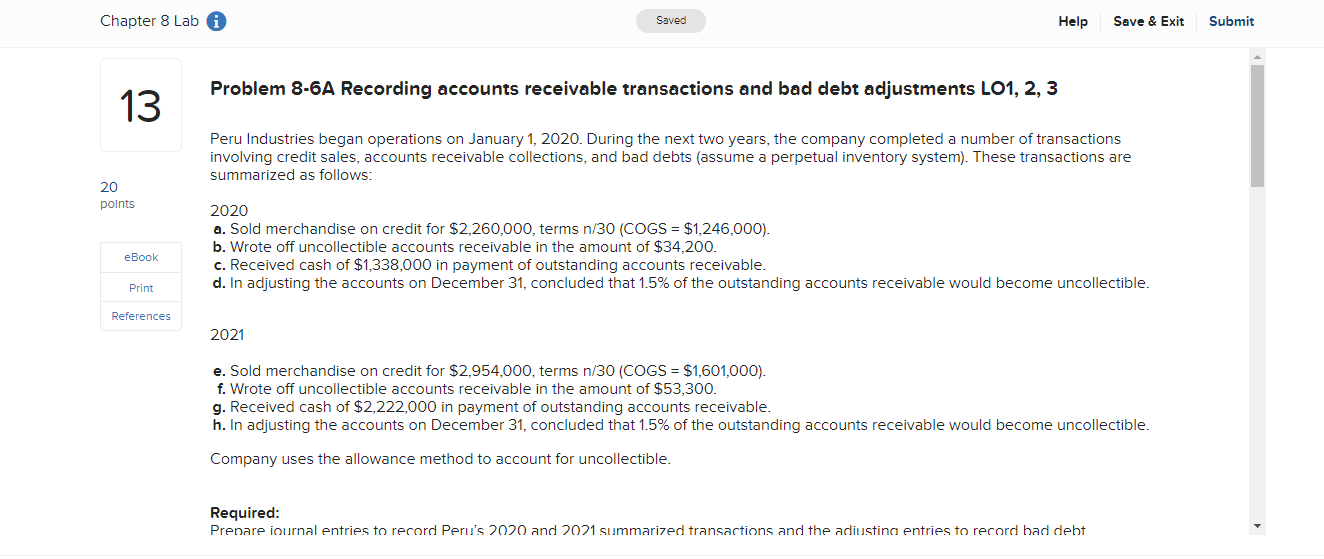

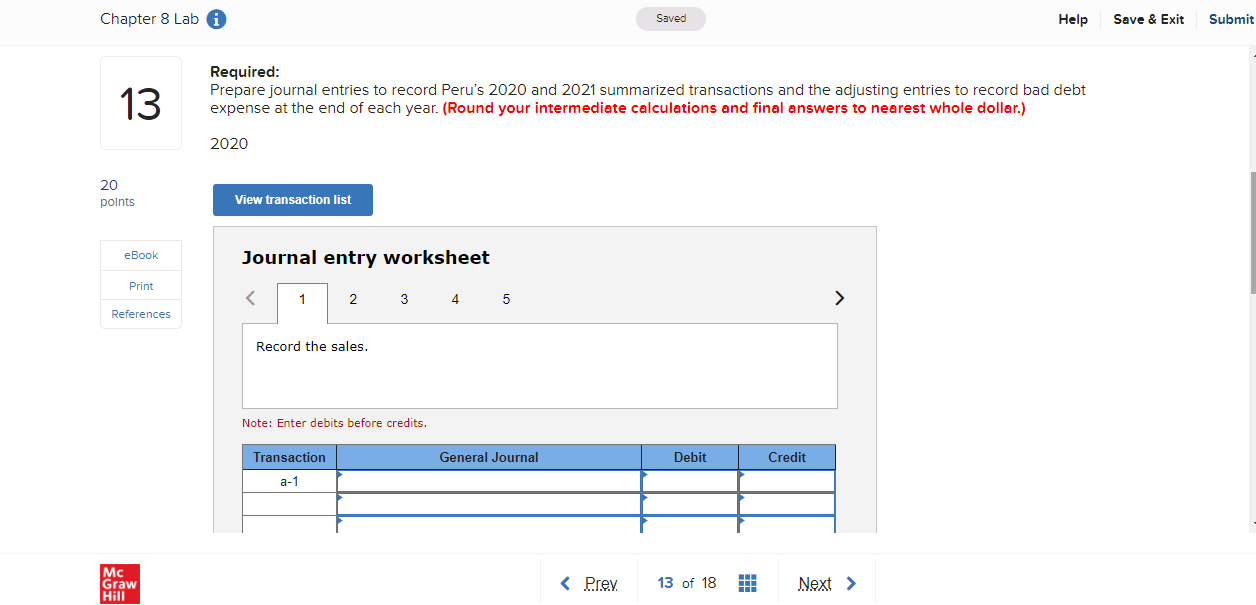

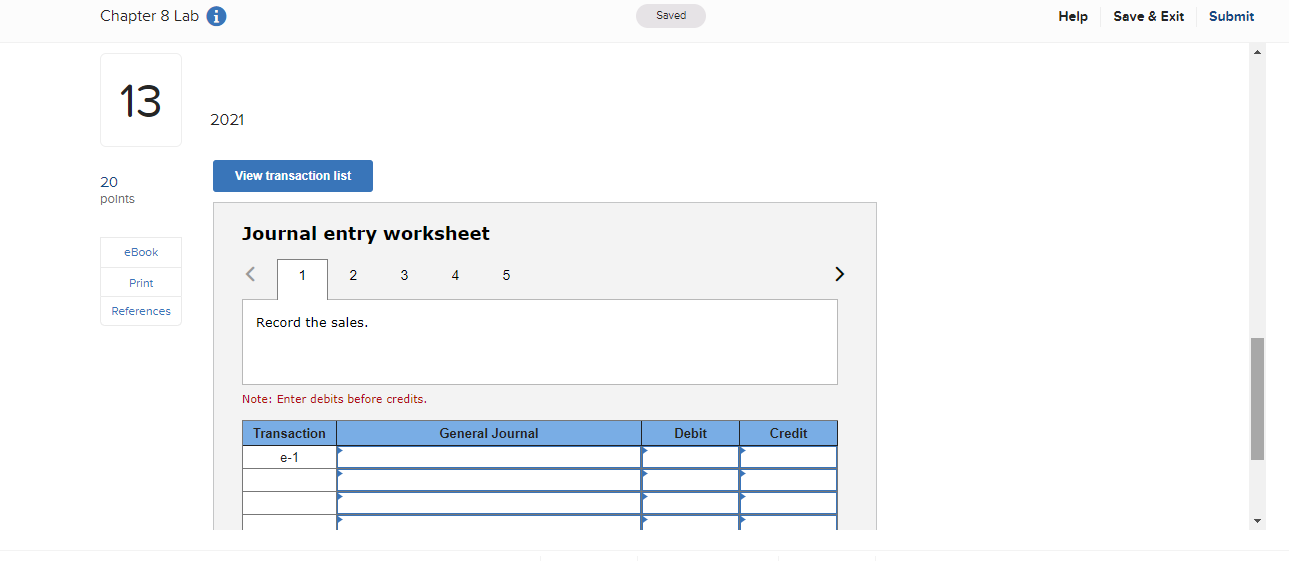

Chapter 8 Lab Saved Help Save & Exit Submit 13 Problem 8-6A Recording accounts receivable transactions and bad debt adjustments LO1, 2, 3 Peru Industries began operations on January 1, 2020. During the next two years, the company completed a number of transactions involving credit sales, accounts receivable collections, and bad debts (assume a perpetual inventory system). These transactions are summarized as follows: 20 points 2020 a. Sold merchandise on credit for $2,260,000, terms n/30 (COGS = $1,246,000). b. Wrote off uncollectible accounts receivable in the amount of $34,200. eBook c. Received cash of $1,338,000 in payment of outstanding accounts receivable. Print d. In adjusting the accounts on December 31, concluded that 1.5% of the outstanding accounts receivable would become uncollectible. References 2021 e. Sold merchandise on credit for $2,954,000, terms n/30 (COGS = $1,601,000). f. Wrote off uncollectible accounts receivable in the amount of $53,300. g. Received cash of $2,222,000 in payment of outstanding accounts receivable. h. In adjusting the accounts on December 31, concluded that 1.5% of the outstanding accounts receivable would become uncollectible. Company uses the allowance method to account for uncollectible. Required: Prepare journal entries to record Peru's 2020 and 2021 summarized transactions and the adjusting entries to record bad debtChapter 8 Lab 0 Saved Help Save 3 Exit Submit Required: Prepare journal entries to record Peru's 2020 and 2021 summarized transactions and the adjusting entries to record bad debt 1 3 expense at the end of each year. (Round your intermediate calculations and final answers to nearest whole dollar.) 2020 20 Bk Journal entry worksheet Print ( 1 2 3 4 5 ) References Record the sales. Note: Enter debit: before credits. a4 __ MC Graw Hill Chapter 8 Lab 9 Saved Help Save & Exit Submit 1 3 2021 m palms Journal entry worksheet eBook PM ( 1 2 3 4 5 ) References Record the sales. Note: Enter debits before credils. 9-1 _

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts