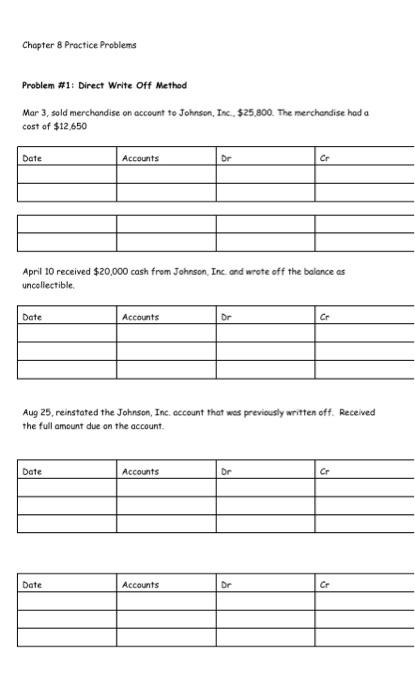

Question: Chapter 8 Practice Problems Problem #1: Direct Write Off Method Mar 3, sold merchandise on account to Johnson, Inc., $25,800. The merchandise had a cost

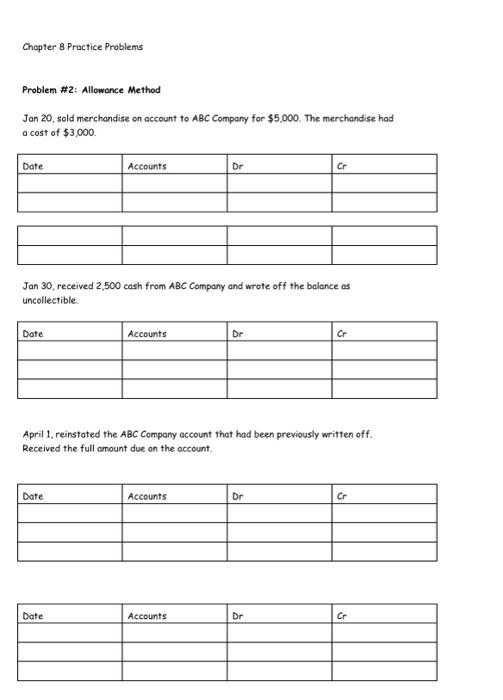

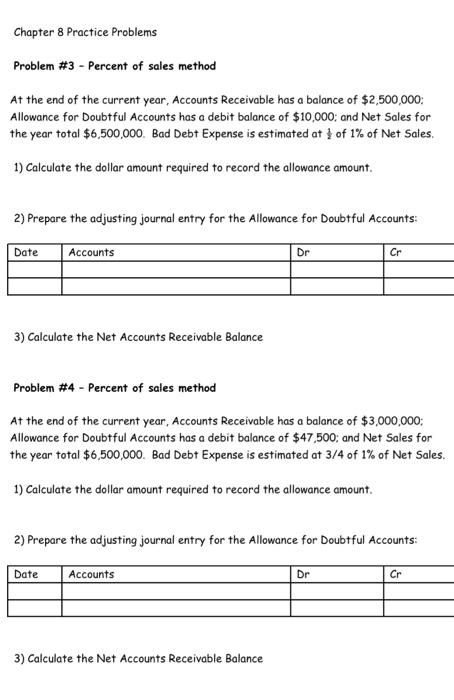

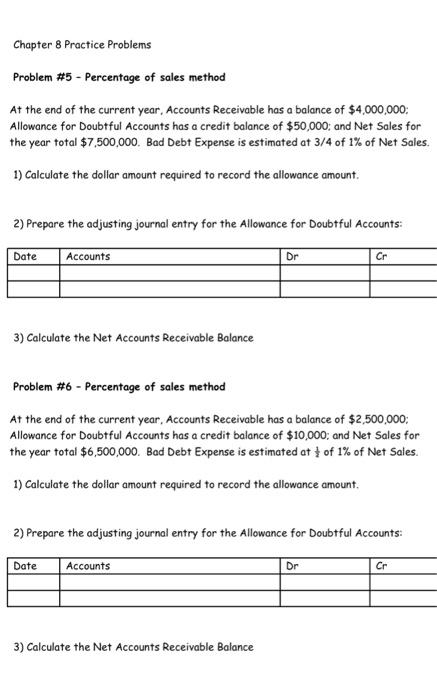

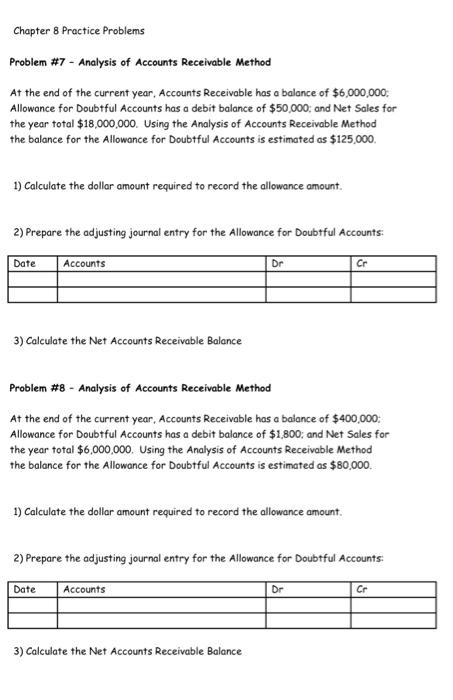

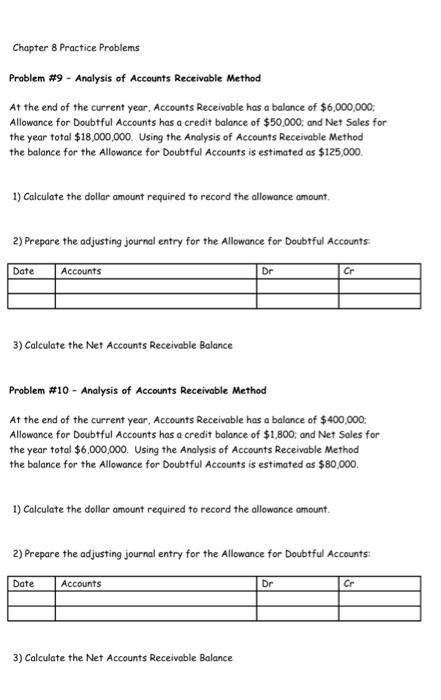

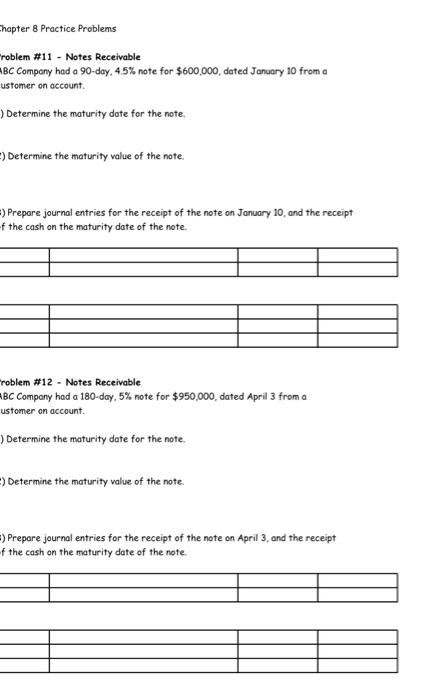

Problem \#1: Direct Write Off Method Mar 3, sold merchandise on ccceunt to Johnson, Inc, $25,800. The merchendise hod a cost of $12,650 April 10 received $20,000 cash from Johnson. Inc and wrote of f the balance as uncellectible. Aug 25, reinstated the Johnson, Inc. occount that wes previously written off. Received the full amount due on the account. Chapter 8 Practice Problems Problem \#3 - Percent of sales method At the end of the current year, Accounts Receivable has a balance of $2,500,000 : Allowance for Doubtful Accounts has a debit balance of $10,000; and Net Sales for the year total $6,500,000. Bad Debt Expense is estimated at 21 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Problem \#4 - Percent of sales method At the end of the current year, Accounts Receivable has a balance of $3,000,000; Allowance for Doubtful Accounts has a debit balance of $47,500; and Net Sales for the year total $6,500,000. Bad Debt Expense is estimated at 3/4 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Chapter 8 Practice Problems Problem \#5 - Percentage of sales method At the end of the current year, Accounts Receivable has a balance of $4,000,000 : Allowance for Doubtful Accounts has a credit balance of $50,000; and Net Sales for the year total $7,500,000. Bad Debt Expense is estimated at 3/4 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Problem \#6 - Percentage of sales method At the end of the current year, Accounts Receivable has a balance of $2,500,000; Allowance for Doubtful Accounts has a credit balance of $10,000; and Net Sales for the year total $6,500,000. Bad Debt Expense is estimated at 21 of 1% of Net Sales. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Chapter 8 Practice Problems Problem \#7 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $6,000,000; Allowance for Doubtful Accounts has a debit balance of $50,000; and Net Sales for the year total $18,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $125,000. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Problem \#8 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $400,000 : Allowance for Doubtful Accounts has a debit balance of $1,800; and Net Sales for the year total $6,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $80,000. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Chapter 8 Practice Problems roblem \#11 - Notes Receivable BC Company had a 90-day, 4.5% note for $600,000, dated January 10 from a ustomer on account. Determine the maturity date for the note. Determine the maturity value of the note. ) Prepare journal entries for the receipt of the note on January 10, and the receipt f the cash on the maturity date of the note. roblem \#12 - Notes Receivable BC Company had a 180-day, 5% note for $950,000, dated April 3 from a ustomer on account. Determine the maturity date for the note. Determine the maturity value of the note. ) Prepare journal entries for the receipt of the note on April 3, and the receipt f the cash on the maturity date of the note. Problem \#2: Allowance Method Jan 20, sold merchandise on account to ABC Company for $5,000. The merchandise had a cost of $3,000. Jan 30 , received 2,500 cash from ABC Company and wrote off the balance as uncollectible. April 1, reinstated the ABC Company account that had been previously written off. Received the full amount due on the occount. Chapter 8 Practice Problems Problem \#9 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $6,000,000 : Allowance for Doubtful Accounts has a credit balance of $50,000; and Net Sales for the year total $18,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $125,000. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance Problem \#10 - Analysis of Accounts Receivable Method At the end of the current year, Accounts Receivable has a balance of $400,000 : Allowance for Doubtful Accounts has a credit balance of $1,800; and Net Soles for the year total $6,000,000. Using the Analysis of Accounts Receivable Method the balance for the Allowance for Doubtful Accounts is estimated as $80,000. 1) Calculate the dollar amount required to record the allowance amount. 2) Prepare the adjusting journal entry for the Allowance for Doubtful Accounts: 3) Calculate the Net Accounts Receivable Balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts