Question: Chapter 8 Practice Problems TRUE FALSE 1. Parent PLUS Loans are for parents to borrow to help pay for a dependent's undergraduate cducation expenses and

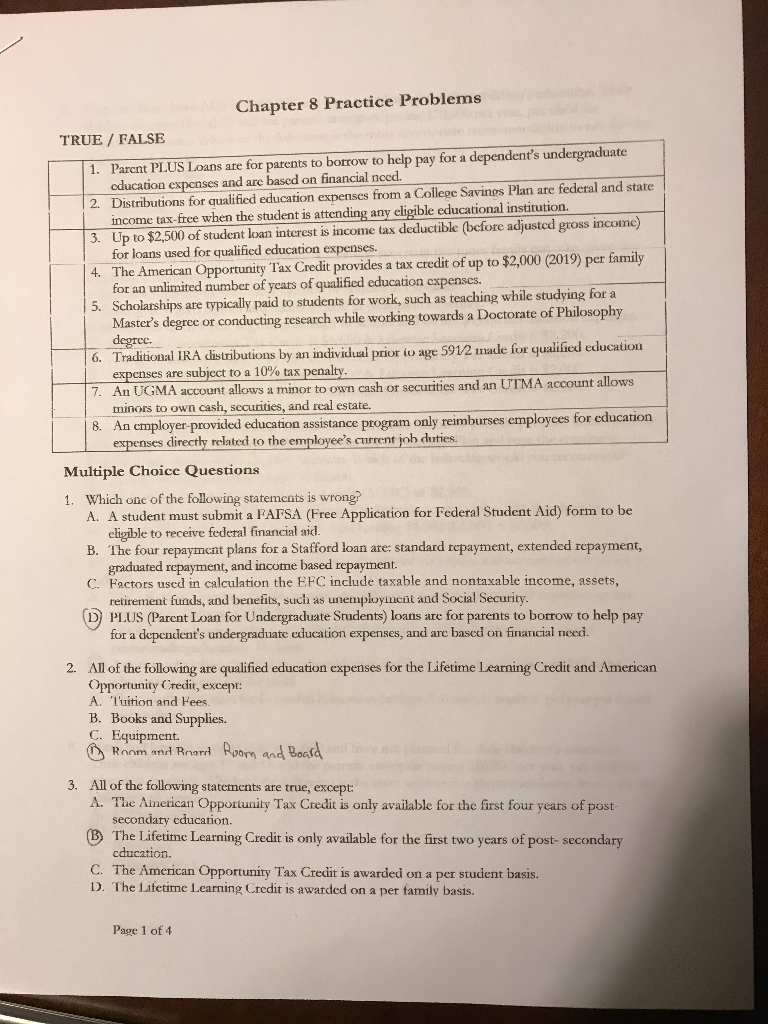

Chapter 8 Practice Problems TRUE FALSE 1. Parent PLUS Loans are for parents to borrow to help pay for a dependent's undergraduate cducation expenses and are bascd on financial nced. 2. Distributions for qualified education expenses from a College Savings Plan are federal and state income tax-free when the student is attending any cligible educational institution. 3. Up to $2,500 of student loan interest is income tax deductible (before adjustcd gross income) for loans used for qualified education expenses. 4. The American Opportunity Tax Credit provides a tax credit of up to $2,000 (2019) per family fot an unlimited number of yeats of qualified education expenses. 5. Scholarships are typically paid to students for work, such as teaching while studying for a Master's degree or conducting research while working towards a Doctorate of Philosophy degree. 6. Traditional IRA distributions by an individual prior io age 591/2 made for qualified education expenses are subject to a 10 % tax penalty. 7. An UGMA account allows a minor to own cash or securities and an UTMA account allows minors to own cash, securities, and real estate. 8. An cmployer-provided education assistance program only reimburses employces for education expenses directly related to the employee's current job duties. Multiple Choice Questions 1. Which one of the following statements is wrong? A. A student must submit a FAFSA (Free Application for Federal Student Aid) form to be eligible to receive federal financial aid. B. The four repayment plans for a Stafford loan are: standard repayment, extended repayment, graduated repayment, and income based repayment. C. Factors used in calculation the EFC include taxable and nontaxable income, assets, retirement funds, and benefits, such as unemployincnt and Social Security. (D) PLUS (Parent Loan for Undergraduate Students) loans are for parents to borrow to help pay for a dependent's undergraduate education expenses, and are based on financial need. All of the following are qualified education expenses for the Lifetime Learning Credit and American Opportunity Credit, except: A. 'Iuition and Fees. 2. B. Books and Supplies. C. Equipment Ranm and Rnard Room and Bocsa 3. All of the following statements are true, except: A. The American Opportunity Tax Credit is only available for the first four years of post secondary cducation. (B) The Lifetime Learning Credit is only available for the first two years of post- secondary cducation. C. The American Opportunity Tax Credit is awarded on a per student basis. D. The Lifetime Learning Credit is awarded on a per family basis. Page 1 of 4 Chapter 8 Practice Problems TRUE FALSE 1. Parent PLUS Loans are for parents to borrow to help pay for a dependent's undergraduate cducation expenses and are bascd on financial nced. 2. Distributions for qualified education expenses from a College Savings Plan are federal and state income tax-free when the student is attending any cligible educational institution. 3. Up to $2,500 of student loan interest is income tax deductible (before adjustcd gross income) for loans used for qualified education expenses. 4. The American Opportunity Tax Credit provides a tax credit of up to $2,000 (2019) per family fot an unlimited number of yeats of qualified education expenses. 5. Scholarships are typically paid to students for work, such as teaching while studying for a Master's degree or conducting research while working towards a Doctorate of Philosophy degree. 6. Traditional IRA distributions by an individual prior io age 591/2 made for qualified education expenses are subject to a 10 % tax penalty. 7. An UGMA account allows a minor to own cash or securities and an UTMA account allows minors to own cash, securities, and real estate. 8. An cmployer-provided education assistance program only reimburses employces for education expenses directly related to the employee's current job duties. Multiple Choice Questions 1. Which one of the following statements is wrong? A. A student must submit a FAFSA (Free Application for Federal Student Aid) form to be eligible to receive federal financial aid. B. The four repayment plans for a Stafford loan are: standard repayment, extended repayment, graduated repayment, and income based repayment. C. Factors used in calculation the EFC include taxable and nontaxable income, assets, retirement funds, and benefits, such as unemployincnt and Social Security. (D) PLUS (Parent Loan for Undergraduate Students) loans are for parents to borrow to help pay for a dependent's undergraduate education expenses, and are based on financial need. All of the following are qualified education expenses for the Lifetime Learning Credit and American Opportunity Credit, except: A. 'Iuition and Fees. 2. B. Books and Supplies. C. Equipment Ranm and Rnard Room and Bocsa 3. All of the following statements are true, except: A. The American Opportunity Tax Credit is only available for the first four years of post secondary cducation. (B) The Lifetime Learning Credit is only available for the first two years of post- secondary cducation. C. The American Opportunity Tax Credit is awarded on a per student basis. D. The Lifetime Learning Credit is awarded on a per family basis. Page 1 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts