Question: Chapter 8- Paying Employees- multiple choice 1. The social security number of new employees is entered in the employee window. _tab of the new a.

Chapter 8- Paying Employees- multiple choice

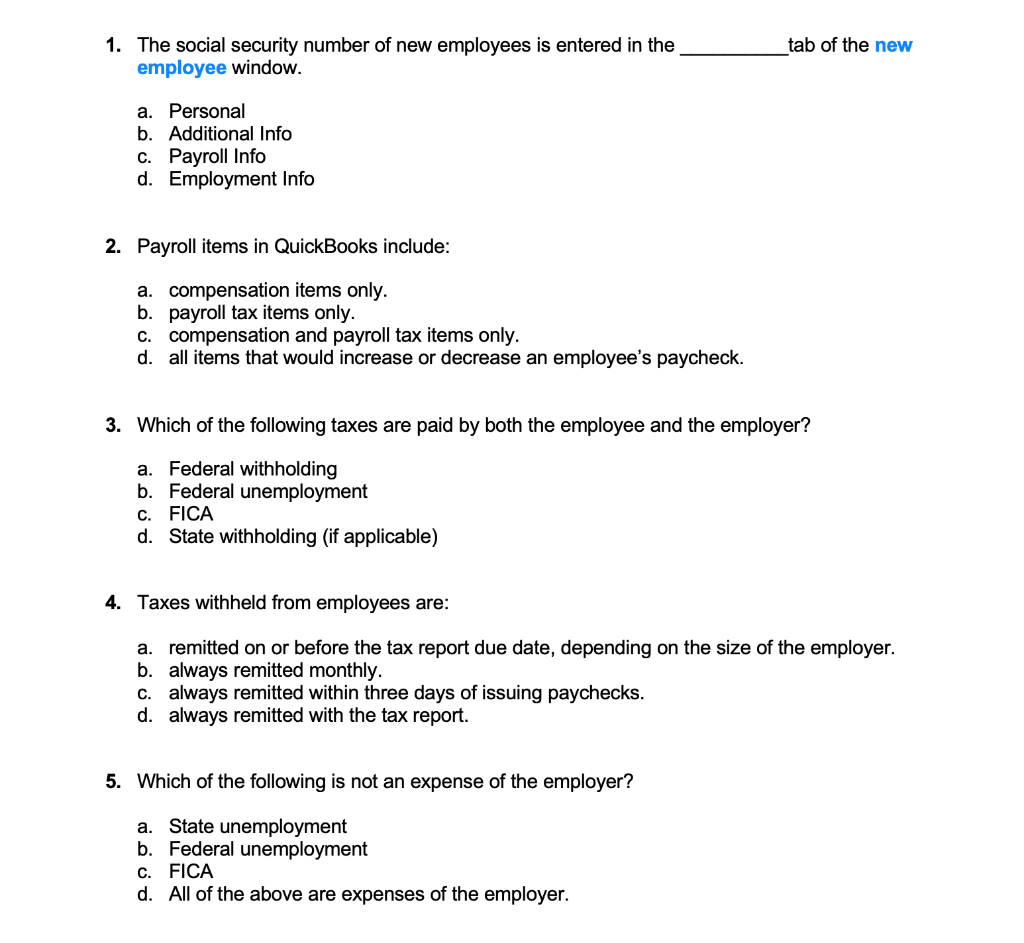

1. The social security number of new employees is entered in the employee window. _tab of the new a. Personal b. Additional Info c. Payroll Info d. Employment Info 2. Payroll items in QuickBooks include: a. compensation items only. b. payroll tax items only. c. compensation and payroll tax items only. d. all items that would increase or decrease an employee's paycheck. 3. Which of the following taxes are paid by both the employee and the employer? a. Federal withholding b. Federal unemployment C. FICA d. State withholding (if applicable) 4. Taxes withheld from employees are: a. remitted on or before the tax report due date, depending on the size of the employer. b. always remitted monthly. always remitted within three days of issuing paychecks. d. always remitted with the tax report. C. alv 5. Which of the following is not an expense of the employer? a. State unemployment b. Federal unemployment FICA d. All of the above are expenses of the employer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts