Question: Chapter #8 Problem #1 Nov. 1 11 Dec. 16 21 31 31 Received a $ 2,000, 12%, 60-day note for a sale. Received a $

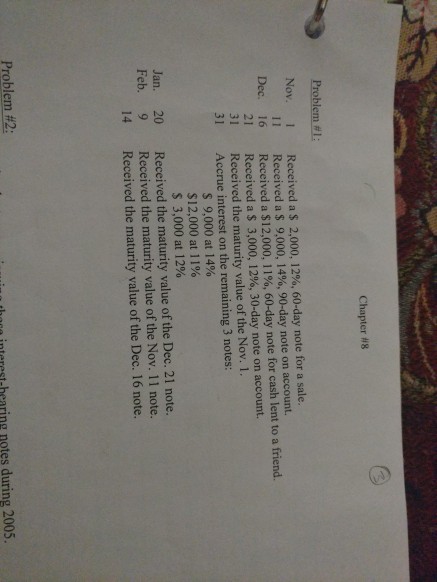

Chapter #8 Problem #1 Nov. 1 11 Dec. 16 21 31 31 Received a $ 2,000, 12%, 60-day note for a sale. Received a $ 9,000, 14%, 90-day note on account. Received a $12,000, 1 1%, 60-day note for cash lent to a friend. Received a $ 3,000, 12%, 30-day note on account. Received the maturity value of the Nov. 1. Accrue interest on the remaining 3 notes: $ 9,000 at 14% $12,000 at 1 1% $ 3,000 at 12% Jan. Feb. 20 9 14 Received the maturity value of the Dec. 21 note. Received the maturity value of the Nov. 11 note. Received the maturity value of the Dec. 16 note. Problem #2: ing thoca interest-bearing notes during 2005. Chapter #8 Problem #1 Nov. 1 11 Dec. 16 21 31 31 Received a $ 2,000, 12%, 60-day note for a sale. Received a $ 9,000, 14%, 90-day note on account. Received a $12,000, 1 1%, 60-day note for cash lent to a friend. Received a $ 3,000, 12%, 30-day note on account. Received the maturity value of the Nov. 1. Accrue interest on the remaining 3 notes: $ 9,000 at 14% $12,000 at 1 1% $ 3,000 at 12% Jan. Feb. 20 9 14 Received the maturity value of the Dec. 21 note. Received the maturity value of the Nov. 11 note. Received the maturity value of the Dec. 16 note. Problem #2: ing thoca interest-bearing notes during 2005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts